Recent data shows that countries with corrupt governments have a strong correlation with Localbitcoins trade volumes. However, even though the over-the-counter (OTC) marketplace Localbitcoins has grown massive over the years, traders are complaining about heightened know-your-customer/anti-money laundering requirements. The exchange recently changed its KYC/AML guidelines on September 1 and users say more verification mandates might be coming this October.

Also read: Software Engineer Reveals Oracle Creation Platform for Bitcoin Cash

Localbitcoins Trade Volumes Correlate With the Corruption Perception Index But KYC/AML Isn’t Helping

The Helsinki-based OTC bitcoin trading platform Localbitcoins.com (LBC) has been providing peer-to-peer exchange since 2012. Since then, the platform has grown very large and the exchange saw roughly $54.8 million in global trade volume for the week of September 21. Six days ago, a researcher explained on Twitter that the regions with the highest LBC volumes stem from corrupt governments. The data explains that the Corruption Perception Index (CPI) tied to governments with an unfavorable rating shows significantly larger LBC trade volumes than countries with less corruption.

The Twitter user’s data shows the correlation with countries like Venezuela, Nigeria, Russia, Colombia, and Ukraine. The researcher also noted that Bisq exchange and Paxful saw an influx of trade volume when LBC removed cash trades and introduced new KYC/AML requirements. Privacy advocates have also complained about how people have connected to LBC using the Tor browser and witnessed a banner that says: “Warning to all Tor users: A Tor browser exposes you to the risk of having your bitcoins stolen.”

Corelation between corruption and@LocalBitcoins usage for 2018

Share of GDP = share of LBC volume for 2018 of countries GDP

CPI = corruption perception index pic.twitter.com/lo8cWGEG0W— trooper (@raw_avocado) September 21, 2019

The removal of cash and in-person trades has caused a lot of migration to other peer-to-peer trading platforms. The added KYC/AML requirements have made it worse for users who trade a lot and even for individuals who only trade small sums. On September 27, a Pakastani explained on the Reddit forum r/btc that Localbitcoins was getting worse for him. “The user experience is getting degraded day by day on Localbitcoins,” the individual claimed. “To place any buy or sell ads, you need to put BTC into the site’s custodial wallet which is very inconvenient given BTC is as slow as a turtle to confirm.” The trader from Pakistan continued:

[Localbitcoins] ad price calculation formula is so complicated and the platform is feeling creepier than ever, even though I am KYC verified, they are randomly frisking users again now — I have been warned to submit more KYC data before the 1st of October.

Localbitcoins has really lost the plot pic.twitter.com/tNxtbLEr3t

— Richard Bensberg (@richardbensberg) September 9, 2019

Concerns About More KYC/AML Requirements and Alternative OTC Avenues

The trader said he was stuck using LBC because the liquidity is high for a country like Pakistan. Just recently LBC partnered with the identity verification service Onfido and the company introduced a new tier system for traders. Each LBC tier shows the trader how much they can trade annually and how much verification is needed for each stage. The lowest tier is only $1,000 a year, which mandates the user must submit their phone number, surname, and email address. The mid-range of $20,000 per year requires ID verification, proof of residency, and more.

LBC traders who swap vast amounts of BTC have also been arrested for transgressing against money transmission laws. LBC is required to comply with regulatory standards because of Finland’s Act on Virtual Currency Service Providers. When all the new rules were established, many crypto advocates argued that LBC is not decentralized, and some have even questioned the term “local” in its brand name. You may be able to find local traders in your area on LBC, but cash and in-person trades are now prohibited.

