Following a brief downturn in mid-February 2023, artificial intelligence (AI) crypto assets have continued to see gains over the last 30 days. Currently, out of 74 listed AI-focused cryptocurrencies, the net value of all these tokens has risen to more than $4 billion, which accounts for 0.37% of the entire crypto economy’s value.

Majority of Listed AI Cryptocurrencies See Positive Gains Over Last Month

Artificial intelligence (AI) has been a dominant theme in 2023, resulting in a significant surge in the value of AI-focused tokens this year. Bitcoin.com News reported on the rise of these cryptocurrencies at the end of January, and despite a brief pullback in mid-February, AI crypto assets have continued to see gains throughout the month.

According to data from cryptoslate.com, 74 AI-centric digital currencies are now worth $4.03 billion, accounting for 0.37% of the overall crypto market and 1.19% of the smart contract token market. Moreover, the majority of the 74 listed cryptocurrencies associated with artificial intelligence have experienced positive gains in the last month.

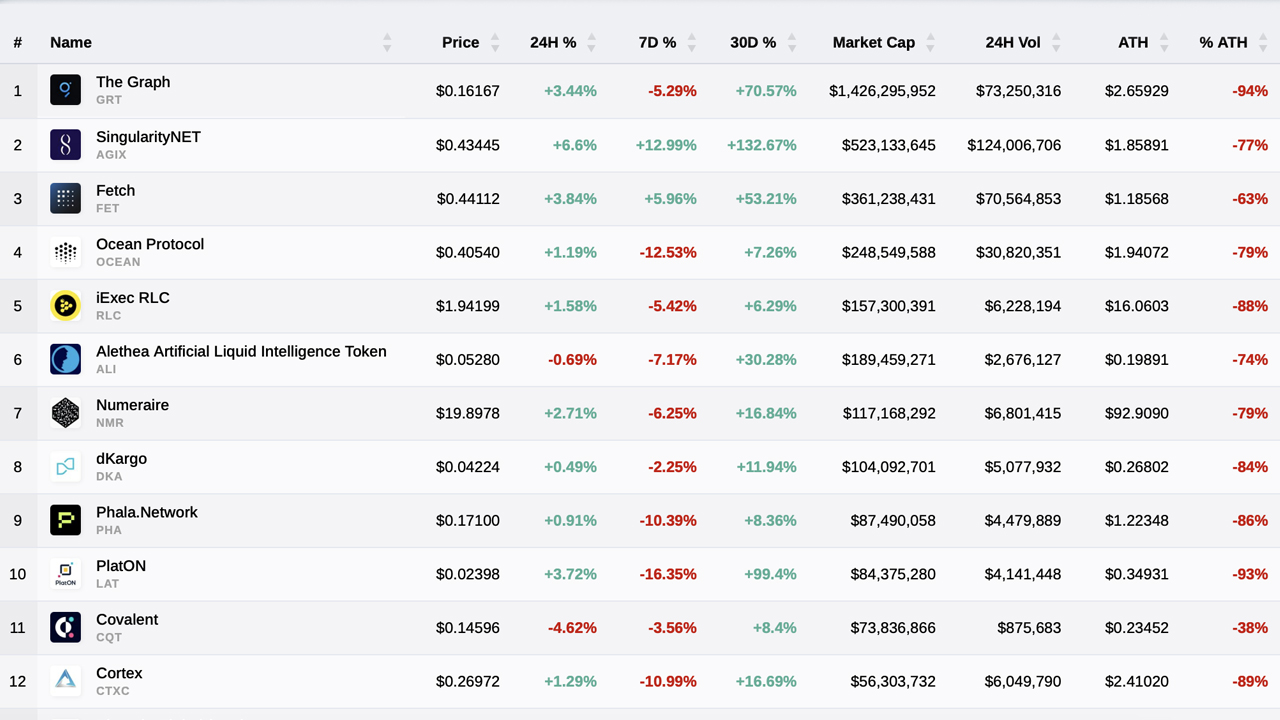

The largest of the AI-focused digital currencies is graph (GRT), with a current market valuation of approximately $1.42 billion. GRT has increased 70.57% against the U.S. dollar in the last 30 days. Singularitynet (AGIX), the second-largest AI-centric crypto asset, has surged 132.67% this month.

Fetch.ai (FET) has risen by 53.21%, and ocean protocol (OCEAN) is up 7.26% in the 30-day period. Iexec rlc (RLC), the fifth-largest AI-focused token, increased 6.29% against the U.S. dollar last month. The top five AI digital currencies, namely graph (GRT), singularitynet (AGIX), fetch.ai (FET), ocean protocol (OCEAN), and iexec rlc (RLC), account for $2.69 billion, or 67.3%, of the AI-crypto economy’s $4 billion.

Other notable gainers in the AI digital currency market this month include alethea artificial liquid intelligence token (ALI), which increased 30.28%; phoenix global (PHB), which swelled by 23.64%; xmon (XMON), which jumped 30.47%; measurable data token (MDT), which spiked 124.97%; and singularitydao (SDAO), increased by 121.48%.

As of writing, the 74 AI-centric digital currencies have collectively risen 3.07% against the U.S. dollar in the last 24 hours. However, in the last seven days, the AI digital currency sector has experienced a 4.14% decline in value. The AI digital currency market’s trading volume in the last day was approximately $444.39 million. This figure represents 0.8% of the current $55.39 billion global trade volume in the last 24 hours.

What are your thoughts on the continued growth of AI-focused crypto assets? Do you believe these digital currencies will continue to see significant gains in the future? Share your opinions in the comments section below.

from Bitcoin News https://ift.tt/s3T0XN1

Comments

Post a Comment