This week marked a milestone as the number of Ordinal inscriptions minted on the Bitcoin blockchain crossed the impressive 20 million threshold. But despite this achievement, Bitcoin-based non-fungible token (NFT) or Ordinal marketplace sales have witnessed a downturn since mid-July. Once consistently taking the second spot week after week in the NFT sales ranking, Bitcoin-based NFT sales have now stumbled, finishing seventh in the last seven-day stretch.

Amid 20 Million Ordinal Inscriptions, Bitcoin’s NFT Sales Nosedive

On July 28, 2023, the tally of Ordinal inscriptions achieved a significant milestone, exceeding 20 million. These Bitcoin Ordinals, digital asset inscriptions within the Bitcoin blockchain, enable users to affix information to individual satoshis, the smallest fraction of BTC. Pioneered by Casey Rodarmor and facilitated by Bitcoin’s Taproot upgrade, this technology catapulted the blockchain into prominence. As the numbers swelled into the millions, Bitcoin Ordinal inscriptions contributed to making the blockchain the second-largest in weekly NFT sales, time and time again.

The week from July 22 to July 29, 2023, however, painted a different picture. Bitcoin-centric NFT sales slumped by 35.22%, as per the statistics on cryptoslam.io. Data revealed that Bitcoin-based NFT sales amounted to $4.54 million during the past seven days, relegating the blockchain to a seventh-place position, below Polygon. Meanwhile, Solana (SOL), with $6.61 million in NFT sales, clinched this past week’s second-place spot. Among the top 20 priciest sales, a mere two Ordinals secured positions in this week’s rankings.

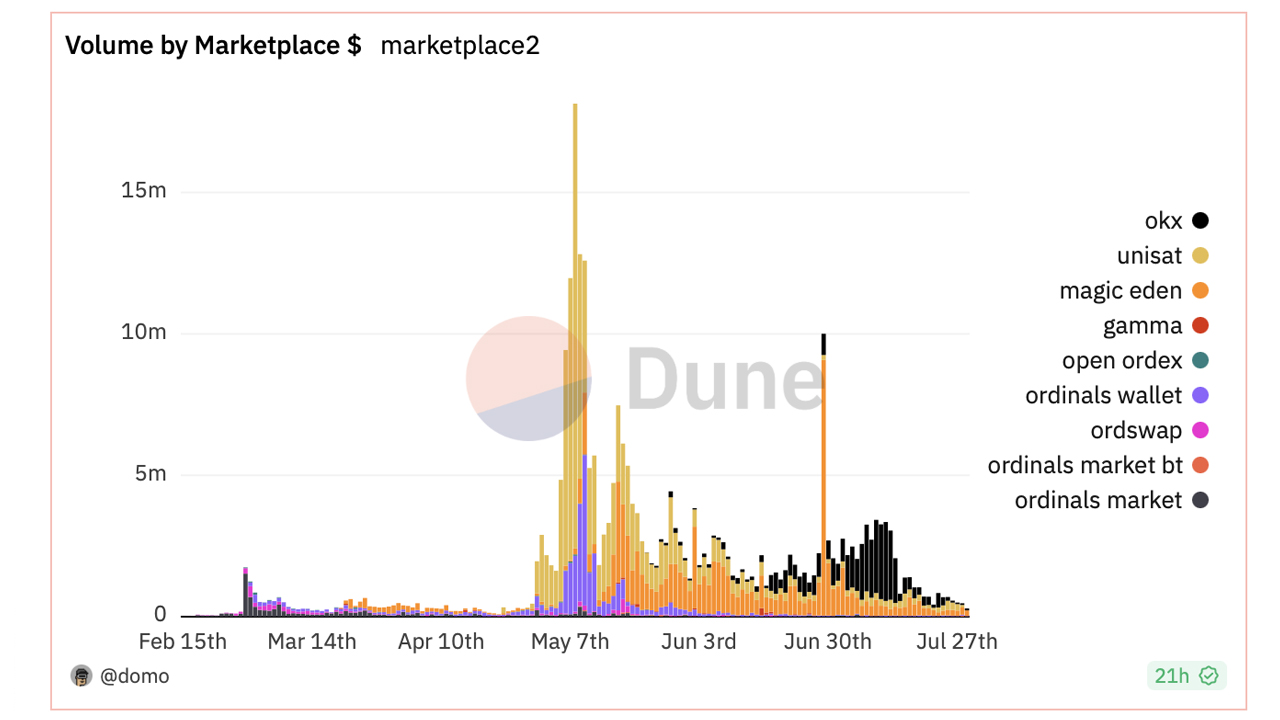

Data from Dune Analytics further illustrates a decline in volumes since mid-July concerning marketplaces engaged in Ordinal trades, including Okx, Unisat, Magic Eden, Gamma, Open Ordex, Ordinals Wallet, Ordswap, and Ordinals Market. Following a pronounced drop since May, there was a fleeting surge on June 29. However, the situation worsened after July 14, as volumes by Ordinal marketplaces slumped to even lower levels. Both transactions by marketplace and unique daily users within those marketplaces have experienced a decline.

While Bitcoin NFT sales have witnessed a downtrend, other blockchains have experienced a rise, and this week’s seven-day sales figures as a whole have jumped 8.43% higher than the week prior. This contrast in performance is a striking illustration of the dynamic and often unpredictable nature of NFT markets. No one knows for sure if Bitcoin’s falling NFT sales will continue or turn around in the next few weeks.

What do you think about Ordinal inscriptions crossing the 20 million mark? What do you think about Bitcoin-based NFT sales dropping this past week? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/dj1ipL4

Comments

Post a Comment