Cryptocurrency users can face a lot of challenges finding the right information needed for reporting taxes. Koinly, a leading cryptocurrency tax calculator and portfolio tracker for traders, has created the ultimate guide to help.

Koinly Presents The Ultimate Bitcoin Tax Guide for 2022

Crypto tax regulations and laws can be confusing, leaving investors with many questions about what crypto taxation looks like – how much tax to pay on Bitcoin and the tax rate? But do not worry. Koinly brings an ultimate crypto tax guide to help answer all the questions related to crypto taxes and more.

Bitcoin, just like any other cryptocurrency, is not recognized as a fiat currency – like USD, GBP and AED, by almost all countries worldwide. For taxation purposes, crypto is an asset & is taxed just like any other asset – much like property, stock, or shares. So yes, taxes are due on Bitcoin.

It does not matter where someone lives, as most taxation departments worldwide are cracking down on crypto and taxing Bitcoin and other cryptocurrencies. Each country has slightly varying views on crypto and its taxation. Koinly offers regularly updated guides on many countries, including the US and Canada too.

Since Bitcoin is an asset for taxation purposes, the owner must pay a Capital Gains Tax anytime an asset is liquidated and disposed of. In what scenarios are Bitcoin disposals taxed?

- When Bitcoin sells for Fiat currency

- When Bitcoin/crypto swaps for another cryptocurrency, including stablecoins

- Goods or services bought using Bitcoin

- And in Ireland, Australia and the UK, the tax is levied even when Bitcoin is gifted

Aside from Capital Gains Tax, there are instances where Bitcoin can be taxed because it is also transacted in other ways. Bitcoin transactions that could be taxed as income include:

- Getting paid in Bitcoin – like a salary.

- Mining Bitcoin – like income.

- Earning Bitcoin through loaning – like earning interest.

- Receiving new coins from a Bitcoin fork – a bonus.

In theory it is easy to figure out how much Bitcoin capital gains tax someone needs to pay. You need to know the fair market value of Bitcoin on the day it is received, and on the day it is disposed in fiat currency terms – like USD or GBP. The difference in price will present either a profit or a loss, and it’s a profit that attracts capital gains tax. When an individual’s Bitcoin is taxed as income, it will be taxed at the same rate as their current Income Tax rate.

It is important to note that the Bitcoin someone has paid Income Tax on will still be subject to Capital Gains Tax when it is disposed of later. It might seem daunting at first, but thanks to Koinly, it is not that difficult to figure out crypto tax.

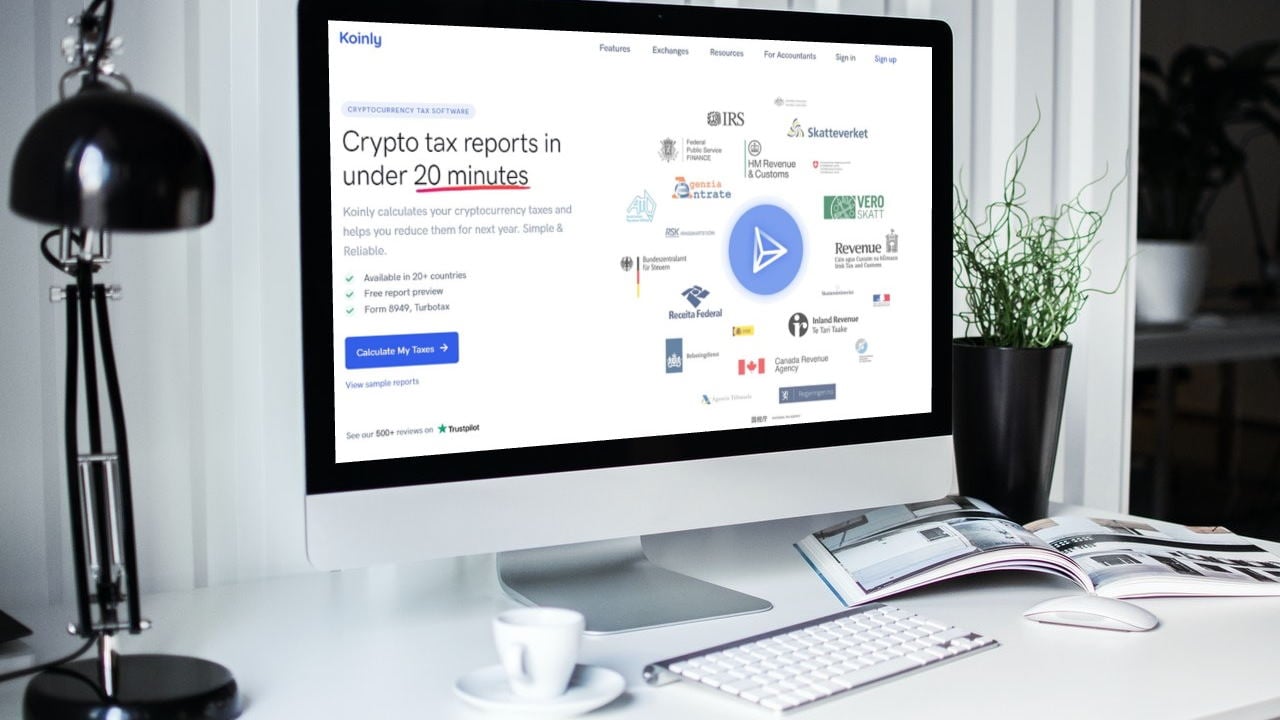

Free Bitcoin Tax Calculator

It is advisable to use a crypto-tax calculator like Koinly to stay tax-compliant because the IRS, HMRC, the ATO, the CRA and more, are cracking down hard on crypto every day. They are working with big crypto exchanges to gain customers’ information and send letters to investors who need to pay Bitcoin tax. Koinly makes it simple and easy to calculate tax and prepare reports to the tax office. While there are other crypto-tax calculators, Koinly is a free Bitcoin tax calculator, supporting Bitcoin and other major cryptocurrencies, making it easier for users to calculate crypto tax. Koinly is also adding support for multiple new tokens and coins all the time; also keeping up with the constantly evolving and changing crypto tax legislation and laws.

It is so easy to sign up for an account on Koinly. Once a user has signed up for an account, they can use Koinly’s extensive functionality to sync all the crypto wallets, exchanges, or blockchains they use, with Koinly, via API or CSV file upload. Instead of manually calculating tax rates and formulas to figure out tax, let Koinly calculate the taxes for you. It quickly calculates gains and losses and Bitcoin income and expenses within minutes.

The user can also head to the tax reports page in Koinly to see a summary of their Bitcoin taxes. Scrolling down on the page will help the user find the type of tax report they need. They can download a specific type of tax report based on their country – like the IRS Form 8949 and Schedule D for reporting Bitcoin gains for American investors or the HMRC Capital Gains Summary Form for reporting Bitcoin gains for UK investors. Koinly can even generate tax reports for tax apps like TurboTax and TaxAct.

To learn more about crypto taxes in 2022 check out Koinly today.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

from Bitcoin News https://ift.tt/5KLSXT6

Comments

Post a Comment