Some 41% of central banks that participated in the Official Monetary and Financial Institutions Forum (OMFIF) study said they expect to have an operational central bank digital currency (CBDC) by 2028. The survey found that the sentiment towards CBDCs is turning positive with 30% of the respondents having become more inclined to issue a digital currency in the last 12 months.

17% of Respondents Rule out CBDC Deployment

As per the latest Official Monetary and Financial Institutions Forum (OMFIF) survey study, 41% of central banks expect to have an operational central bank digital currency (CBDC) by 2028, while close to 70% hope to have one within ten years. However, 17% of the central banks that participated in the study have ruled out launching one.

The survey found that the sentiment towards CBDCs is turning positive with 30% of the respondents having become more inclined to issue a digital currency in the last 12 months. According to the study report, this change of heart could well suggest that the exploratory work and feasibility studies carried out by central banks are producing results.

Low CBDC Adoption a Key Concern

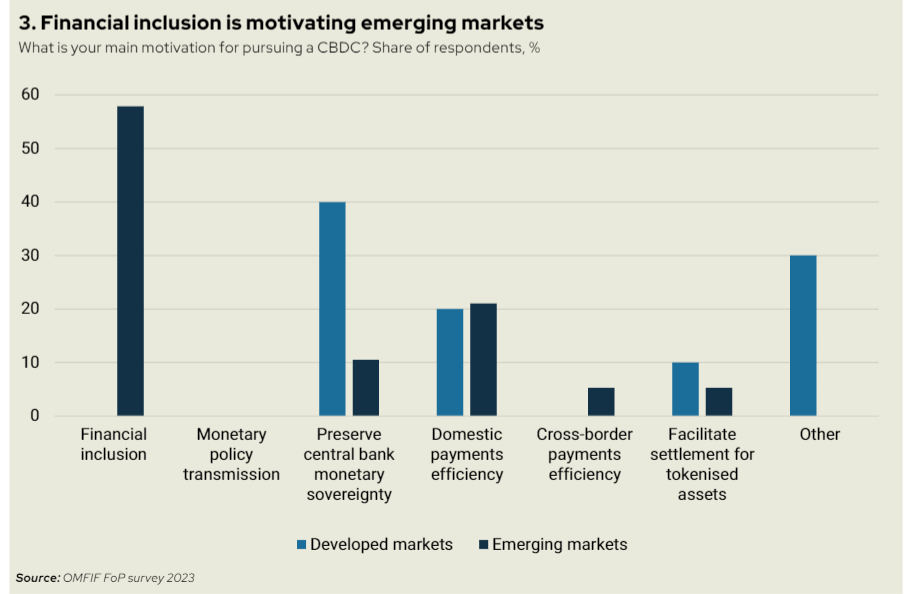

Regarding the apparent split between the central banks’ reasons for wanting to issue CBDCs, the OMFIF report states:

For the majority of emerging market respondents, the clear motivation is to improve financial inclusion. For many developed market central banks, it is more of a defensive play to preserve monetary sovereignty.

Only one in five of the respondents cited the efficiency of payment systems as their motivation for seeking to deploy CBDCs.

The survey findings meanwhile indicate that 68% of central banks from the developed markets see the low adoption of CBDCs as a key concern. They also identify possible bank disintermediation as their second highest concern. However, for respondents from emerging markets, only 37% identified low adoption of CBDCs as their primary concern. A similar percentage of the central banks cite cybersecurity as their main concern.

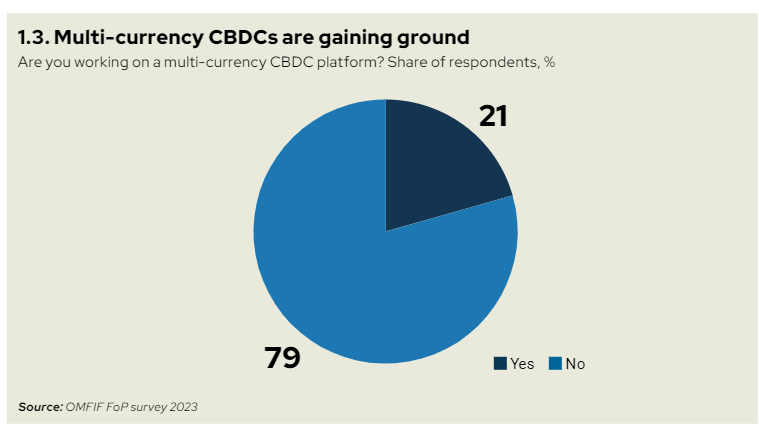

As the number of active CBDCs grows, many players in the private sector see know-your-customers capacity, wallet provision, and payment processing as key areas of collaboration. The survey also found that the concept of cross-border CBDC networks is becoming popular.

What are your thoughts on this story? Let us know what you think in the comments section below.

from Bitcoin News https://ift.tt/drlJVko

Comments

Post a Comment