SwissOne Capital AG Makes It Easy for New Investors to Take Advantage of the Top 50 Cryptocurrencies With Smart Index Crypto Fund Tracker Certificate

PRESS RELEASE. Zug, Switzerland: SwissOne Capital AG, a specialized digital asset manager with a focus on blockchain investment funds, has partnered with ISP Securities AG for the launch of their Smart Index Crypto Fund Tracker Certificate. This fund tracker certificate is the first of its kind to capitalize on 50 of the best-performing cryptocurrencies, offering unprecedented market exposure compared to individual currencies, exchanges, DeFi, and other platforms. SwissOne Capital’s deep experience in the crypto space combined with their premiere concierge service can give professional, qualified investors in their jurisdictions the edge they need to increase their portfolio’s performance (via this completely uncorrelated asset class).

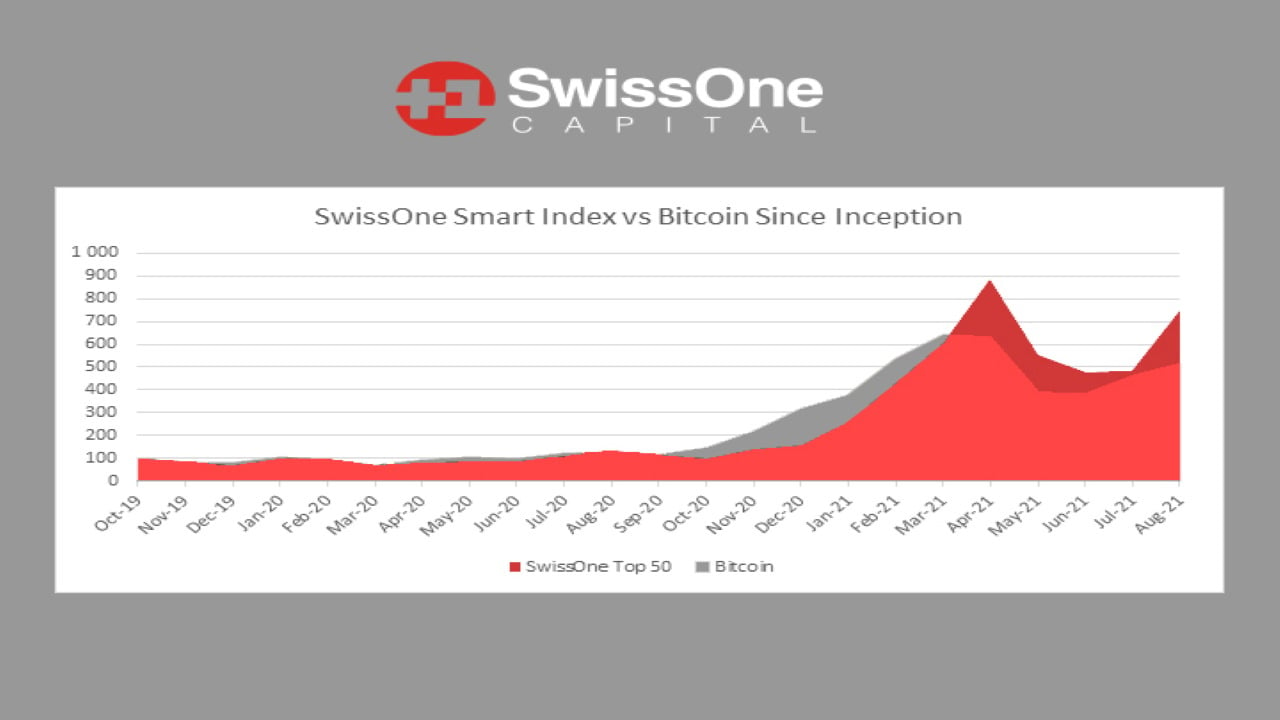

“Our first flagship financial product received a lot of attention and enthusiasm from the market when we launched in 2019. This new Tracker Certificate provides professional investors the opportunity to invest as little as €1,000, making this a far more accessible investment than the underlying fund. Each certificate is backed by an equal investment into the underlying registered Mutual Fund, providing certificate holders peace of mind that their investment is in safe hands. And year-to-date, SwissOne’s Smart Index has beaten the investment performance of Bitcoin: 383.6% over 62.6%, respectively,” states Antony Turner, SwissOne Capital COO.

Committed to offering continuous financial innovation, SwissOne’s fund tracker certificate has been carefully constructed with tested trading parameters, aiming to replicate the performance of an equally-weighted portfolio of the top 50 crypto assets in the world. This is the broadest asset offering by any crypto investment fund to date, and new clients can start with only a €1,000 investment. These assets are ranked by market capitalization and passively determined by the market, using smart rebalancing and allocation rules that produce superior returns by overweighting strong performing assets.

The increased market exposure offered by this fund tracker certificate reduces risk, especially for those who lack experience in the potentially volatile crypto market while allowing investors to take advantage of promising up-and-coming projects.

“Just do a simple search on cryptocurrencies and you’ll see how complex and convoluted this asset class truly is. An individual could barely keep track of Bitcoin alone, let alone the top cryptocurrencies on the market. Our objective is to provide investors with a simple, safe, and cost-effective means to invest into the broader crypto market, through a regulated fund structure where we allow the market to do the talking by means of a passive strategy,” adds Steffen Bassler, SwissOne Capital CEO.

The crypto investment space has continued to gain interest from both experienced investors and newcomers. Yet, with increased potential comes added complexity. As experts in blockchain investment funds, SwissOne Capital is uniquely equipped to help both new and experienced investors reach their goals. One of SwissOne’s main objectives is to keep its investors’ assets safe. To this end, they have partnered with blue-chip service providers to ensure that the crypto assets are stored safely, and transactions ringfenced to trusted parties.

The Smart Index Crypto Fund Tracker Certificate follows the highest quality financial and blockchain standards — exactly what is expected of a Swiss-made service — and is fully backed by an investment into the underlying Cayman registered Mutual Fund. Client assets are protected by institutional-grade security via multi-signature authorization required for all transactions, and all private keys are secured within custom-developed, redundant Hardware Security Modules.

More information about SwissOne Capital and the Smart Index Crypto Fund Tracker is available at https://www.swissone.capital/

###

To learn more about SwissOne Capital AG, or to schedule an interview with their team, please call +1-603-306-3645 or e-mail brian@contentfac.com. You can also learn more at the SwissOne Capital AG website at https://www.swissone.capital.

The Smart Index Crypto Fund Limited is registered as an exempted company, limited by shares, under Cayman Islands law with registration number [C344261]. It is registered as a mutual fund under section 4(3) of the Cayman Mutual Funds law and it is subject to continuing obligations under the Cayman Mutual Funds law. It is only available to investors qualifying as professional Qualifying investors outside of the US and as defined in your local jurisdiction.

This is a press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in the press release.

from Bitcoin News https://ift.tt/39OqTkR

Comments

Post a Comment