On September 24, digital currency markets saw significant losses as the entire cryptoconomy lost $35 billion in a short period of time. Cryptocurrency enthusiasts and traders are now even more uncertain to where markets are headed in the short term. The sudden sell-off that took place on Wednesday afternoon was unexpected and today traders are preparing their positions for the next big market move.

Also read: Bitcoin Cash-Accepting Mayoral Candidate ‘Nobody’ Hosts Keene’s 420 Rally

September’s Crypto Market Shake Out

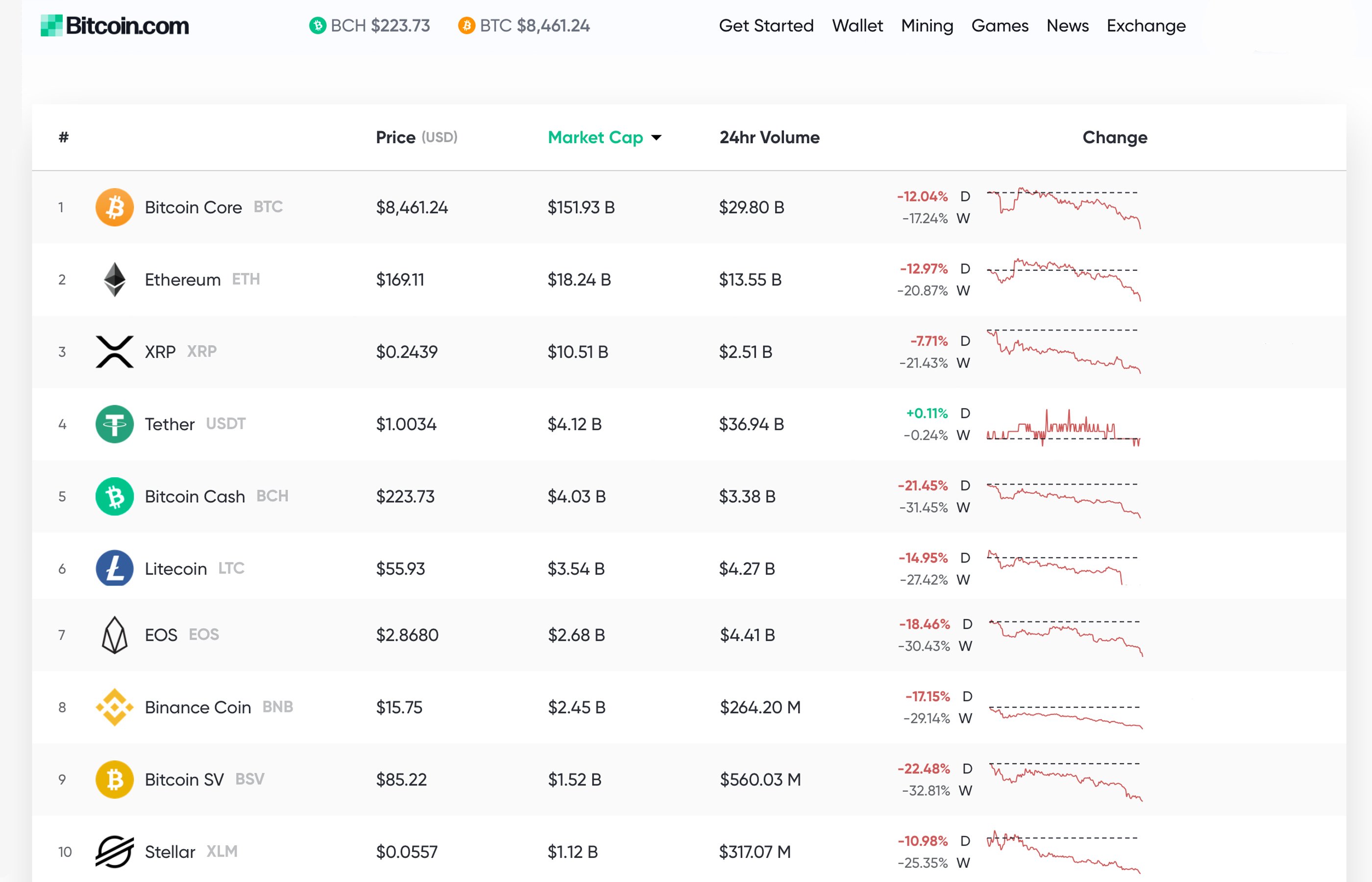

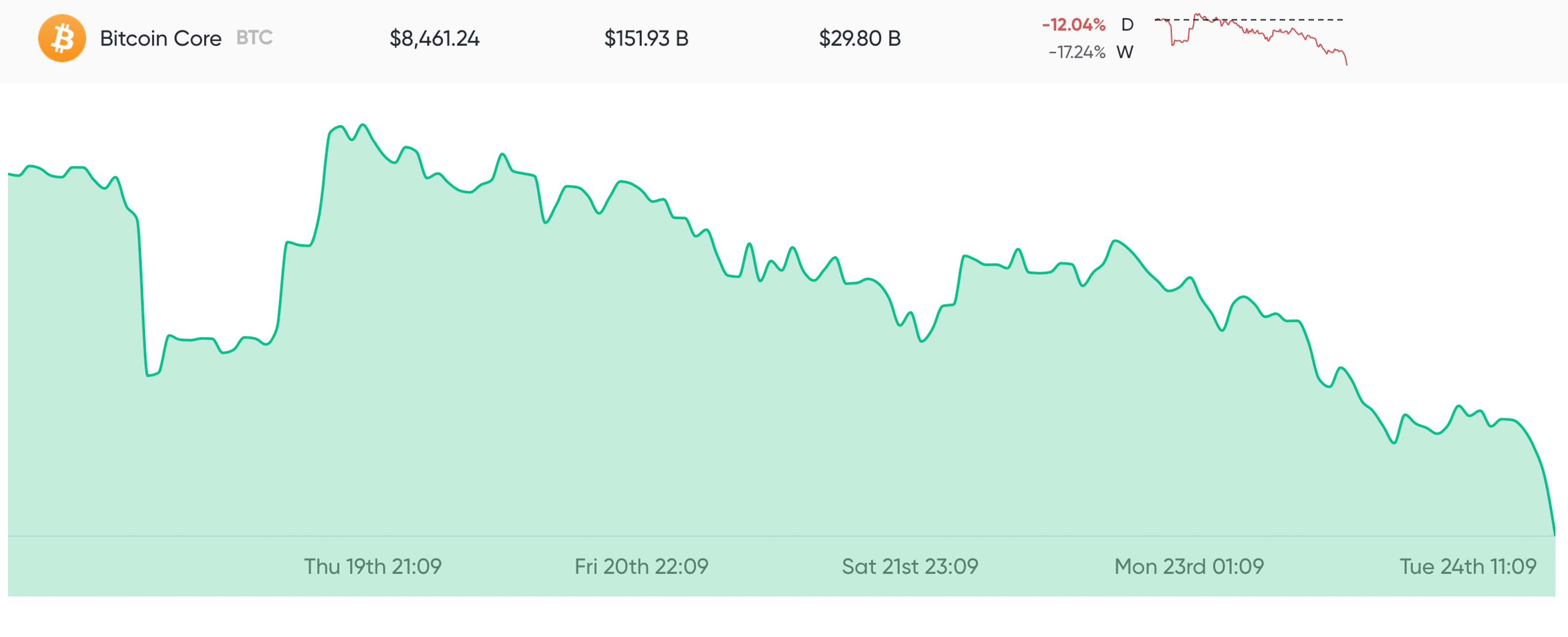

Wednesday’s trading sessions saw some deep losses as the majority of the most popular digital assets have lost 10-25% in the last 24 hours and roughly 15-35% over seven days. When we reported on the market action yesterday, the entire market cap of all 2,000+ coins was around $257 billion. But on September 24, the valuation of all coins combined now stands at roughly $222 billion. Bitcoin core (BTC) saw its biggest losses since the month of June as the price was shaved by $1,000 in less than 30 minutes on Wednesday afternoon. BTC tumbled under $8K for a quick spell and has since jumped back to prices between $8,300-8,500. The cryptocurrency is hovering around $8,461 at press time, showing 12% losses in 24 hours and minus 17.2% for the week.

