During the last two months, the stablecoin tether has been one of the most traded crypto assets swapped against a myriad of digital currencies. 66 days ago on April 11, 2022, tether’s market valuation was over $82 billion with 82,694,361,442 tethers in circulation. Since then, more than 12 billion tethers have been removed from circulation amid the Terra blockchain implosion, the recent crypto market carnage, and rumors circulating around Celsius and Three Arrows Capital (3AC).

More Than 12 Billion Tethers Leave the Crypto Economy Since April 11

According to market data, the number of tether (USDT) in circulation has dwindled down from over 82 billion to today’s 70 billion. Bitcoin.com News reported on the swelling stablecoin market valuation of all the fiat-pegged tokens in existence as the stablecoin economy neared $200 billion, on April 11.

On that day, there were approximately 82,694,361,442 tethers in circulation after the dollar-pegged crypto saw a 3% increase in growth the month prior. Since then, 15.30% has been removed from circulation as the circulating supply on June 16, 2022, is 70,038,816,028 USDT, according to coingecko.com metrics.

People have been noticing the number of tethers in circulation dropping, as crypto advocates have been discussing the subject on social media. Much of the USDT in circulation has been removed since the terrausd (UST) de-pegging incident, as there were 82.79 billion tethers in circulation on May 12, 2022.

Two days later on May 14, the number or tethers in circulation was down 7.25% to 76.70 billion USDT, according to coingecko.com stats saved on archive.org. During the course of 33 days, another 8.73% has been removed from circulation since May 14.

USDC’s Market Cap Grows Over the Last 2 Months, Tether Commands Lion’s Share of Global Trade Volume

Meanwhile, tether’s competitor usd coin (USDC) has grown during the last two months. On April 16, 2022, the total amount of USDC in circulation was approximately 50,090,822,252 tokens according to coingecko.com metrics recorded on archive.org. Since then, the number of USDC has grown to 54,582,713,063, or 8.96% larger, during the past two months.

During the terrausd (UST) fiasco, the number of USDC slid to 49,122,170,211 on May 12. The USDC in circulation then grew from the 49.12 billion region to 53,804,005,416 by June 10. USDC saw a slight issuance increase since then. Circle also announced the launch of euro coin (EUROC) backed 1:1 by the euro this month.

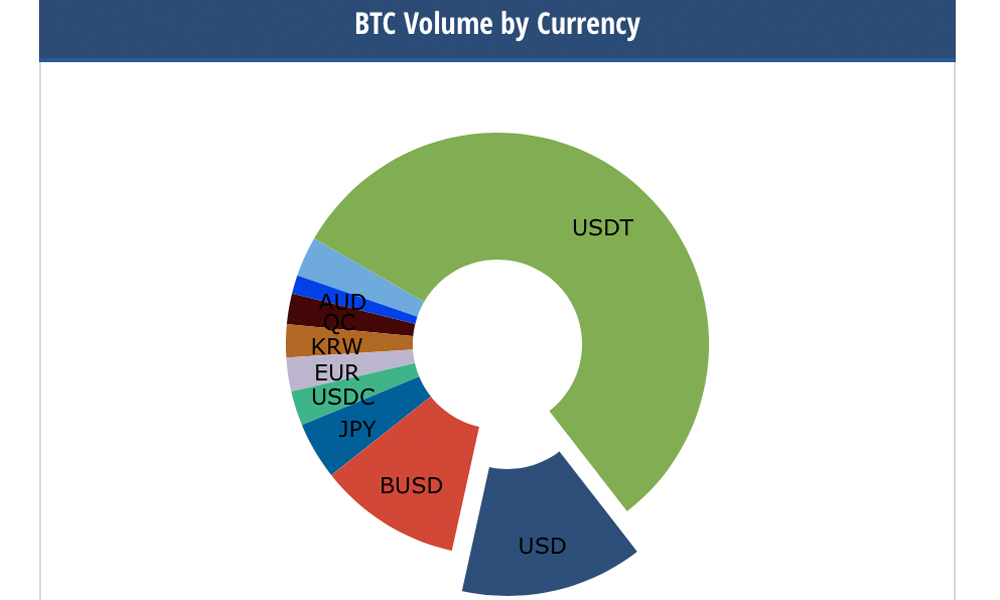

Data recorded on June 16 shows that USDT commands the lion’s share of the global cryptocurrency trade volume, as it accounts for $51.41 billion of the $96.31 billion in volume on Thursday. That means 53.37% of all the crypto trades on Thursday have been paired with USDT.

The amount of USDC traded on June 16 pales in comparison, as the stablecoin recorded $5.93 billion or 6.15% of the global crypto trade volume during the last 24 hours. Cryptocompare data recorded on June 16 shows USDT trades accounted for 56% of bitcoin’s (BTC) trade volume. While USDC accounted for 2.77% of all BTC trades on Thursday.

What do you think about the number of tethers in circulation declining? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/bSDaOvl

Comments

Post a Comment