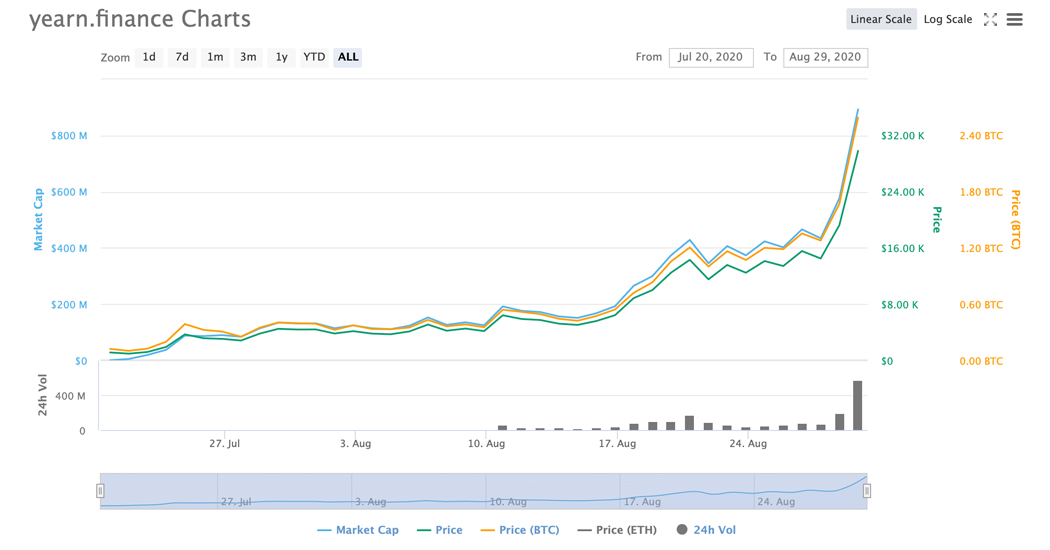

The decentralized finance (defi) crypto asset tied to the Yearn Finance project has smashed records this week, as the coin touched a high of $30,324 on Saturday evening. Yearn’s token YFI has been recently added to the Aave platform and the project’s founder, Andre Cronje, is currently talking about collaborating with the exchange FTX.

Yearn Finance and the project’s native token YFI has jumped significantly in value since news.Bitcoin.com last reported on the project. Last week, YFI made headlines for outpacing bitcoin (BTC) by price per coin, as the YFI token value spiked to $16k on August 20.

On Friday, YFI was averaging around $17-18k per coin, and the value leaped even higher during Saturday afternoon’s (ET) trading sessions. According to market data, YFI touched an all-time high of over $30,324 on August 29 at 8:15 p.m. ET. Presently, the value is hovering around $30,007 at the time of publication.

This week, an individual on Twitter, asked the Yearn Finance founder why he was talking with the FTX exchange CEO Sam Bankman-Fried. Andre Cronje did not detail what Yearn Finance and FTX were collaborating on, but he did confirm that some kind of partnership was in place.

“Guess the cat is out of the bag,” Cronje tweeted. “But just so that there is some expectation management, this is a long roadmap that we are working on, so it won’t be anything anytime soon. But there will be something very sexy in the future.”

In addition to the FTX topic, the defi token YFI was also recently listed on the lending platform Aave this week. Aave has also been making headlines in recent days for its total value locked (TVL), and the project’s electronic money license granted by the UK’s Financial Conduct Authority (FCA). Yearn Finance has also revealed a new insurance primitive this week called “yinsure.finance.”

The Yearn development team published an article about the yinsure.finance subject which states:

We will systematically be releasing yinsure.finance, a prototype for a new kind of tokenized insurance.

Over the course of the last 24 hours, YFI has gained over 44% in value outshining most other token assets. Despite the fact that YFI has climbed far higher than BTC’s all-time high in 2017 ($19,600), people should understand and be aware that there are only 30,000 YFI compared to BTC’s 21 million.

In fact, out of the current 30,000 supply of YFI, there are really only 29,962.791 tokens in circulation today. YFI has seen massive trade volume this week as well, as Saturday’s global YFI trade volume topped $500 million.

What do you think about YFI’s token topping $25k on Saturday? Let us know what you think about this subject in the comments section below.

The post Defi Project Yearn Finance Smashes Records as Native Token Surpasses $30K appeared first on Bitcoin News.

from Bitcoin News https://ift.tt/3jjLBMe

Comments

Post a Comment