According to data from Skew Analytics, more than 55,000 bitcoin options contracts worth $2.2 billion will expire on Friday. Statistics further show, as far as options are concerned, Deribit captures the lion’s share of contracts with 48,469 bitcoin options contracts ($1.95 billion notional) set to expire.

55K in Bitcoin Option Set to Expire, Deribit Carries $1.95 Billion Notional

- Another large options expiry is set to happen on May 28, 2021, following last week’s bitcoin (BTC) market sell-off. The analytics provider’s Twitter account from skew.com revealed on May 25, 2021, that over “55k bitcoin options expiring this Friday with $40k strike open in $130mln notional.”

- Skew data shows approximately 55,900 contracts ($2.2 billion) will expire around 4 a.m. (ET) on Friday.

- The options expiry follows the recent market carnage stemming from China, significant leverage, and environment FUD during the last two weeks. However, Skew Analytics said that bitcoin (BTC) markets absorbed “this week’s sell-off much better than during the COVID-19 panic on the 12th of March 2020 with BTC going

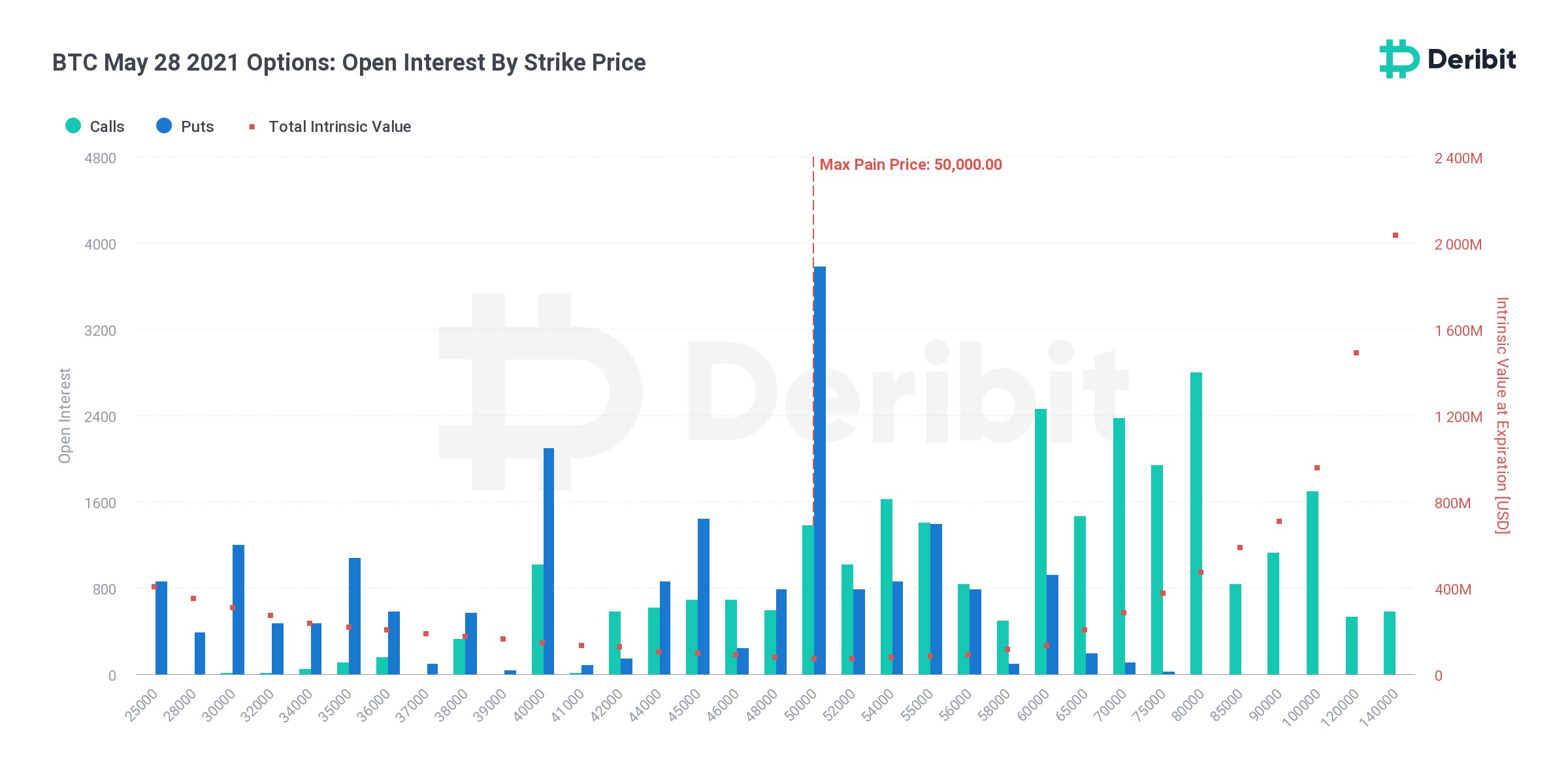

- Data from the derivatives exchange Deribit shows the lion’s share of bitcoin options contracts have been placed on the trading platform. In regard to BTC options, in terms of open interest, exchanges like Ledgerx, Okex, and CME follow Deribit’s lead respectively.

