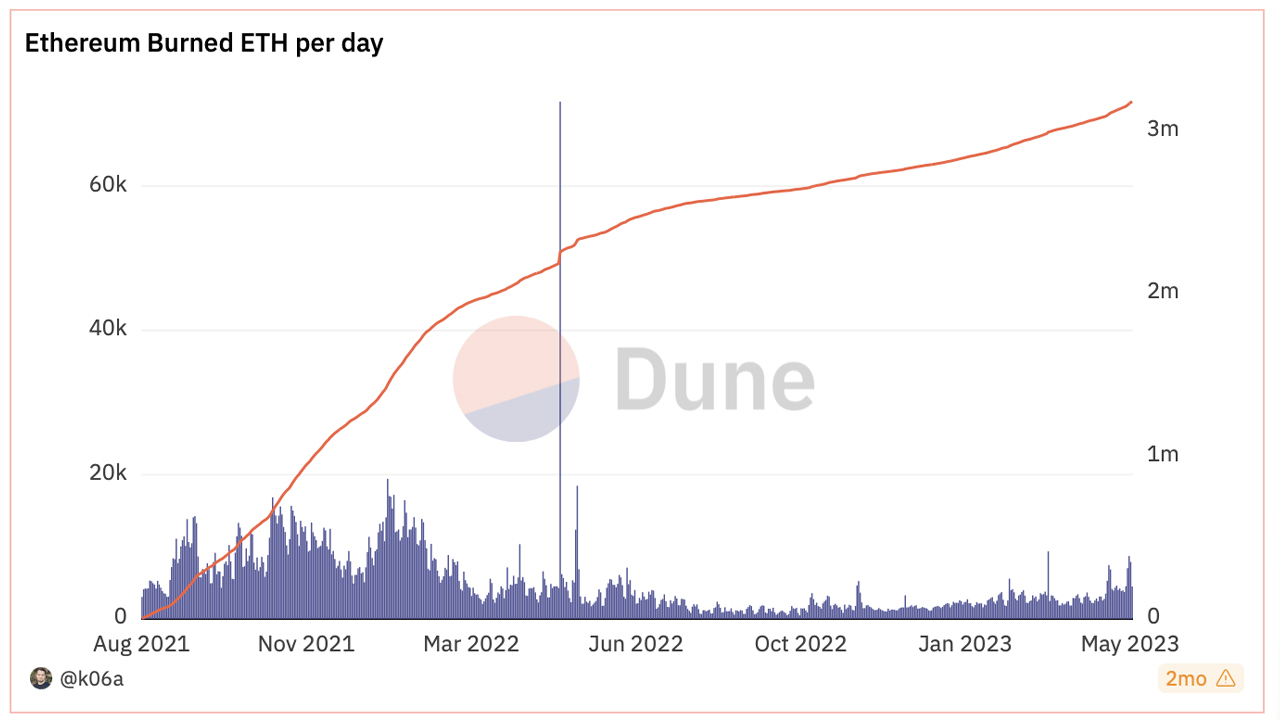

Drawing upon recent data, the Ethereum network has incinerated close to 3.46 million ether, translating to a staggering $6.68 billion in value burned since the London hard fork’s implementation on August 5, 2023. Taking into account the 710-day period that followed, the Ethereum network maintained a relentless burn rate, burning an average of over 146,000 ethereum every month.

Ethereum Has Burned 3.46 Million Ether in 710 Days

Nearly two years — precisely 23 months — have zipped by since the enforcement of Ethereum’s London hard fork, marking the implementation of Ethereum Improvement Proposal (EIP) 1559. This significant change has led to the continuous burn of the base fee portion of a transaction fee on the Ethereum network, around the clock, each day.

Current figures reveal a total of over 3.46 million ether has been burned since the London hard fork. Given the prevailing ETH exchange rates, the overall worth of the obliterated ether adds up to $6.68 billion. This equates to a monthly average of more than 146,000 ether being destroyed since EIP-1559 came into effect.

To give a sense of scale, the sum of $6.68 billion worth of ether burned could enable a person to purchase roughly 19,085 single-family homes, each estimated at an average price tag of $350,000. EIP-1559 paved the way for a deflationary technique in Ethereum, steadily diminishing the total ETH supply.

Regular ETH transfers have contributed most significantly to the Ethereum reduction, incinerating nearly 300,000 ETH. Opensea’s non-fungible token (NFT) transactions have witnessed over 230,000 ether burned, while Uniswap v2 has led to the destruction of close to 200,000 ether.

Transactions involving Tether have wiped out over 150,000 ETH, and combined, Uniswap v3 and v1 have caused the burning of more than 200,000 ETH. At the time of writing, an estimated 120,201,621 ETH is making its rounds in circulation, holding a worth around the $232.53 billion mark.

Post the implementation of EIP-1559, a little over 3 million ethereum has been minted. It’s been 304 days since The Merge on September 15, 2022, the transition when the Ethereum network pivoted from a proof-of-work (PoW) blockchain to a proof-of-stake (PoS) blockchain.

Had The Merge not transpired, the network would have generated 6.5 million ether. Moreover, if the chain remained a PoW model and shunned the implementation of EIP-1559, an additional 9.9 million ETH would be contributed to the existing 120 million ETH in circulation.

As Ethereum continues to chart its deflationary path, how do you think it will influence the future of this network? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/xe7mfRE

Comments

Post a Comment