In 2023, the top ten Web3 projects collectively raised $1.78 billion in funding, a figure which is 70% lower than the $5.87 billion raised in the previous year, the findings of a new study have shown. The findings also show that Web3 projects were able to attract $9 billion in capital with infrastructure projects accounting for 36.5% of the total.

Most Capital Raised in the Latter Half of 2023

According to a study conducted by the crypto exchange Binance, venture capital investments in the top ten Web3 projects saw a significant downturn in 2023, with only $1.78 billion raised. This total is 70% lower than the $5.87 billion raised in 2022.

As explained in the study report, the fundraising fortunes of the top ten projects are a reflection of the bearish market conditions that prevailed in much of 2023. Despite this sharp drop in capital flows, all the top ten Web3 projects were still able to raise more than $100 million.

“Notably, most of the significant funding occurred in the latter half of the year, with six out of the 10 largest fundraises happening in this period. Among these, Phoenix Group, a Bitcoin mining service provider, and Ramp, a non-custodial payment infrastructure company, led the pack with US$370 million and US$300 million in the amount raised, respectively,” the study report said.

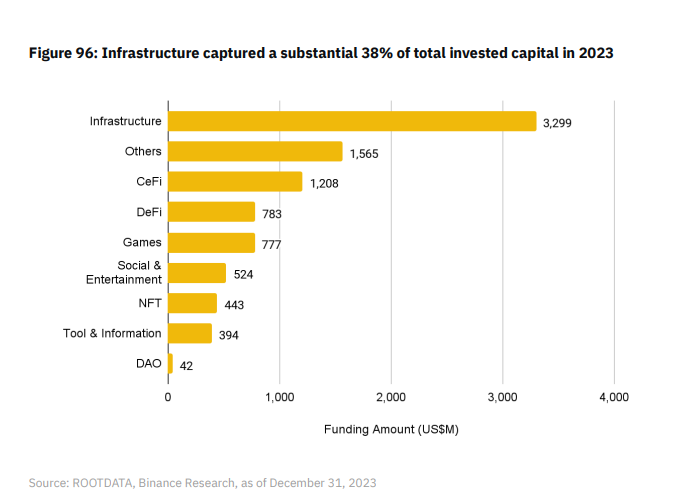

Infrastructure Projects Account for Just Over a Third of Capital Raised

Meanwhile, the study findings show that Web3 projects attracted investments totaling $9 billion, with infrastructure projects accounting for 36.5%, while centralized finance (cefi) and decentralized finance (defi) platforms accounted for 13.3% and 8.6%, respectively. Decentralized autonomous organizations (DAOs) saw the least amount of capital investment, with a share of only 0.47% of the total.

As noted in the report, venture capital (VC) firms’ sentiment towards Web3 projects remained largely negative until the end of Q3. However, after reports of institutional investors’ interest in spot Bitcoin exchange-traded funds (ETF) surfaced, this sentiment turned bullish.

Since then, the crypto market has rallied with bitcoin touching prices last seen nearly two years ago. This rally has in turn laid the foundation for increased VC investments in 2024. Commenting on this likely scenario, the report said:

“Moving into 2024, it would not be surprising to see an uptick in investment activities. This anticipated growth is not only due to the low base period from the previous year but also driven by the increasingly bullish sentiment permeating the market.”

What are your thoughts on this story? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/0c6yRlb

Comments

Post a Comment