Two prominent Solana projects have announced they are transitioning over to new blockchains. The non-fungible token (NFT) venture Degods detailed it will be moving to the Ethereum chain and the Y00ts NFT team detailed it is moving to Polygon. Both teams said the transitions will take place in 2023.

Degods Says NFT Project Will Move to Ethereum, Y00ts Details NFT Venture Is Transitioning to Polygon

The crypto community has been discussing two crypto projects that have said the teams plan to transition their ventures from the Solana blockchain network to an alternative blockchain. Degods is one NFT project that revealed on Twitter it was moving from Solana to the Ethereum network. Launched in October 2021, Degods is an NFT venture that created 10,000 deflationary PFP (profile picture) NFTs. On Twitter the Degods team said:

Degods will officially bridge to Ethereum in Q1 of 2023. The bridge is not the destination. It is on the path to get there.

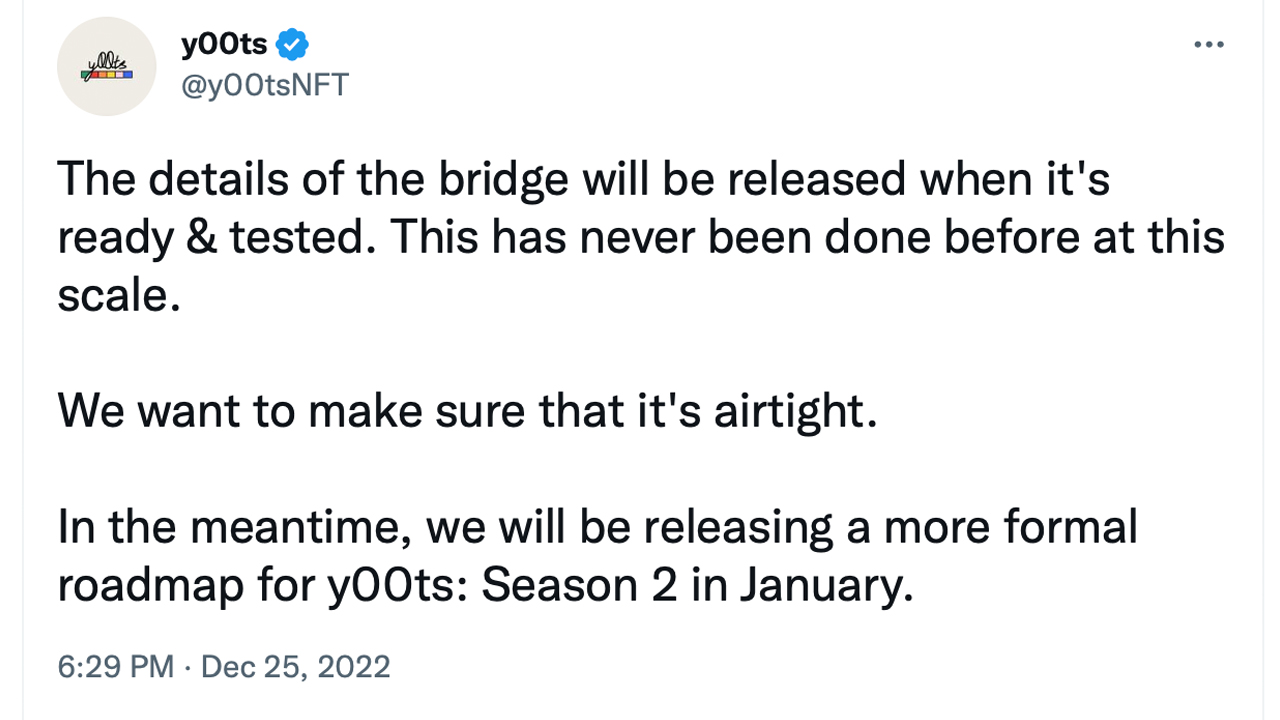

Interestingly, the team behind the Y00ts NFT collection said it plans to transition over to the Polygon network. “Y00ts will officially bridge to [Polygon] in Q1 2023,” the official Twitter account tweeted on Dec. 25, 2022. The decisions to transition the two NFT projects from one chain to another come at a time where the Solana project itself has been hurt by its former relationships with FTX.

Solana’s native crypto asset solana (SOL) is down 94.2% year-to-date and over the last 30 days SOL has lost 19.7% against the U.S. dollar. Last year, SOL was a top ten crypto asset but the digital currency has been struggling to hold the 18th largest market cap position in more recent times. Seven-day stats show that Solana’s NFT sales are still the second largest out of 19 different blockchain networks, according to cryptoslam.io data.

While Ethereum dominated the last seven days of sales with $129.12 million out of the $154 million in sales, Solana took the second position with its $14.65 million in NFT sales recorded this past week. Meanwhile, Polygon holds the fourth-largest position in terms of NFT sales with $2.38 million.

Defillama metrics shows that there’s $39.42 billion total value locked (TVL) in decentralized finance (defi) today and Solana commands the 12th largest TVL in defi. Solana’s TVL on Dec. 26, 2022 is $216.39 million which equates to 0.55% of the entire TVL locked in defi. Interestingly, the tweets from Degods and Y00ts say the same thing as both teams mention transitioning “has never been done before at this scale.”

What do you think about the two NFT projects transitioning from Solana to different blockchain networks? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/LJNnRF5

Comments

Post a Comment