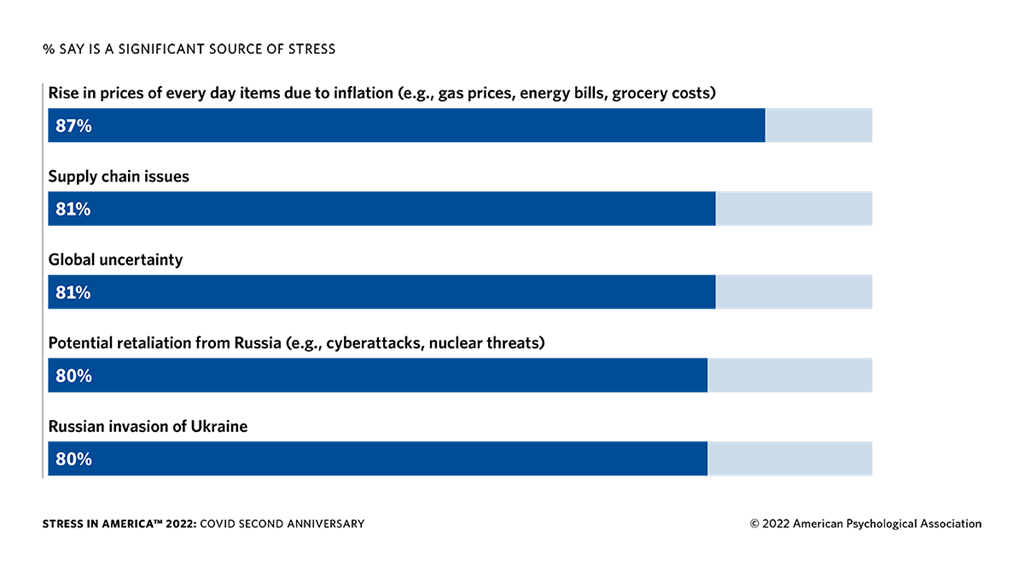

As the consumer price index (CPI), a measure of prices for goods and services, hit another all-time high in April reaching 8.3%, Americans are stressed out more than ever about inflation and money. A recent survey published by the American Psychological Association shows that 87% of U.S. residents say inflation on everyday items has driven their stress levels way up.

APA Survey Says 87% of Americans Are Stressed About Inflation

Two recent studies show that a great number of Americans are stressed out over inflation and the rising costs of everyday goods and services. According to the American Psychological Association (APA) “Stress In America Survey,” Americans are burdened by mental health issues tied to money and inflationary pressures.

Vaile Wright, a senior director of health care innovation at the American Psychological Association, further explained to CNBC’s Charlotte Morabito that “Eighty-seven percent of Americans said that inflation and the rising costs of everyday goods [are] what’s driving their stress.”

Moreover, Mark Hamrick, the Washington bureau chief at Bankrate, told Morabito that Americans do have hope. “I think that people need to have a sense of hope,” Hamrick said. “When the economy is working for them, there’s a greater likelihood that people will have hope that they can accomplish their basic personal financial objectives.”

The Stress In America Survey published by the APA shows that the top issue for stress was “due to inflation (e.g., gas prices, energy bills, grocery costs, etc.)” and other top issues included “supply chain issues,” and “global uncertainty.” In fact, the APA study shows that Americans are tired of dealing with crises and most believe that there seems to be a streamlining of catastrophe after catastrophe.

“The survey findings make clear that U.S. adults appear to be emotionally overwhelmed and showing signs of fatigue,” the APA’s Stress In America Survey notes. “The vast majority of adults (87%) agreed it feels like there has been a constant stream of crises over the last two years, and more than seven in 10 (73%) said they are overwhelmed by the number of crises facing the world right now,” the report adds.

