Embr is an all-remote corporation building a global Web3 fundraising infrastructure, and Checkout is the first of many product releases focused on moving startups and creators into a new era of the internet.

| Web3 has the potential to rewrite the future of economic opportunity for innovators and investors everywhere. Still, crypto first-timers and veterans alike often suffer through long, error-prone processes when purchasing digital assets. |

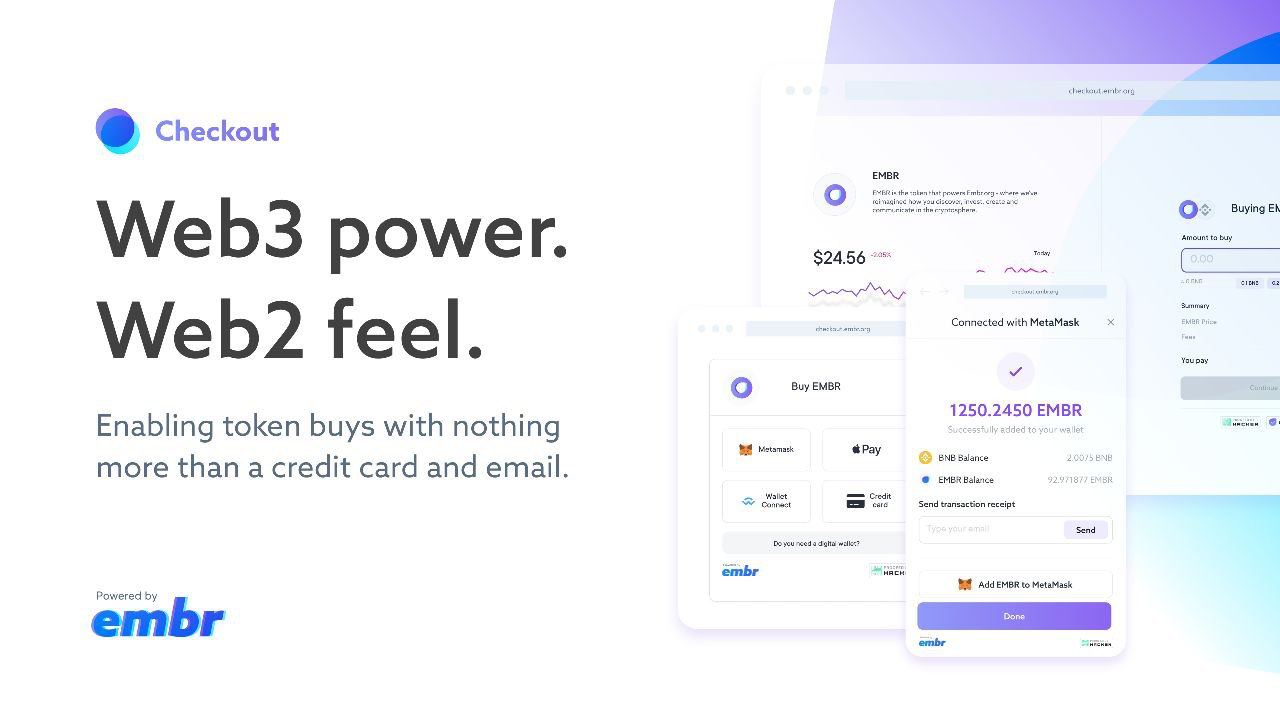

| Embr Checkout eliminates all friction from the current state of token purchases, enabling people to buy tokens with nothing more than a credit card and email. Its Web2-esque design creates optimal experiences where buyers no longer need crypto wallets or assets to back disruptive technology projects they believe in. |

Checkout embodies the enterprise-grade security of Web2 financial rails with Embr Verified, the Web3 equivalent of PayPal verified. All projects are screened for AML by Sentinel Protocol, an AI/ML-powered threat intelligence program that protects the assets of first-class service providers like Samsung and Coindesk. As part of Embr’s verification program, all project founders are KYC’d, and project liquidity pools are checked in real-time to ensure they’re locked with sufficient liquidity. If they’re not, any transactions are blocked as a safeguard measure.

Optimized for everyone, Embr Checkout takes multi-chain navigation, analog contract address entries, and gas fee and slippage calculations out of the equation for anybody wanting to dive right into the borderless, inclusive opportunities Web3 offers. Along with that, there are no setup, monthly, or hidden fees for token-based projects.

Checkout is currently in private beta, with more than 40 token-based projects successfully transacting over half a million dollars to date. Embr is targeting the end of July 2022 to release a public version that allows project leaders that are building on any of the 20 chains and counting to enable token sales directly on their website.

“As project leaders, we’re supposed to be anti-FUD. Yet, we’ve been sending supporters to places of fear, uncertainty, and doubt when they’re ready to commit. Token-based projects need flawless first impressions. Anything less than Embr Checkout will hurt your project.” – @defi_jason – Jason Dominique, CEO, Embr.

Embr Checkout is audited by Hacken, a leading blockchain security consulting firm. It includes a bug bounty program from HackenProof, an expert bug bounty platform for crypto projects, to stay ahead of the curve in discovering any potential security vulnerabilities.

About Embr

Embr is a gateway to the decentralized world. Its mission is to empower innovators with the tools and know-how to ignite the future of economic opportunity. In less than three hours, Embr sold out its private presale, successfully raising $2.5 million for their IDO while affirming a global need for new layers of trust and delight in Web3 payment experiences.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.

from Bitcoin News https://ift.tt/8dGzQqp

Comments

Post a Comment