Binance Launches Billion-Dollar Crypto Industry Recovery Fund to Restore Confidence After FTX Meltdown

Binance has committed $1 billion to a crypto industry recovery initiative to restore confidence following the collapse of crypto exchange FTX. Several other crypto companies have joined Binance’s efforts and committed capital for the recovery fund.

Crypto Industry Recovery Initiative Launched

Cryptocurrency exchange Binance unveiled Thursday some details of its Industry Recovery Initiative (IRI), which the crypto firm described as “a new co-investment opportunity for organizations eager to support the future of web3.”

The announcement states:

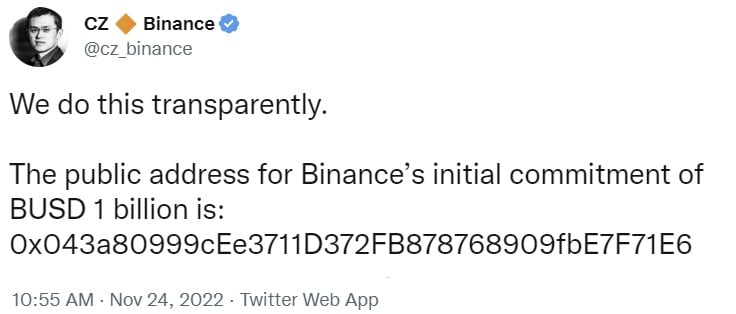

Initially, Binance will commit USD 1 billion to IRI-themed investment opportunities with an intent to ramp up that amount to USD 2 billion in the near future if the need arises.

“So far, Jump Crypto, Polygon Ventures, Aptos Labs, Animoca Brands, GSR, Kronos, and Brooker Group have also committed to participating with an initial aggregate commitment of around USD 50 million, and we expect more participants to join soon,” Binance added. Each participant has set aside committed capital in stablecoins or other tokens.

Binance explained that it will be looking for projects characterized by “innovation and long-term value creation,” “a clearly delineated and viable business model,” and “a laser focus on risk management.”

The global crypto exchange noted:

What makes this initiative unique is the collaborative approach to restoring confidence in web3.

The CEO of Binance, Changpeng Zhao (CZ), first revealed that his company is setting up a crypto industry recovery fund last week. The executive explained at the time that the purpose of the recovery fund is “to reduce further cascading negative effects of FTX” by helping projects that “are otherwise strong, but in a liquidity crisis.” CZ has compared the FTX fiasco to the 2008 financial crisis, warning of “cascading effects.”

FTX filed for Chapter 11 bankruptcy on Nov. 11 and former CEO Sam Bankman-Fried stepped down. The company is under investigation in multiple jurisdictions. In the U.S., a number of authorities are investigating the exchange for mishandling customer funds.

Binance explained that the IRI is not an investment fund. “We have already received around 150 applications from companies seeking support under the IRI,” the exchange noted, elaborating:

The mandate of this new effort is to support the most promising and highest quality companies and projects built by the best technologists and entrepreneurs that, through no fault of their own, are facing significant, short term, financial difficulties.

The announcement further details that the initiative is expected to last about six months and “will be flexible on the investment structure — token, fiat, equity, convertible instruments, debt, credit lines, etc — as we expect individual situations to require tailored solutions.”

What do you think about Binance setting up a crypto industry recovery fund? Let us know in the comments section below.

from Bitcoin News https://ift.tt/ONlZ4Pw

Comments

Post a Comment