Economists Say the Democrats’ ‘Greedflation’ Excuse Doesn’t Add Up

Additionally, a number of Americans and economists are not pleased with the Democrats’ ‘greedflation’ excuse, as one report shows the political party’s rationalization doesn’t add up. “Many Democrats blame price-gouging companies for the worst surge in Americans’ cost of living in more than a generation,” Bloomberg’s author Erik Wasson notes on Thursday. “But economists, including several who are left-leaning, disagree.”

Jason Furman, a Harvard professor who worked with the Obama administration’s Council of Economic Advisers, says ‘greedflation’ is playing a small role. “Corporate power is playing likely a very small role in the inflation that we’re seeing right now,” Furman explained on Thursday. “The primary solution has to come from the primary cause of inflation, which is demand is way too high,” the Harvard professor added.

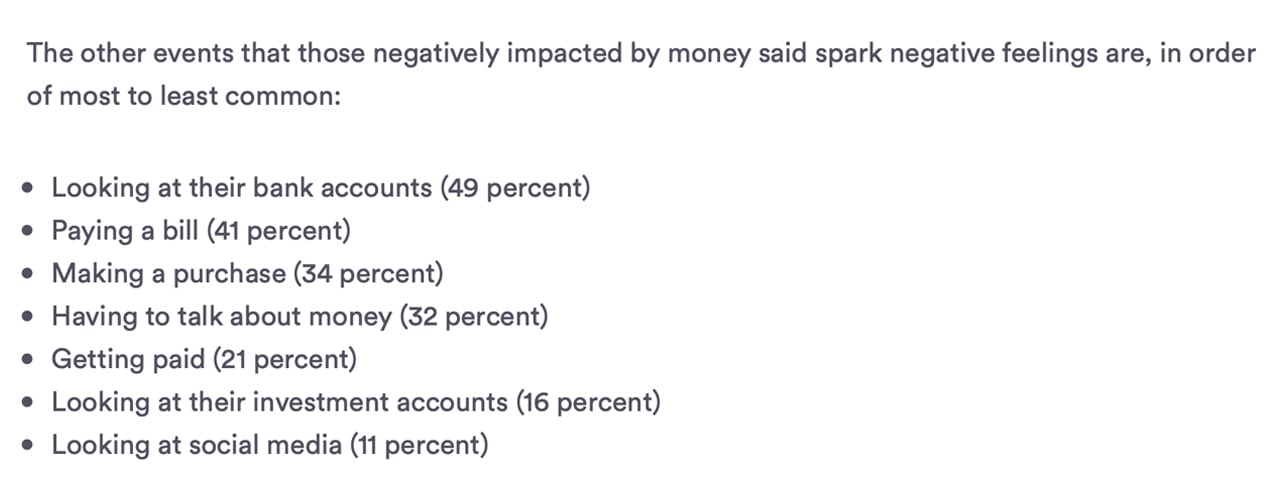

Bankrate’s April Mental Health Report Shows 40% of Americans Say Money Is Impacting Their Mental Health Negatively

In addition to the APA’s Stress In America Survey, Bankrate’s April 2022 Money and Mental Health report says 40% of Americans have said money is impacting their mental health in a negative way.

“And among adults who say money can have a negative impact on their mental health, about half (49 percent) say looking at their bank accounts is a trigger,” the Bankrate April mental health report notes. “This suggests that as a society, we need to do a better job having experiences with, and conversations about, money.”

Making matters worse, equities markets and the macro environment indicate things are headed toward a long and drawn-out bear market. On top of that, the Federal Reserve’s chief Jerome Powell recently explained that the U.S. central bank has no issues with continuing to hike the benchmark interest rate.

“We will go until we feel we’re at a place where we can say financial conditions are in an appropriate place, we see inflation coming down,” Powell said in a Wall Street Journal interview. “We’ll go to that point. There won’t be any hesitation about that,” the U.S. central bank’s chair added.

What do you think about the recent stress survey from the American Psychological Association? Is inflation adding stress to your life? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/HcGsfjC

Comments

Post a Comment