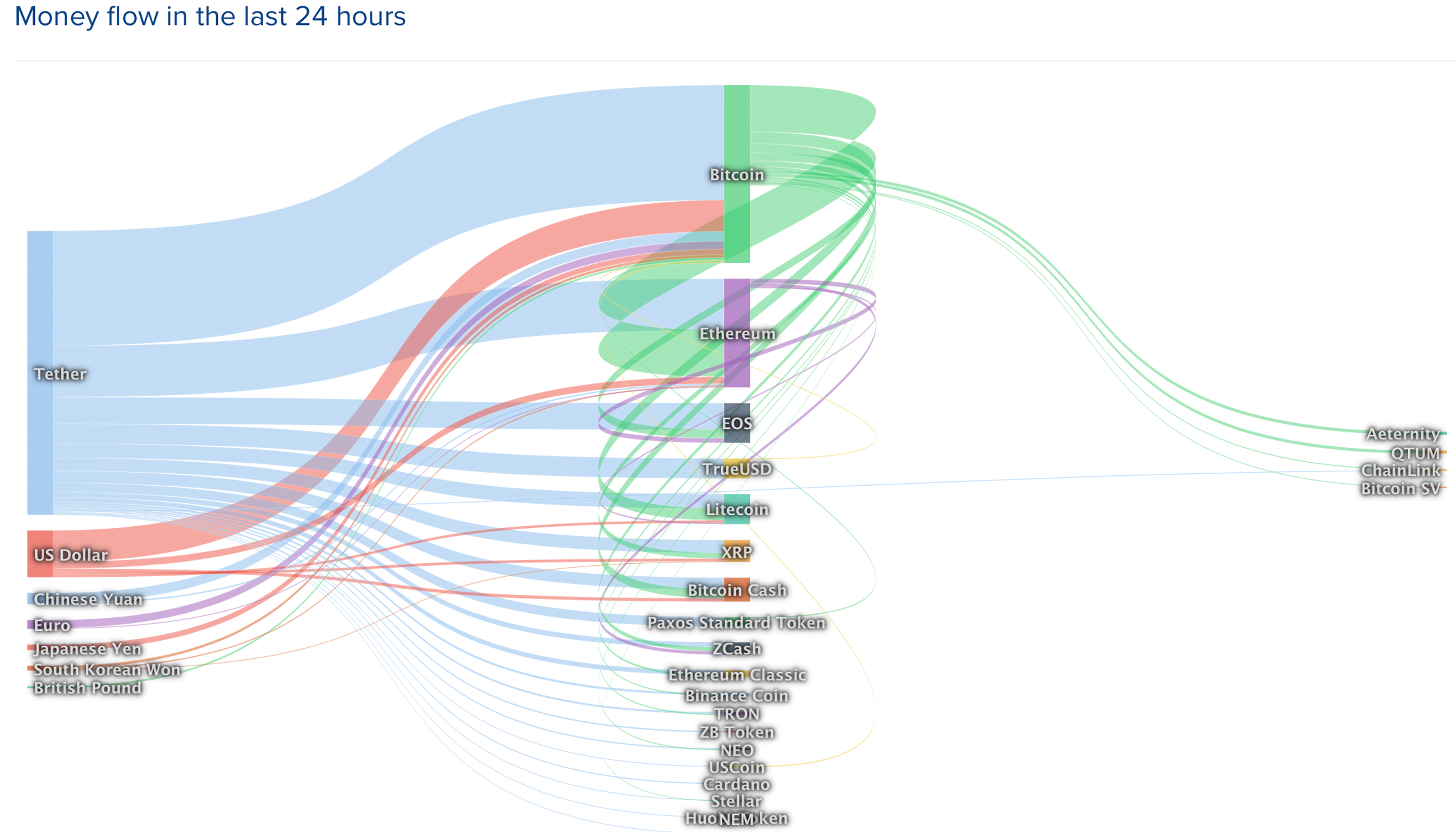

Behind BTC is ethereum (ETH) which has dropped in value by 12.9% for the day and by 20% over the course of the week. A single ETH is swapping for $169 per coin and there’s $13.5 billion in global ETH trades today. The third-largest market cap is ripple (XRP) as each coin is trading for $0.24 and markets are down 7% in the last 24 hours. Interestingly, tether (USDT) has captured the fourth-largest market cap during the mass sell-off. The stablecoin pegged to the USD is a dominant force to be reckoned with in the cryptoconomy, capturing the majority of digital asset trades this week. It’s the most traded coin today with $36.9 billion in global trades and 57% of BTC trades.

