Snowden to Musk: ‘I Take Payment in Bitcoin’; Big Short Investor Says Audits of Exchanges like Binance and FTX Are ‘Meaningless,’ and More — Week in Review

Ahead of the holidays and new year, the former U.S. National Security Agency (NSA) contractor known to the world as a staunch privacy advocate and whistleblower, Edward Snowden, has offered to step up as the new CEO of Twitter after current “Chief Twit” Elon Musk has said he is stepping down. In other news from this week, hedge fund manager Michael Burry — of “The Big Short” fame — said that audits of cryptocurrency exchanges like FTX and Binance are “meaningless.” Get caught up on these hot stories and much more just below in this latest issue of the Bitcoin.com News Week in Review.

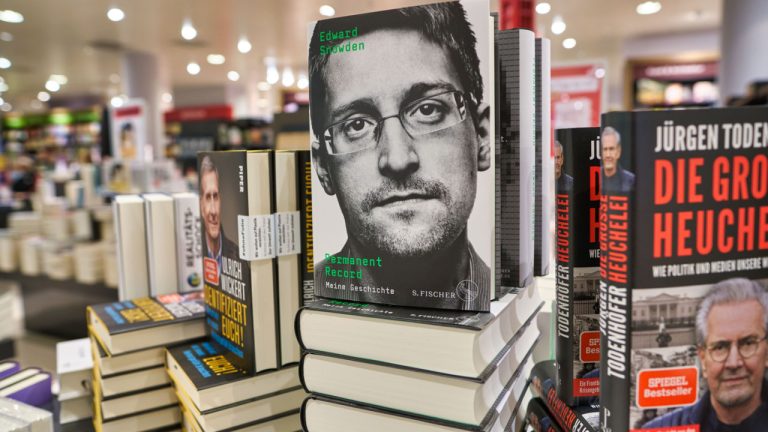

Elon Musk Promises to Step Down as Head of Twitter — Edward Snowden Throws His Name in the Hat for CEO

Tesla CEO and Twitter chief Elon Musk has promised to step down as head of Twitter. As the billionaire seeks a new CEO to run the social media platform, privacy advocate Edward Snowden threw his name in the hat, stating that he takes payment in bitcoin. “The question is not finding a CEO, the question is finding a CEO who can keep Twitter alive,” Musk clarified.

New FTX CEO Told Members of Congress SBF’s Family ‘Certainly Received Payments’ From the Business

According to multiple reports, FTX co-founder Sam Bankman-Fried’s parents face scrutiny over their reported involvement with their son’s business operations. The two Stanford professors Joseph Bankman and Barbara Fried have not been charged with any wrongdoing, but the current FTX CEO, John J. Ray III, recently told members of the U.S. Congress that Joseph Bankman and “the family certainly received payments” from FTX.

‘Visibly Shaking’ FTX Co-Founder Hammers out a ‘Wasted Day’ in Court as Bahamian, US Legal Team Prep for Extradition

FTX co-founder Sam Bankman-Fried (SBF) had a difficult day in court on Monday according to a number of accounts that said SBF’s local attorney seemed to be in conflict with his U.S. legal team. Furthermore, courtroom reports noted that SBF dozed off for an extended period of time and had to be shaken awake by an official.

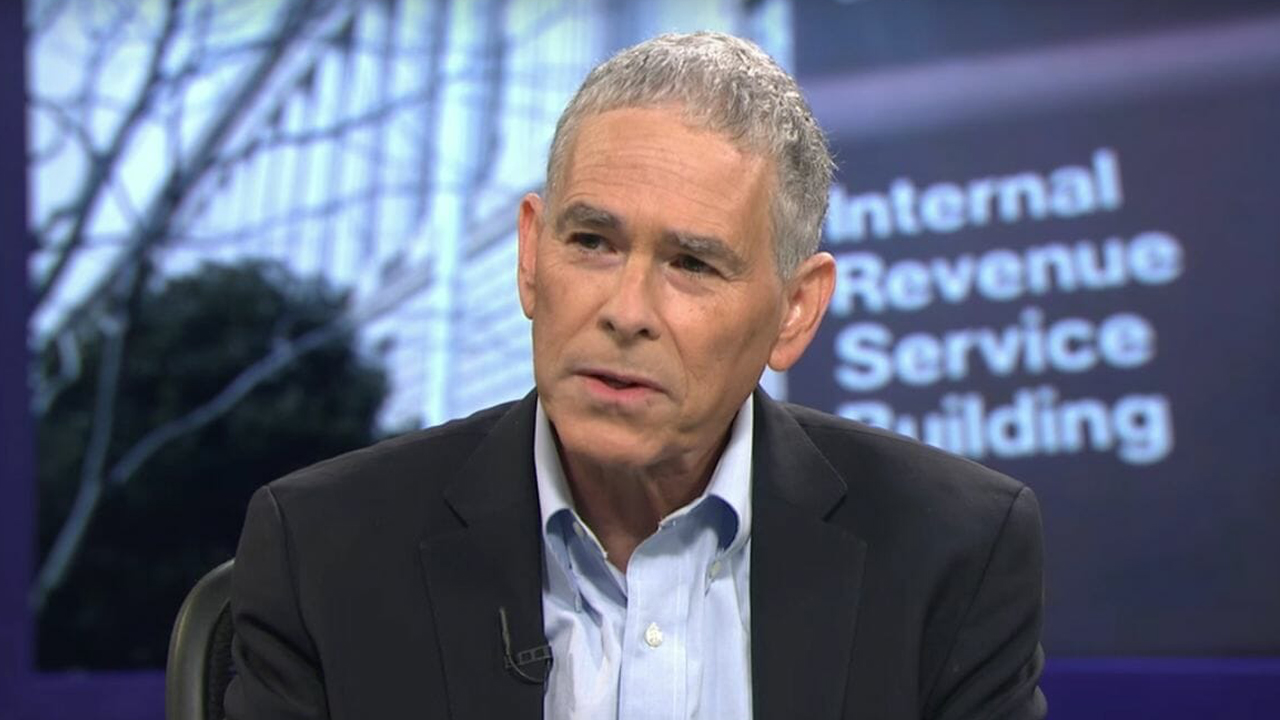

Big Short Investor Michael Burry Says Audits of Crypto Exchanges Like Binance and FTX Are ‘Meaningless’

Hedge fund manager Michael Burry, famed for forecasting the 2008 financial crisis, says the problem with auditing cryptocurrency exchanges, like Binance and FTX, is the same as when he started using a new kind of credit default swap. “Our auditors were learning on the job,” he described, adding that it’s “not a good thing.”

What are your thoughts on this past week’s hottest stories from Bitcoin.com News? Be sure to let us know in the comment section below.

from Bitcoin News https://ift.tt/w9iI8fh

Comments

Post a Comment