Hedge fund manager Michael Burry, famed for forecasting the 2008 financial crisis, has warned of a looming consumer recession and more earnings trouble. He cited falling U.S. personal savings and record-setting revolving credit card debt despite trillions of dollars in stimulus money.

Michael Burry’s Recession Warning

Famous investor and founder of investment firm Scion Asset Management, Michael Burry, warned on Friday about a looming consumer recession and more earnings trouble ahead.

He is best known for being the first investor to foresee and profit from the U.S. subprime mortgage crisis that occurred between 2007 and 2010. He is profiled in “The Big Short,” a book by Michael Lewis about the mortgage crisis, which was made into a movie starring Christian Bale.

Burry explained on Twitter Friday:

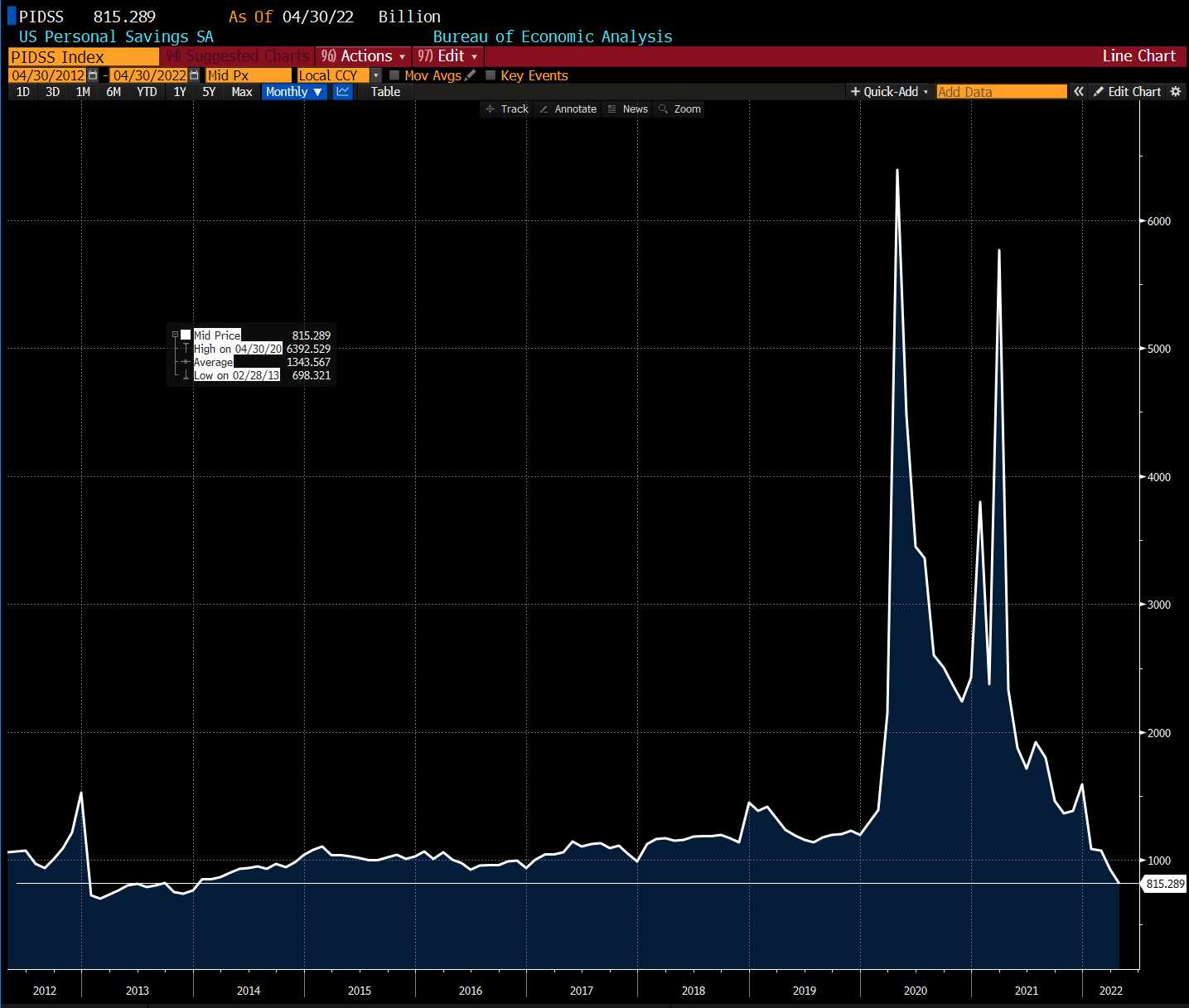

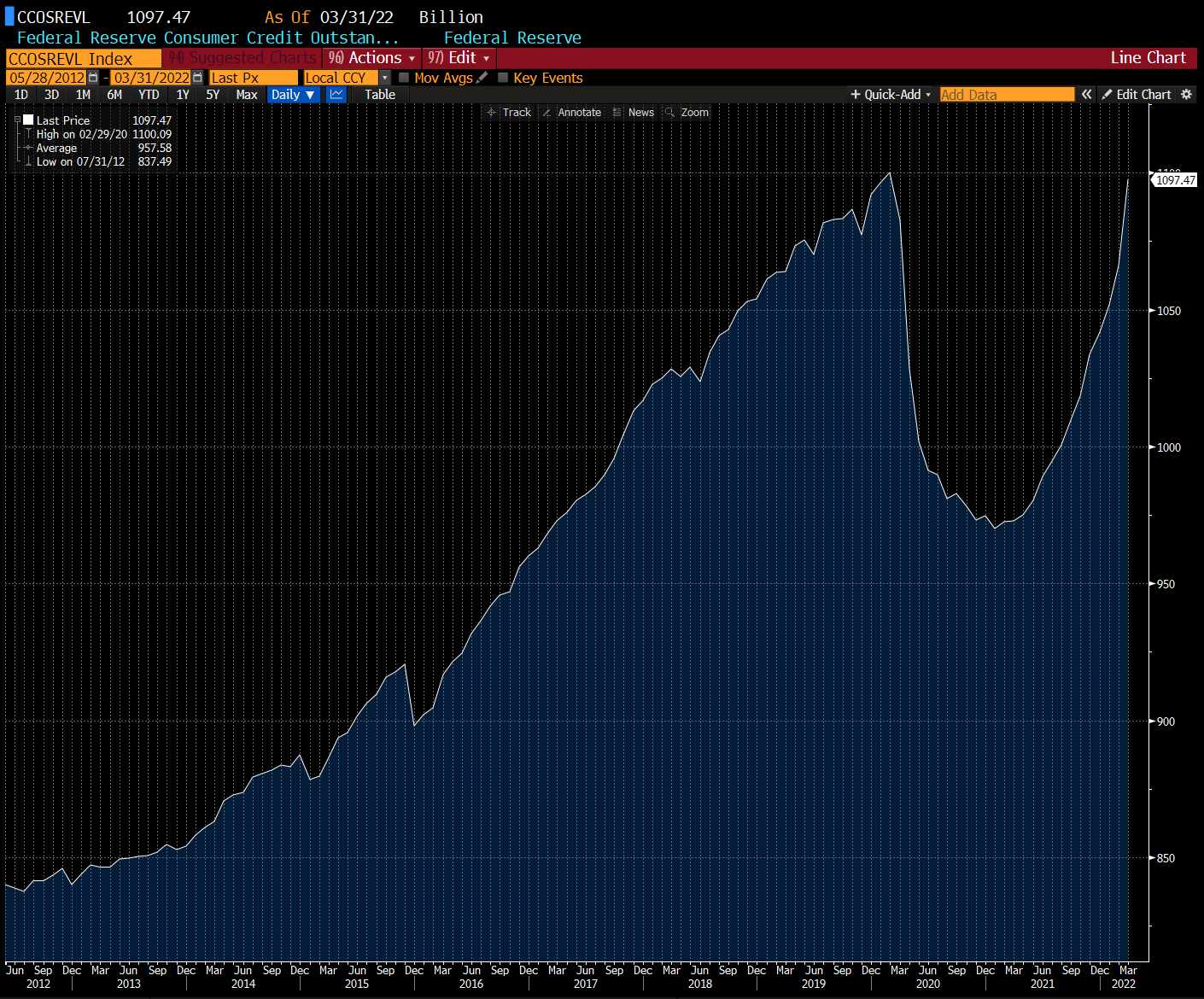

US Personal Savings fell to 2013 levels, the savings rate to 2008 levels – while revolving credit card debt grew at a record-setting pace back to the pre-Covid peak despite all those trillions of cash dropped in their laps. Looming: a consumer recession and more earnings trouble.

His tweet includes two images. The first shows a sharp decline in U.S. personal savings. The other shows a steep rise in consumer credit outstanding.