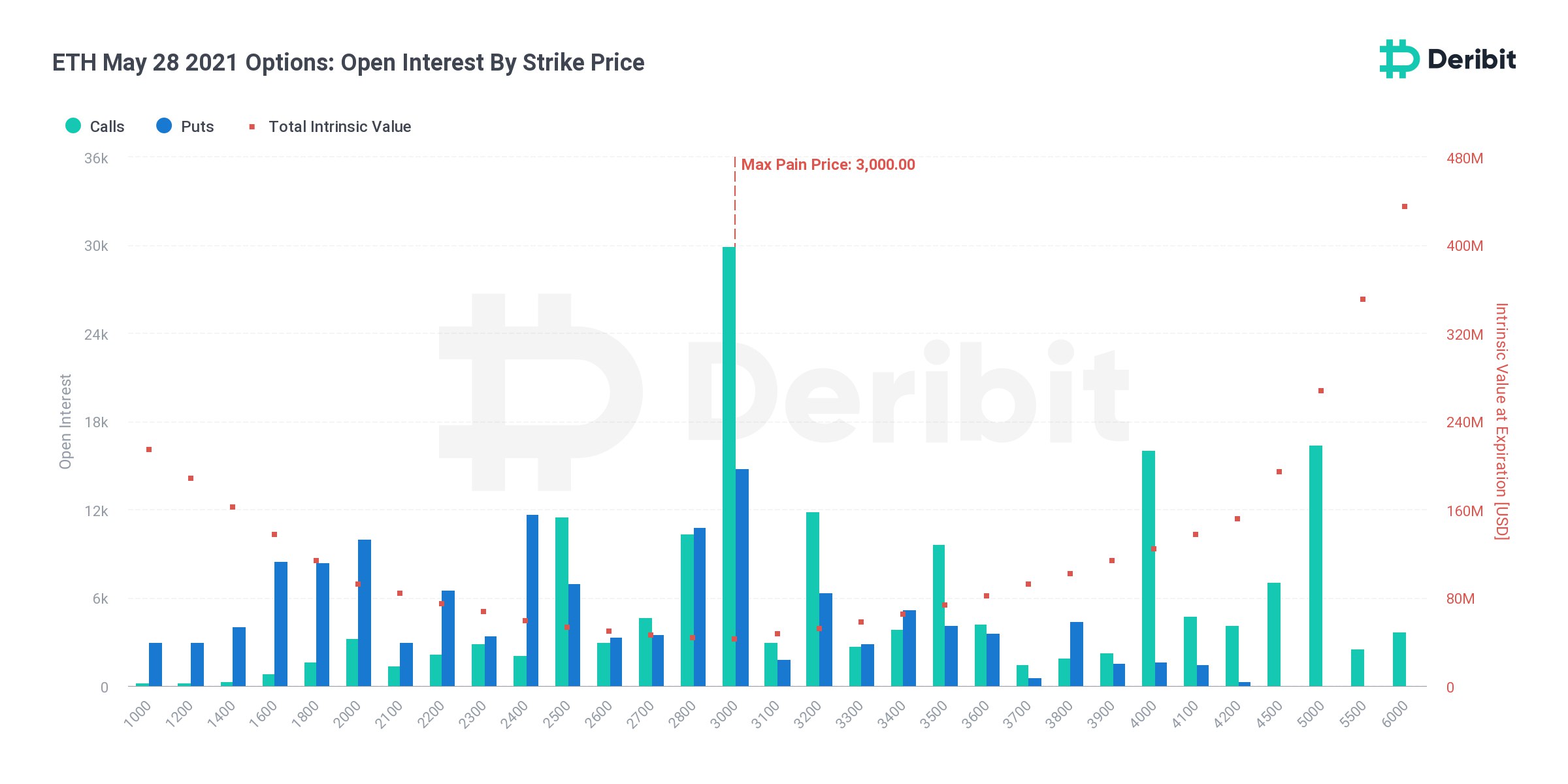

- Insights from Deribit indicate the exchange has a “large expiry coming up tomorrow as 48,469 BTC option contracts (USD 1.95b notional) expire and 307,558 ETH options (USD 877m notional).”

- Deribit Insights notes that “‘max pain’ for BTC is USD 50k and ETH USD 3k.” Deribit has also launched a new August expiry and July futures will be launched on May 28, 2021.

- The derivatives exchange further notes that “Contango has returned with annualised yields up to 8.5% for BTC and 10% for ETH,” and “perpetual funding positive again as well.” The Deribit Implied Volatility Index (DVOL) “ decreased to (still elevated) level of 110-115.”

- Last Friday, Deribit’s Insights’ Twitter account tweeted about the 48 hours in ethereum (ETH) options. “19/5 Short gamma+vega positions forced closed in explosive spot volatility. Fast market pricing surged Implied vol >350%; Realized way higher,” the exchange noted at the time. “But on 20/5 while BTC Options were calm, ETH Option flows saw large Straddle buyers pre-empting a big move.”

- Five days later on May 26, Skew Analytics wrote that as far as ETH volatility is concerned “current market volatility is back on par with [the] 2017 cycle.”

What do you think about the 55k worth of bitcoin options set to expire on Friday? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3c07Qp5

Comments

Post a Comment