Bitcoin Cash (BCH) Market Action

Bitcoin cash (BCH) markets are down 21% in the last day and 31% over the last seven days. BCH is now the fifth-largest market cap after tether (USDT) took fourth position in overall market valuation. BCH is trading for $219 per coin and has a market cap of $3.9 billion and $3.2 billion in global trade volume. USDT captures 64% of BCH trades on Wednesday followed by USD/BHC at 14.2%. Behind the U.S. dollar there’s BTC (14%), KRW (3%), ETH (1.8%), EUR (1.4%), and JPY (0.43%). BCH has lost the most value this week in comparison to other coins within the top 10.

Depending on how markets react this week, BCH looks like it could get a taste of ranges below the sub-$200 range. On Tuesday, BCH shaved $100 off its overall value, but if bulls break the bearish reversal then the price could see a sharp recovery to the $250-260 zone. An extended recovery toward higher regions will be met with psychological resistance at the $285-300 range.

Bakkt’s Disappointing Volumes

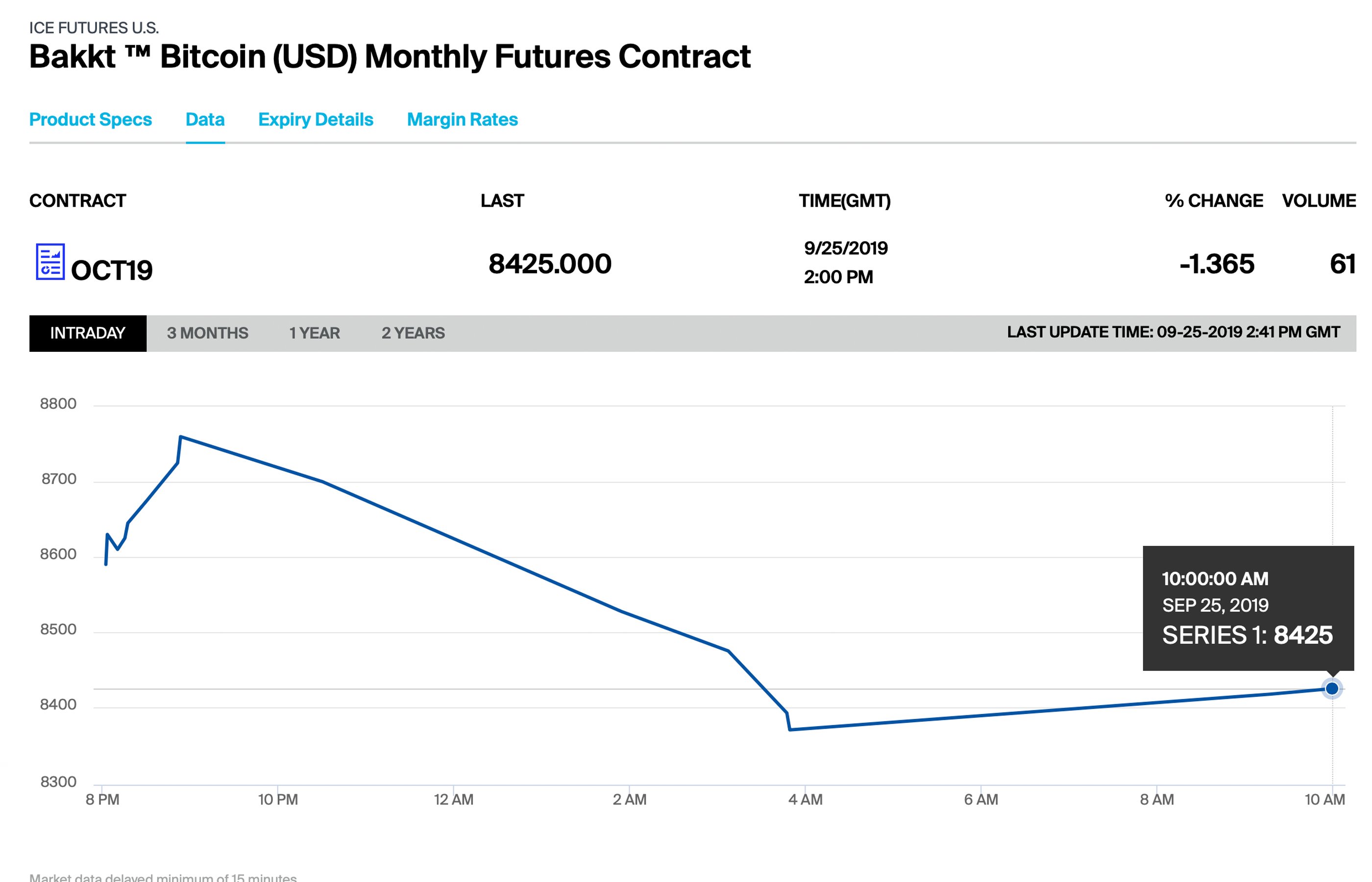

While blood is in the streets, most traders don’t know who to blame for the recent downturn. Some have attributed the losses to the lackluster response on Monday to Bakkt initiating its BTC futures markets. The highly anticipated physically settled futures opening day only saw 72 BTC compared to the whopping 5,000 BTC swapped on CME Group’s BTC futures settled in cash.

On Tuesday, as spot markets tumbled, Bakkt saw an increase of 113 one-day contracts. The founder of the digital currency hedge fund Ikigai, Travis Kling, explained after the dip that Bakkt’s initial performance pulled the bottom out. “When the actual Bakkt launch showed disappointing volumes on the first day, it opened the hatch and the bottom fell out of the market,” Kling told the press.

Schiff Says BTC Will See Rapid Descent Toward $4K

Gold bug Peter Schiff is at it again and has tweeted that BTC has finally broken a support zone. He figures the price will drop hard from here on out. Schiff has always been a skeptic of cryptocurrencies and has been very vocal about his dislike for bitcoin. “Bitcoin has finally broken below the support line of the large descending triangle it has been carving out for months — This is a very bearish technical pattern, and it confirms that a major top has been established,” Schiff tweeted. “The risk is high for a rapid descent down to $4,000 or lower,” the gold bug added. Of course, every time BTC or crypto markets dive in value, Schiff always has something to say. Moreover, precious metals and gold markets have done exceptionally well in recent months and Schiff has been riding the wave.