At the time of writing, there were 476 comments on Burry’s tweet, which has been liked 11K times and retweeted almost 2.5K times. Many people agreed with Burry on Twitter, thanking him for raising the issue and telling others to heed his warning.

One commented: “This is wild. We airdropped helicopter money on people and yet personal savings went down and credit card debt went right back to where it was.”

Another wrote: “Exactly what I said- inflation is not a problem. Consumer debt IS a problem. Demand-side monetary policy is faulty. Rate manipulation fails to correct the market. Americans flushed with cash. Divert into long-term savings instead of focusing on expenditure. Kill imports.”

A different user opined:

While the media wants the narrative to be that the consumer is strong, the numbers say otherwise. Decreased savings, increased debt, and inflation metrics that are still rising MoM, with energy prices near highs we haven’t seen since 2008.

Several people agreed that “numbers don’t lie,” and the U.S. economy is looking as grim as Burry suggested or even worse.

A growing number of people have recently warned that a recession is either here or is imminent, including Tesla CEO Elon Musk, Rich Dad Poor Dad Author Robert Kiyosaki, and Goldman Sachs’ senior chairman and former CEO, Lloyd Blankfein.

What do you think about Michael Burry’s warning? Let us know in the comments section below.

from Bitcoin News https://ift.tt/aEYLv3f

Comments

Post a Comment