On Saturday, December 16, the cost of transacting in bitcoin eclipsed its previous peak from May 8, 2023, surging past $40 per transaction. The trend of escalating onchain fees began on the final day of October, steadily increasing thereafter. Numerous crypto proponents foresaw this spike, suggesting a potential shift to Layer two (L2) platforms as a prudent measure. Despite an initial increase in the quantity of BTC on the Lightning Network from late October to November’s conclusion, approximately 350 bitcoin have been withdrawn in the subsequent one and a half months.

The Rush to L2s Remains Underwhelming

After a brief pause in September 2023, Ordinal inscriptions surged towards October’s end, currently accounting for 40-50% of Bitcoin’s transactions. In November, BTC miners hit record highs, processing an unprecedented number of transactions in a single day, and earning substantial fees from these inscriptions.

Yet, the surge in inscription use, combined with bitcoin’s financial transactions and rising prices, has led to a significant buildup of unconfirmed transactions. By Saturday afternoon, 2 p.m. (EST), the mempool had soared, nearing the 400,000 mark from 300,000.

Concurrently, fees escalated, crossing the $40 per transaction threshold as the mempool exceeded 300,000 unconfirmed transactions. Warnings about this high fee rate environment have been circulating for some time.

On November 7, 2023, Barefoot Mining’s Bob Burnett cautioned about this trend, recommending long-term storage. Similarly, others in the crypto community have suggested shifting to offchain solutions like the Lightning Network.

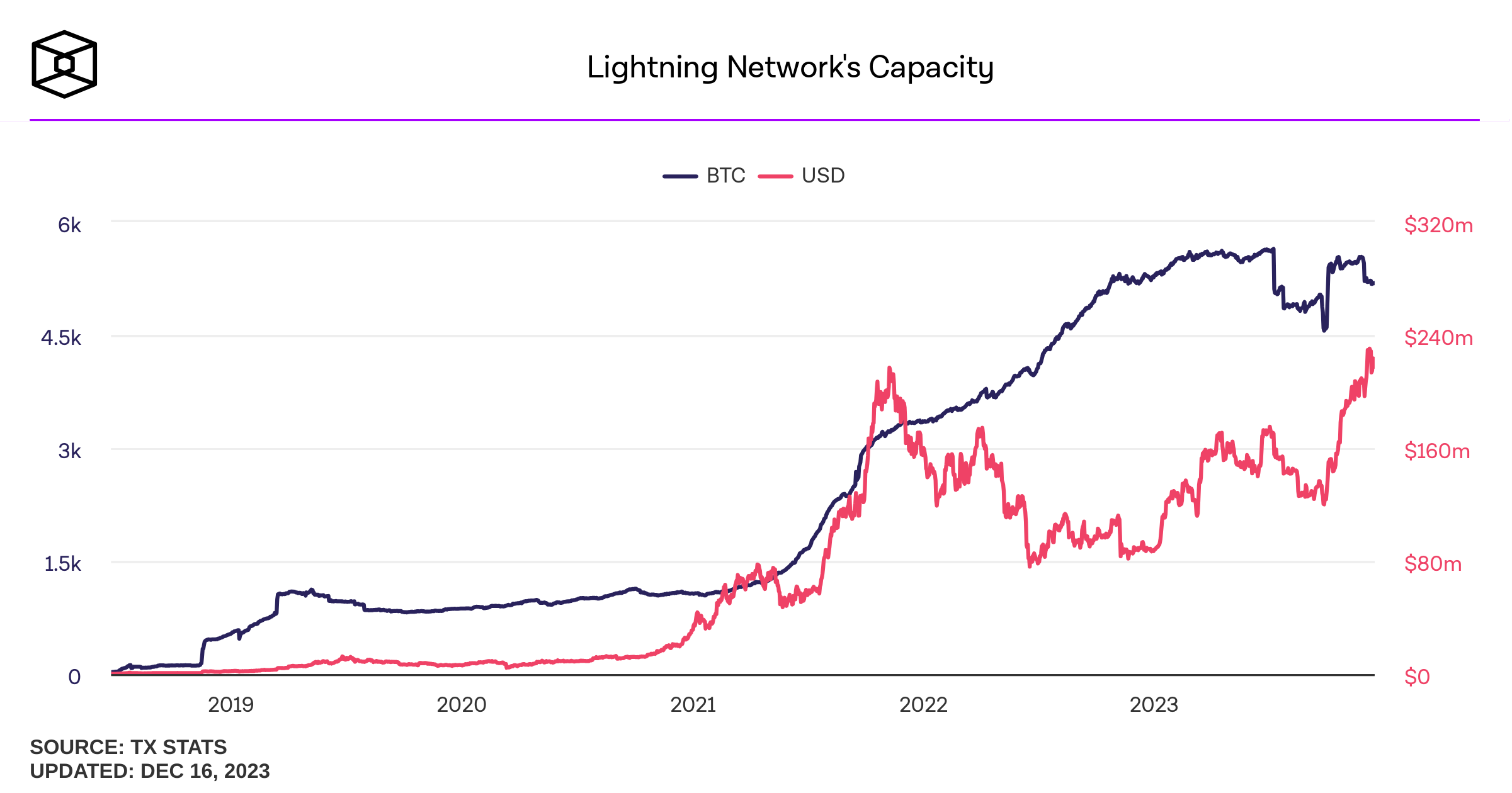

The Lightning Network’s capacity expanded modestly from 5,440 BTC to 5,540 BTC by November’s end. Yet, since November 25, 2023, about 350 BTC, valued at approximately $14.8 million, has exited the L2 network.

The Lightning Network now holds 5,190 BTC, less than what it had when fees began to rise on Halloween. One might expect an increase in capacity before the high-fee rate environment became overwhelming.

However, this expansion didn’t materialize. In this environment of fluctuating high fees, those opting for the Lightning Network face onchain fees to access this L2 solution. Meanwhile, Blockstream’s L2 solution, Liquid, has seen a rise in capacity, with 199 BTC added since November, as stated on the firm’s website.

Yet, Liquid’s explorer indicates minimal transaction activity in blocks. Between block heights 2,640,919 and 2,640,976, blocks contained no more than seven transactions each. In this high fee rate climate, newcomers face daunting challenges adapting, often bewildered by the complex dynamics driving these onchain costs.

Despite prior warnings, the community largely disregarded the signs, leading to an unexpected decline in the Lightning Network’s capacity. This trend starkly contrasts with the anticipated and favored increase, highlighting a disconnect between expectations and the evolving realities of the cryptocurrency landscape.

Even though there are additional L2 solutions available for BTC, so far, these too are not experiencing a significant migration towards their scaling options. Based on concrete data from recent weeks, setting aside subjective views, it seems that users are willing to navigate the steep onchain fees, opting not to turn to alternative solutions.

What do you think about the decline and lackluster demand for Bitcoin L2 solutions before and amid the high-fee rate environment? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/PtoRf9H

Comments

Post a Comment