During the last two weeks, statistics show the new crypto asset dedicated to the Bored Ape Yacht Club community (BAYC), apecoin (APE), has climbed more than 50% against the U.S. dollar. A few days ago, apecoin tapped an all-time high at $17.30 per unit and the crypto asset is now the 32nd largest in terms of market capitalization among 13,691 other cryptocurrencies. Data also shows out of the 48,570 APE holders, there’s a large concentration of apecoin whales.

A Large Concentration of Apecoin Whales

The BAYC-infused apecoin (APE) has been a popular crypto project ever since the coin project was introduced and millions of coins were airdropped to NFT holders. More specifically, the holder’s NFTs derived from the BAYC, Mutant Ape Yacht Club (MAYC), and Bored Ape Kennel Club (BAKC) collections.

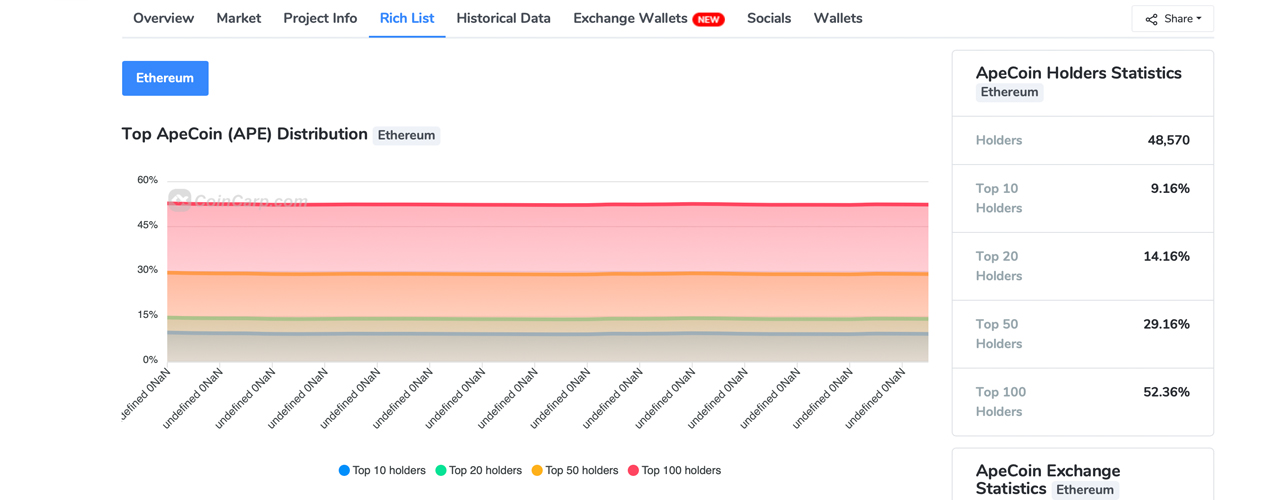

According to statistics, the initial airdrop aimed to distribute 150 million APE and to date, 140,725,540 APE has been claimed. Data shows there’s 284,843,750 APE currently in circulation among 48,570 APE holders. Looking at the apecoin (APE) rich list via coincarp.com shows that out of all the APE in circulation, there’s a large concentration of apecoin whales.

For instance, the top ten APE holders custody 9.16% of the 284.84 million APE in circulation, which equates to 26,091,687.5 apecoin. The top 20 holders currently have 14.16% of the APE in circulation under their control which is 40,333,875 APE. Data further shows the top 50 APE holders command 29.16% of the APE in circulation, which equates to 83,060,437.5 apecoin. Moreover, the top 100 APE wallets hold 52.36% of the APE supply today.

The 100 holders represent 0.20% of the 48,570 APE holders today. In fact, the top address holds 30,305,548 APE which is 3.03% of the current supply. The second-largest APE address holds 10,833,332 APE or 1.08% of the apecoin in circulation.

3% of All APE Trades Settled on Binance, 42% of All APE Trades Are Paired With Tether

Presently, APE is only 4% away from surpassing the token’s all-time high and the coin has seen $1.87 billion in 24-hour trading volume. Apecoin has the largest quantity of trade volume on the decentralized exchange (dex) platform Uniswap. In terms of dex platforms, APE is also prominent on Sushiswap, 1inch, and 0x Native, respectively.

Binance is the most active centralized crypto exchange trading APE today as the crypto’s top pair is tether. At the time of writing, USDT represents 42.26% of all APE trades worldwide. Over 3% of all the apecoin (APE) trade volume has been settled on Binance. Meanwhile, because of apecoin’s recent price high, the hashtag #APECOIN is trending on Twitter this weekend.

What do you think about the large concentration of apecoin whales? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/79DYFqA

Comments

Post a Comment