Crypto․com CEO Kris Marszalek has an issue with coinmarketcap.com’s exchange volume rankings, according to a tweet he published on December 25. Marszalek claimed in his tweet that the popular crypto aggregation website “arbitrarily reduced” the exchange’s ranking.

Crypto․com CEO Complains About Coinmarketcap․com’s Exchange Rankings

A recent tweet stemming from the CEO of Crypto.com’s Kris Marszalek indicates the exchange executive is upset with the web portal coinmarketcap.com. Marszalek claims that Crypto.com’s exchange volumes are being misreported and the trading platform’s ranking was changed to the 14th position on a whim.

“Merry Christmas to [the] team [at] Coinmarketcap who a week after my response to their poorly worded tweet arbitrarily reduced our exchange ranking to 14th,” Marszalek tweeted on Christmas day. “We are 2nd/3rd on Coingecko so you guys know where to look for real and market neutral data,” the exchange CEO added.

According to statistics on coinmarketcap.com, Crypto.com’s exchange ranking is 16th on Sunday. However, Coingecko’s spot exchange metrics indicate that Crypto.com’s ranking is second in terms of trade volume rankings today. 24-hour trade volume from Crypto.com is $2.8 billion, according to Coingecko stats. Meanwhile, coinmarketcap.com (CMC) metrics show Crypto.com’s volume is $1.5 billion and down more than 15%.

Following Marszalek’s tweet, a number of people responded to his claims. The official Baby Doge team said they were having a hard time getting CMC to verify the BABYDOGE supply. Coingecko’s co-founder Bobby Ong thanked Marszalek for his compliment. “Merry Christmas Kris,” Ong replied. “Thanks for all the support. Have a happy holiday with your family.”

A number of other people who responded to Marszalek’s tweet said that it was well understood that the trading platform Binance owns CMC. “CMC is owned by Binance… I’m not surprised,” one person replied to the Crypto.com executive’s tweet. “[I] never use CMC since Binance bought them,” another person responded.

Coinmarketcap․com’s Price Feed Gets Wonky on December 14

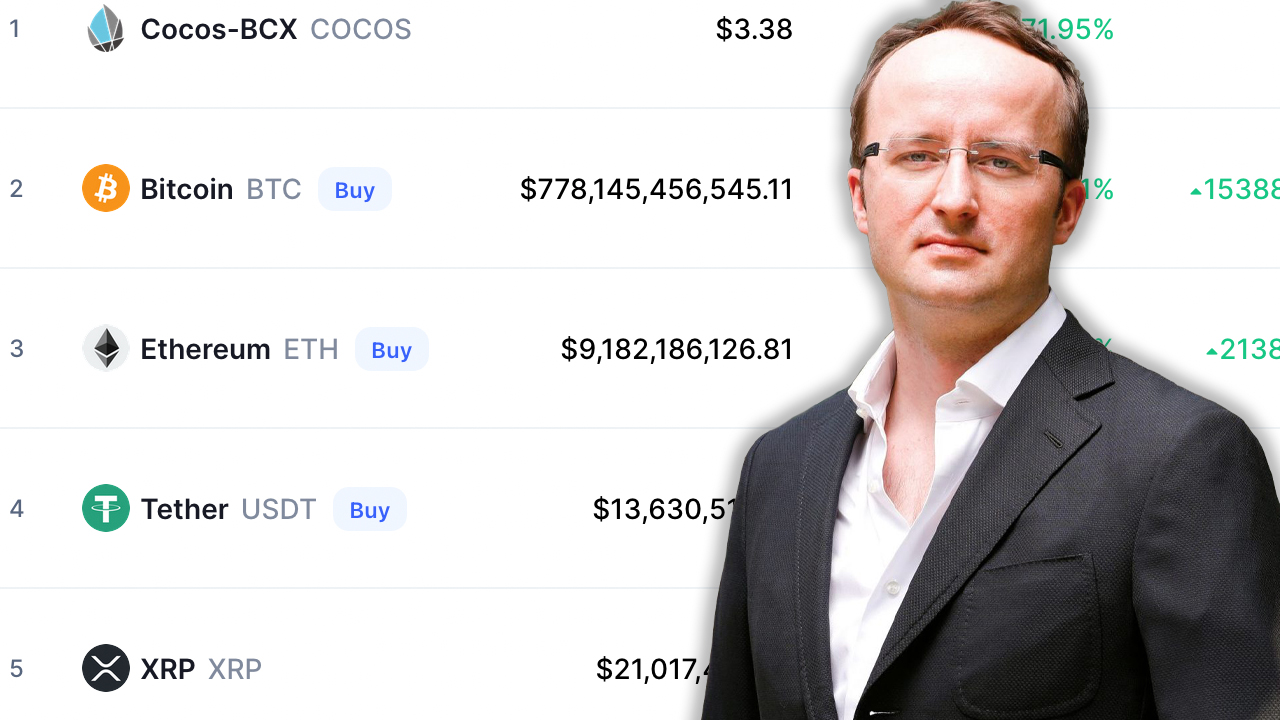

The news follows CMC’s issues on December 14, when people were complaining about the site showing price discrepancies. That day, the price of bitcoin (BTC) on CMC was priced at $778 billion per unit and many other coin prices were wrong. CMC addressed the situation in a tweet concerning the price irregularities after getting numerous complaints on social media.

“Following the irregularities we observed on our platform this afternoon,” CMC wrote in response to the complaints, “[and] despite the issue having been fixed, we will be rebooting our servers as a final step in accordance with our internal remediation plan. Apologies for the inconvenience,” the web portal’s team wrote. Later in the day, CMC jokingly tweeted:

How did it feel to be a trillionaire for a couple [of] hours?

What do you think about the Crypto.com executive’s complaints against CMC’s exchange rankings? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3sB1XYQ

Comments

Post a Comment