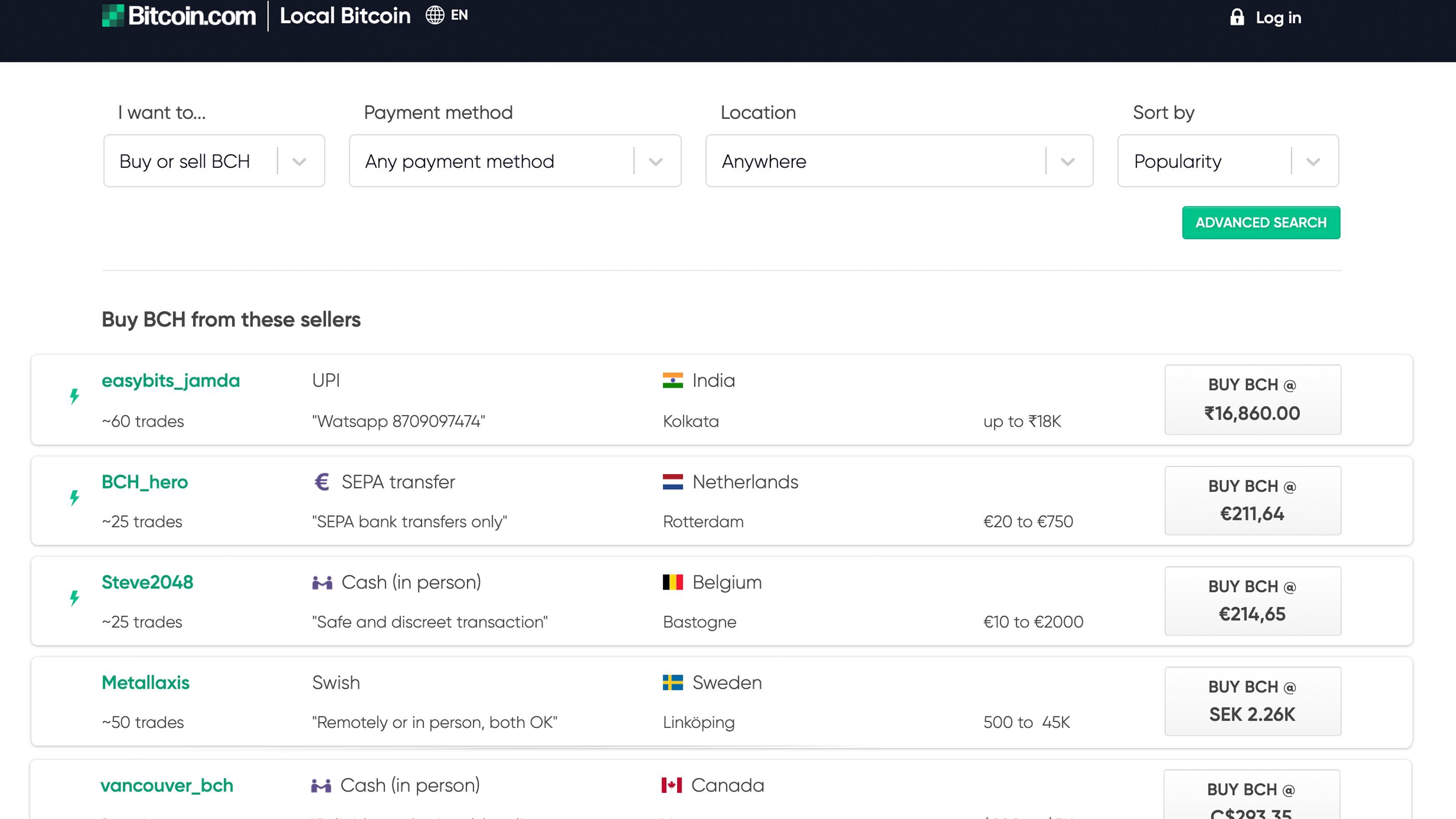

Another avenue besides Paxful and Bisq, for traders who want to swap coins in a peer-to-peer manner, is the BCH marketplace local.Bitcoin.com. Since LBC’s KYC/AML announcement two months ago and the removal of in-person cash trades, many traders have migrated to Bitcoin.com’s OTC platform. This week the marketplace has surpassed 60,000 users worldwide and has shown continuous growth since the launch in June. Local.Bitcoin.com is a private, noncustodial trading platform that allows peers to trade bitcoin cash (BCH) in a safe environment. Moreover, in-person cash trades are allowed and you can trade literally anything with other users on local.Bitcoin.com.

The Finland-based Localbitcoins’ trade volumes do indicate that citizens from countries with corrupt governments are searching to purchase crypto to escape the wrath of inflation and manipulation. Countries like Argentina, Venezuela, and Colombia have touched all-time high volumes but trades have lessened throughout August. The latest round of KYC/AML requirements doesn’t bode well for residents in these regions and privacy concerns may force them to migrate elsewhere. Especially when Tor users are being warned and if even more KYC/AML mandates are revealed in October.

What do you think about Localbitcoins making it hard for people to trade due to KYC/AML requirements? Let us know what you think about this subject in the comments section below.

Image credits: Shutterstock, Localbitcoins.com, Twitter, Local.Bitcoin.com, and Pixabay.

Did you know Bitcoin.com offers a peer-to-peer trading platform that allows for private, noncustodial over-the-counter trading? Check out Local.Bitcoin.com today. Alternatively, you can head over to our Purchase Bitcoin page where you can easily buy BTC and BCH with a credit card. Or register for our online trading platform Exchange.Bitcoin.com. At Bitcoin.com we want everyone to get access to cryptocurrencies.

The post Traders Bemoan New Localbitcoins Identity Requirements appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/2nYkbnM

Comments

Post a Comment