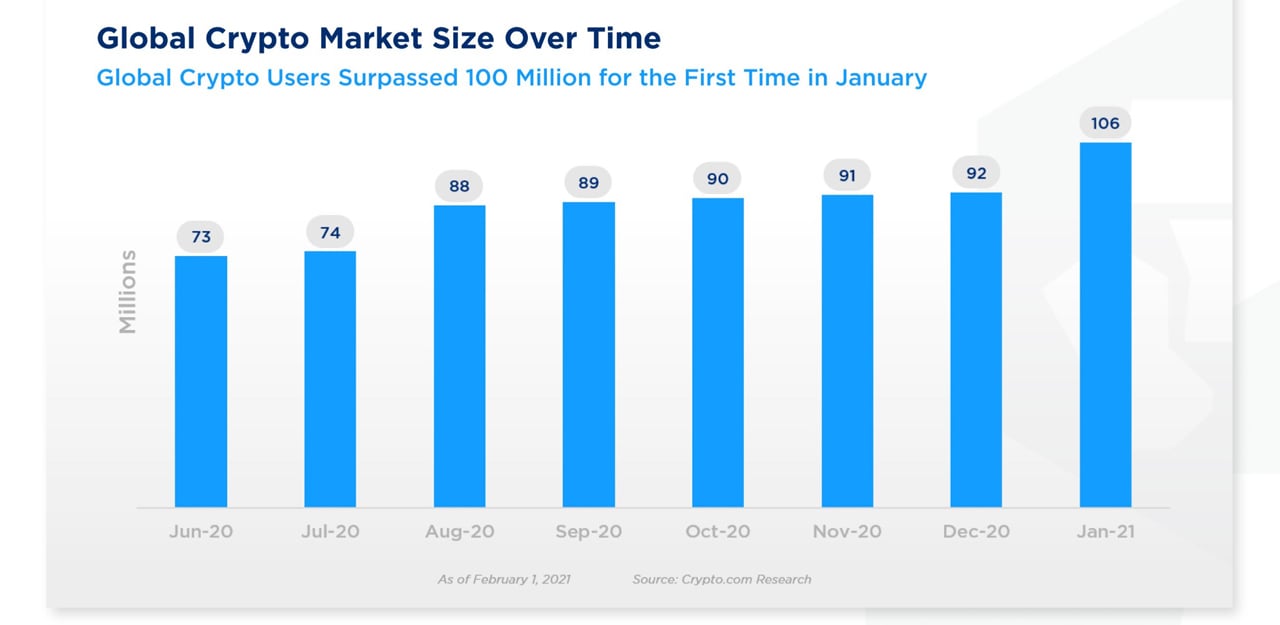

According to a new study conducted by Crypto.com, the total number of global cryptocurrency users has surpassed 100 million for the first time ever. The study, which measured the cryptocurrency marketplace’s size using onchain metrics, survey analysis, and internal data, recorded 106 million cryptocurrency users in January 2021.

January’s Bitcoin Rally Accumulated a 15.7% Jump in Global Users

Compared to December 2020, the 106 million users represent a 15.7% increase in just one month. What’s fueling the growth of the crypto market? According to Crypto.com’s research, it comes down to bitcoin adoption momentum.

Eric Anziani, Crypto.com COO had this to say to Bitcoin.com regarding the research’s findings:

Our study improves upon previously used methods to find a clear trend of growing cryptocurrency ownership. As more companies and merchants adopt cryptocurrencies as a treasury asset and means of payment, we expect 2021 to be a banner year for crypto mass adoption, bringing us ever closer to our vision of ‘Cryptocurrency in Every Wallet’.

Bitcoin smashed through its previous all-time high, pushing its market capitalization past $1 trillion. The growth shows no apparent signs of slowing down either as sentiment around cryptocurrency increases, especially as JP Morgan and BNY Mellon will start offering digital payment methods. Not even two full months into the year yet, investors are piling 10-digit figures into bitcoin. Tesla bought $1.5 billion of bitcoin at the beginning of February, and investment website Motley Fool announced a $5 million investment just a week later.

Bitcoin isn’t the only thing that’s fueling the demand for cryptocurrency. Several other factors are at play too. Crypto.com’s research attributes this rapid ascent to the growth of the decentralized finance (defi) market, the ability to buy, sell, and hold cryptocurrency through Paypal, and the institutional adoption of cryptocurrency are attracting new crypto users every day.

Defi Momentum is Growing

The defi market’s momentum is significant given the increased demand for ethereum and other altcoins like Binance’s BNB. The total market capitalization of coins locked in defi has grown from $690 million to over $11.7 billion, a significant number that’s encouraging new investors to enter the market.

According to Crypto.com’s research, ETH’s growth rate was higher than BTC in November and December 2020; BTC’s unique users grew by 1.5% in November compared to ETH’s 2.8% growth. In December, ETH’s change was nearly double that of BTC’s: 2.8% compared to 1.2%.

How accurate are all of these numbers? A total number of 24 exchanges were included in the research, and while Crypto.com has updated and improved its methodology since its last report, it does admit these figures may be subject to some small caveats.

How long do you think it will now take to reach 200 million users? Let us know in the comments section below.

from Bitcoin News https://ift.tt/3st9bum

Comments

Post a Comment