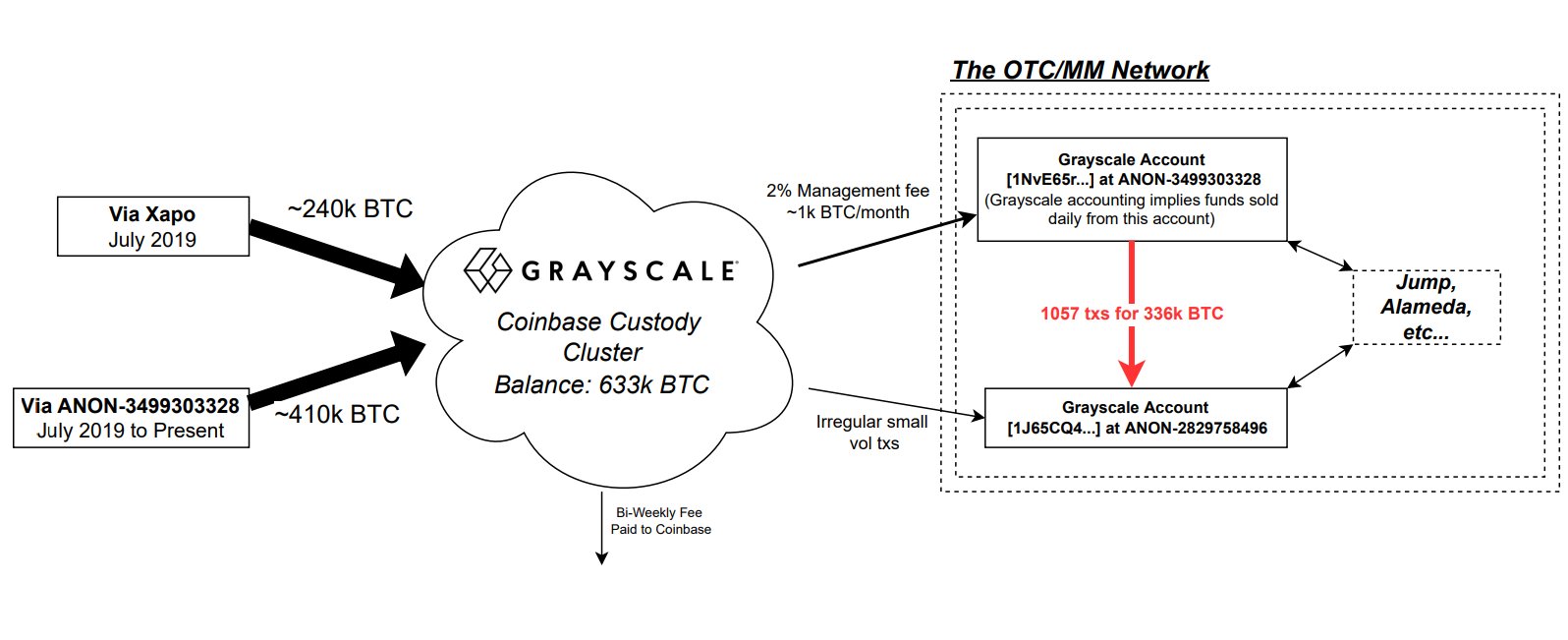

After Grayscale Investments shared information concerning the company’s product holdings, people questioned why the firm wouldn’t share the public addresses associated with the crypto assets it holds. However, on Nov. 23, OXT researcher Ergo published a Twitter thread featuring onchain forensics that confirm Coinbase Custody holds a balance of 633K bitcoin that likely belongs to the Grayscale Bitcoin Trust (GBTC).

OXT Researcher Verifies Grayscale’s Bitcoin Holdings

Five days ago, Bitcoin.com News reported on Grayscale disclosing information tied to the safety and security of the company’s digital assets. Grayscale’s statements were meant to assure the public that the company’s cryptocurrencies are “safe and secure” after the FTX collapse.

The digital asset fund manager detailed that all of the company’s digital assets are stored with Coinbase Custody Trust Company. On the Grayscale website, the firm says Coinbase Custody is a qualified custodian under New York banking laws and the funds are kept in “cold storage.”

The one thing Grayscale did not disclose is the company’s digital asset addresses and it did mention why it chose not to share the wallets. Grayscale explained that it has never publicly disclosed onchain addresses to the general public “due to security concerns.” The claim was criticized and mocked, but Grayscale said that it understood the non-disclosure would be “a disappointment to some.”

Despite Grayscale’s non-disclosure, the OXT researcher (oxt.me) Ergo explained that it started a community-led effort to create transparency around GBTC holdings. “We have taken steps to ID likely GBTC addresses and balances based on public info and blockchain forensics,” Ergo said on Nov. 20.

Leveraging an article from Coindesk, heuristics, and publicly known bitcoin addresses associated with the custodian Xapo, that day, Ergo “attributed 432 addresses holding 317,705 BTC to likely GBTC custody activity.”

The researcher discovered at least 50% of the GBTC holdings and added: “additional work is necessary to ID the remaining addresses.” By 2:49 p.m. (ET) on Nov. 23, Ergo said the additional work was finished in a Twitter thread called: “The Grayscale G(BTC) Coins Part 2” Ergo tweeted:

In this analysis, we use additional [onchain] forensics to CONFIRM the approximate 633K BTC balance held by G(BTC) at Coinbase Custody.

Ergo’s summary notes that after discovering the first 50% of bitcoins associated with Grayscale’s BTC, the team had to ‘scan the blockchain’ for additional addresses fitting the profile of those found in Part 1.

Ergo further leaves independent analysts with information on the heuristics used and the bitcoin addresses compiled for the search. “Obviously no heuristic or set of heuristics are perfect, and this analysis certainly includes false positives and negatives,” Ergo remarked. “But our result is almost identical to the G(BTC) self-reported holdings.”

In the Twitter thread, Ergo says that it doesn’t know why Grayscale decided not to share the company’s BTC addresses. Ergo said the team originally thought Coinbase Custody may have a non-disclosure policy. But after reading some information published by Coinbase, Ergo said “it seems clear that Coinbase Custody is willing to disclose addresses.”

A number of people complimented Ergo’s Twitter thread and analysis of the GBTC coins. Furthermore, the news follows Coinbase CEO Brian Armstrong explaining that as of Sept. 30, Coinbase holds 2 million bitcoin.

What do you think about Ergo’s onchain analysis of GBTC’s bitcoin horde? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/SWIfg3T

Comments

Post a Comment