FTX Warns Community of Phony ‘Debt Tokens’ and Scams Claiming to Be Affiliated With the Bankrupt Exchange

On Friday, debtors who control the official FTX Twitter account warned the community to “be on alert for scams from entities claiming to be affiliated with FTX.” They also noted that neither FTX debtors nor any entity related to the company has issued any IOU crypto assets or “debt tokens.” The alert comes as a token called “FUD (FTX User’s Debt)” has been circulating on the Tron blockchain and is listed on Huobi.

FTX Debtors Leverage Official Twitter Account to Inform Community

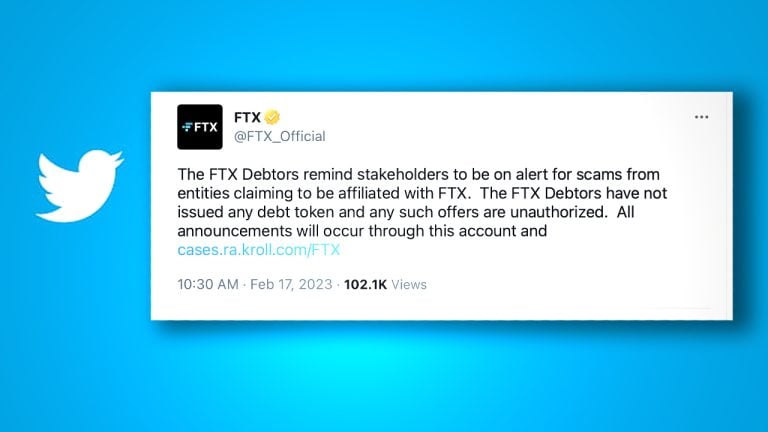

FTX debtors who control the official FTX Twitter account are warning the community about entities claiming to be associated with the now-defunct cryptocurrency exchange. The company filed for Chapter 11 bankruptcy, and the restructuring team and debtors use the official FTX Twitter account often to inform the community of updates. On Feb. 17, 2023, the debtors issued a warning, stating that the bankrupt firm has not issued any debt tokens.

“The FTX Debtors remind stakeholders to be on alert for scams from entities claiming to be affiliated with FTX,” the bankrupt exchange’s official Twitter account said on Friday. “The FTX Debtors have not issued any debt token and any such offers are unauthorized.”

FUD Token Circulating on Tron Blockchain, Listed on Huobi

As the exchange’s restructuring team and debtors warn the community about unofficial tokens, a cryptocurrency issued on the Tron blockchain called FUD, or FTX User’s Debt, has been circulating. Some information about the coin is available on coingecko.com, and as of Feb. 18, 2023, it has been trading for prices between $15.05 and $16.88 per unit. On Feb. 6, 2023, Huobi announced that it had listed FUD, with an initial supply of 20 million.

The announcement also states that the “Debtdao” decided to destroy 18 million FUD. Tron founder Justin Sun discussed the project in detail on Feb. 4, 2023, noting that the “bond token represents the top-quality FTX debt asset and is set to benefit everyone in the crypto world.” Coingecko.com does not list a circulating supply for the FUD token, and Tronscan shows that there are currently 2,000,000 FUD tokens. Of this supply, 1,999,966 are hosted on Huobi, and there are only four unique holders, according to the Tron explorer.

According to Coingecko.com, Huobi is also the most active exchange, and over the last 24 hours, FUD has seen $213,072 in trading volume, mostly paired against tether (USDT). FUD reached an all-time high of $73.97 per unit on Feb. 7, 2023, the day after it was listed, and it has since fallen 78%. The warning issued on Friday from FTX debtors and the official FTX Twitter account does not mention any specific token by name. It simply provides the web portal link where people can obtain information about the bankruptcy and restructuring process at kroll.com.

What do you think about FTX’s warning about unofficial “debt tokens” and the recently launched FUD token? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/KD0aMqA

Comments

Post a Comment