Publicly-Listed Bitcoin Mining Operations See Shares Skyrocket, Riot Blockchain Market Cap Reaches $1B

While bitcoin’s value has captured new all-time price highs, a number of publicly listed bitcoin mining operations have seen significant profits. The U.S.-based firm Riot Blockchain’s market valuation recently obtained a $1 billion capitalization. Meanwhile, a number of other bitcoin mining business operations have seen colossal demand for company shares.

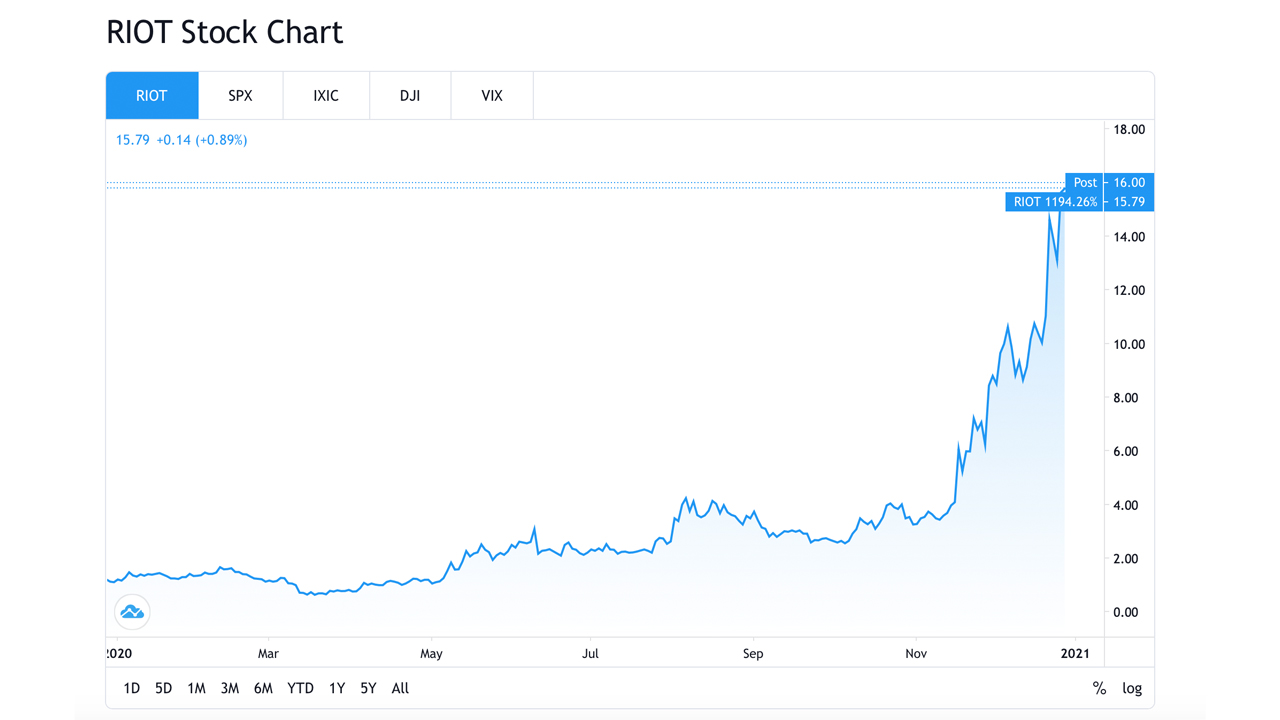

Riot Blockchain, Inc. (Nasdaq: RIOT) shares have increased a great deal and the company has recently captured a $1 billion market capitalization. After trading for $3.47 per unit during the first week of November 2020, shares climbed 332% and are now trading above the $15 range on December 29.

2020 stats show Riot’s shares have jumped more than 1,200% during the course of the year. Riot has also been part of the trend of enterprise companies purchasing mass quantities of bitcoin miners in 2020. The company bought 15,000 S19 Pro and S19j Pro Antminer mining rigs from Bitmain on December 23.

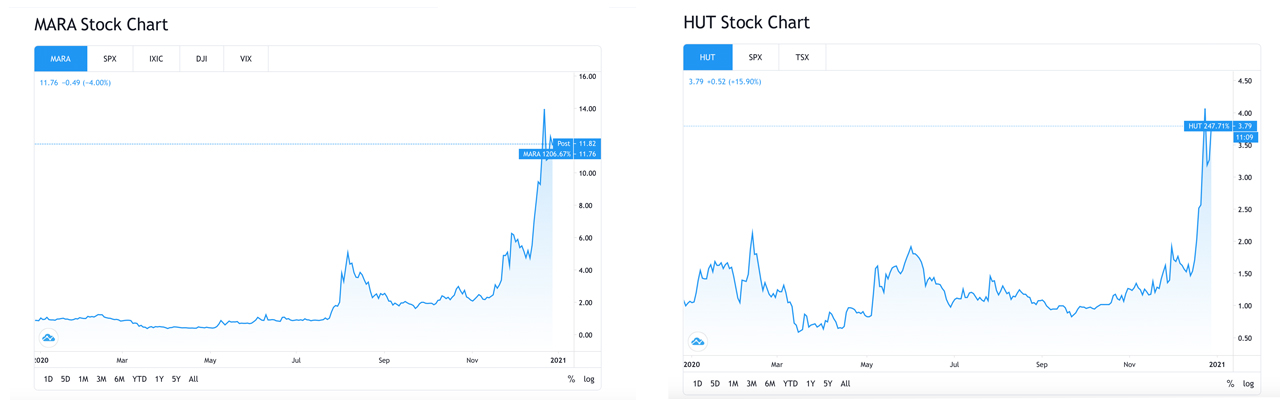

In fact, Riot is not the only publicly listed bitcoin mining operation that has seen shares swell immensely in value. On December 11, 2020, Hut8 shares were swapping for $1.46 per unit but have increased 154% since then to $3.71 per share.

The publicly listed firm Marathon Patent Group (Nasdaq:MARA) has seen shares jump in value by over 156% since December 11, when shares were swapping for $4.63 per unit. At the time of publication Marathon’s shares are trading for $11.87. Marathon is another firm that just recently announced the largest acquisition of next-generation miners when it settled a deal with Bitmain to buy 70,000 Antminers for $170 million.

The microgrid software company Cleanspark’s (Nasdaq: CLSK) shares jumped after the company revealed it would purchase 1,000 bitcoin miners. The deployed S19 Antminers will increase Cleanspark’s mining capacity to 300PH/s. Since December 11, 2020, CLSK shares climbed 103% from $13.21 to $26.82 per unit.

After the Chinese company Canaan Creative (Nasdaq: CAN) launched its initial public offering (IPO), shares didn’t do so well for quite some time as shares slumped.

More recently, however, CAN shares have increased in value since bitcoin’s (BTC) price rise. While Canaan’s shares have risen, they have not seen the growth as the aforementioned bitcoin mining companies have seen. Since December 11th’s $3.39 share value, CAN is up to $3.97 per share.

What do you think about the publicly listed mining operations shares gaining immense value following bitcoin’s price rise? Let us know what you think about this subject in the comments section below.

The post Publicly-Listed Bitcoin Mining Operations See Shares Skyrocket, Riot Blockchain Market Cap Reaches $1B appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/3pBgVJm

Comments

Post a Comment