Since the Terra stablecoin fiasco in May, the top stablecoins by market capitalization dropped 10.66% from $171.37 billion to today’s $153.09 billion. During the last two months, the top stablecoins by market capitalization have seen little growth remaining at $153 billion since mid-July.

For More Than 2 Months Stablecoin Market Caps Stagnate Seeing Little Growth

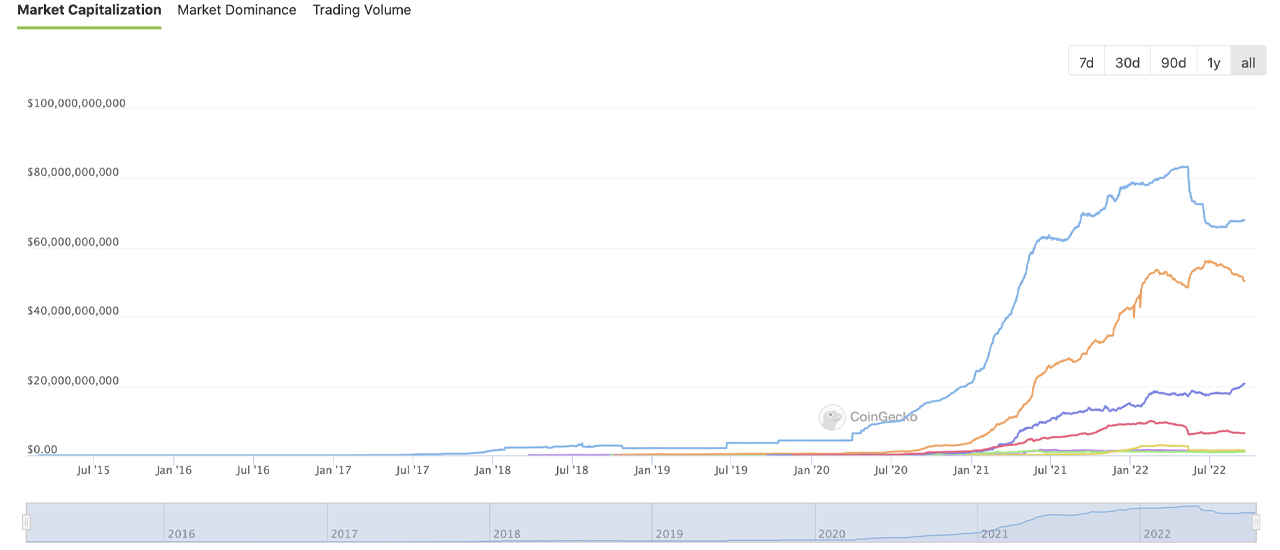

Following the significant climb since mid-2020, the stablecoin economy has seen growth slow during the last few months. In mid-April 2022, the stablecoin economy neared the $200 billion range for the first time in history, but following Terra’s stablecoin fiasco, more than $35 billion disappeared from the stablecoin economy by May 13, 2022. On May 12, 2022, the stablecoin economy was 10.66% larger than it is today at $171.37 billion.

By July 7, the stablecoin economy was down to $154 billion, according to stats saved by archive.org via coingecko.com. The stablecoin economy has remained stagnant in terms of growth during the past 73 days. Tether (USDT), the largest stablecoin market cap, has grown slightly rising 0.7% during the past month, while usd coin (USDC) saw a 4.9% decline. Binance’s stablecoin BUSD saw an 11.1% increase, while DAI, FRAX, and TUSD declined during the last 30 days.

Pax dollar (USDP) jumped 19.7% higher this past month, but neutrino usd (USDN) dipped by 9.5% lower. Besides BUSD and USDP, celo dollar (CUSD) was one of the only stablecoin market valuations that grew, as CUSD saw a 7.1% increase. A lion’s share of stablecoins within the stablecoin economy saw their market valuations slide during the past month. Furthermore, out of all the stablecoins in existence today, both USDT and USDC equate to 77.26% of the $153 billion stablecoin economy.

Out of the entire crypto economy’s net value at $1 trillion, tether (USDT) represents 6.761%, while usd coin (USDC) equates to 4.995%. While the stablecoin economy has seen stagnant growth during the last 73 days, stablecoins still represent a great deal of the global crypto trade volumes worldwide. Today, $37.68 billion of the $50.55 billion in overall global crypto trade volume is settled in stablecoin assets. The stablecoin trade volume equates to 74% of the global crypto trade volume on Sunday, September 18, 2022.

What do you think about the stablecoin economy’s stagnant growth during the last 73 days? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/txG5P62

Comments

Post a Comment