Ripple has launched its first On-Demand Liquidity (ODL) service implementation in Japan in partnership with SBI Remit, a large Japanese money transfer provider, and Philippine crypto exchange Coins.ph.

Ripple, SBI, Coins.ph Collaborate to Launch Ripplenet’s On-Demand Liquidity

Ripple Labs announced Wednesday “the launch of Ripplenet’s first live On-Demand Liquidity (ODL) service implementation in Japan” in collaboration with SBI Remit Co. Ltd. and Coins.ph.

SBI Holdings, an investor and shareholder of Ripple, independently announced Wednesday that SBI Remit and crypto exchange SBI VC Trade have launched “Japan’s first international remittance service using crypto assets” in partnership with Ripple Labs. SBI Remit, a subsidiary of SBI Fintech Solutions, is one of the largest money transfer companies in Japan. It has been using Ripplenet since 2017.

Coins.ph, a product of Betur Inc., is a crypto exchange and a leading mobile wallet service in the Philippines that is regulated by the central bank, Bangko Sentral ng Pilipinas (BSP).

The announcement details:

This expanded partnership will see SBI Remit connect with Coins.ph and digital asset exchange platform SBI VC Trade on Ripplenet for faster and more affordable cross-border payments from Japan to the Philippines.

SBI explained that after a remittance request is initiated with SBI Remit, SBI VC Trade sends XRP in real time to Coins.ph, which converts the cryptocurrency to the Philippine peso to pay the remittance recipient.

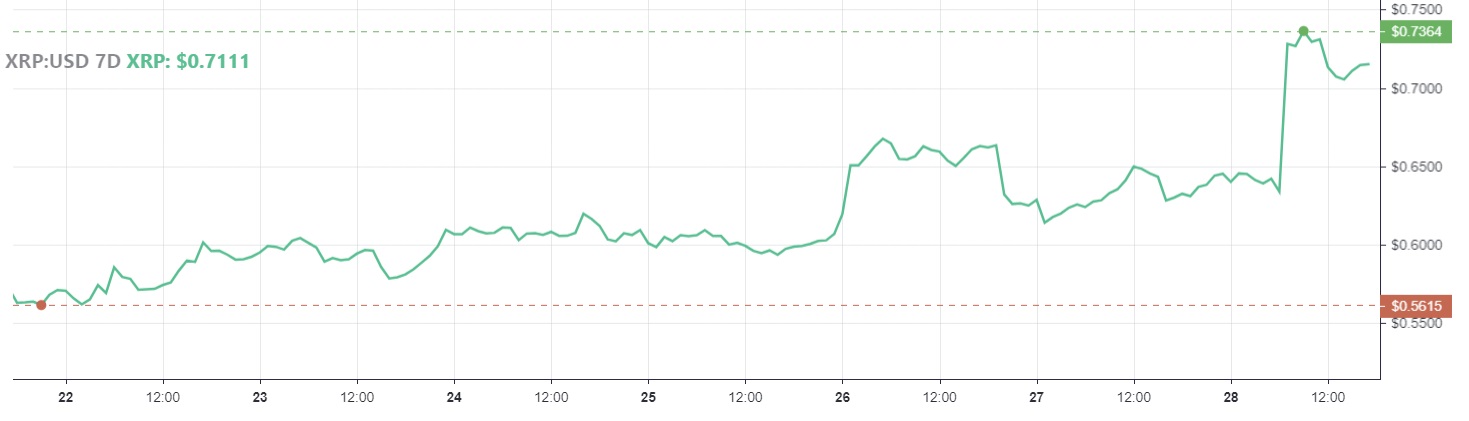

The price of XRP jumped more than 16% Wednesday following the news. At the time of writing, XRP is trading at $0.7148 based on data from Bitcoin.com Markets.

Ripple explained that “The Filipino diaspora is currently the third largest in Japan,” noting that remittance flows from Japan to the Philippines sent by overseas Filipino workers in 2020 totaled approximately $1.8 billion. In addition, Japan has one of the highest cross-border payment fees in the world. The company detailed:

This is Ripple’s first On-Demand Liquidity (ODL) service implementation in Japan, setting the stage to drive more adoption of crypto-enabled services in the region. By leveraging the digital asset XRP to eliminate pre-funding, the two companies can also free up capital and accelerate the expansion of their own payments businesses.

Nobuo Ando, Representative Director of SBI Remit, commented: “The launch of ODL in Japan is just the start, and we look forward to continuing to push into the next frontier of financial innovation, beyond real-time payments in just the Philippines, but to other parts of the region as well.”

Meanwhile, the lawsuit brought by the U.S. Securities and Exchange Commission (SEC) against Ripple Labs and its executives is still ongoing. Ripple CEO Brad Garlinghouse has revealed, however, that the company could go public after the SEC lawsuit is resolved.

What do you think about Ripple launching On-Demand Liquidity (ODL) service in Japan? Let us know in the comments section below.

from Bitcoin News https://ift.tt/2UY3rhe

Comments

Post a Comment