Tuesday’s Market Anomalies Keep Traders on Edge

Tuesday’s intense drop saw some interesting events on a few exchanges during the carnage. For instance, the dump saw a significant amount of liquidations on margin calls on the Seychelles-based exchange Bitmex. BTC/USD shorts on Bitfinex have been slowly rising but the number of long traders has been much higher which gives experienced traders the opportunity to create a long squeeze. Additionally, the Binance stablecoin BUSD market that’s paired with BTC saw a significant flash crash on Tuesday. Traders witnessed BTC purchased at $1,800 BUSD during the quick drop in prices around 2:30 p.m.

There’s been some slight recovery on Wednesday but nothing spectacular so far. Most digital assets have found new support zones and traders are waiting for the next move. There are those who believe crypto prices will spike very soon and jump well past the recovery zones by the year’s end. However, right now some bearish traders can envision BTC dipping to the $7K zone in the short term and due to the extremely correlated market patterns lately, many other coins will follow suit. For now, all intraday traders can do is hope they’ve played their positions correctly and look out for sharks aiming to take their lunch. Enthusiasts who are in it for the long haul are simply being patient and waiting for better days.

Where do you see the cryptocurrency markets heading from here? Let us know what you think about this subject in the comments section below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.” Cryptocurrency and gold prices referenced in this article were recorded at 11:15 a.m. EDT.

Images via Shutterstock, Trading View, Bitcoin.com Markets, Getty, Goldprice.org, Wiki Commons, and Pixabay.

Want to create your own secure cold storage paper wallet? Check our tools section. You can also enjoy the easiest way to buy Bitcoin online with us. Download your free Bitcoin wallet and head to our Purchase Bitcoin page where you can buy BCH and BTC securely.

The post Market Outlook: Traders Play New Positions After Massive Drop in Crypto Prices appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2lIioT0

Comments

Post a Comment