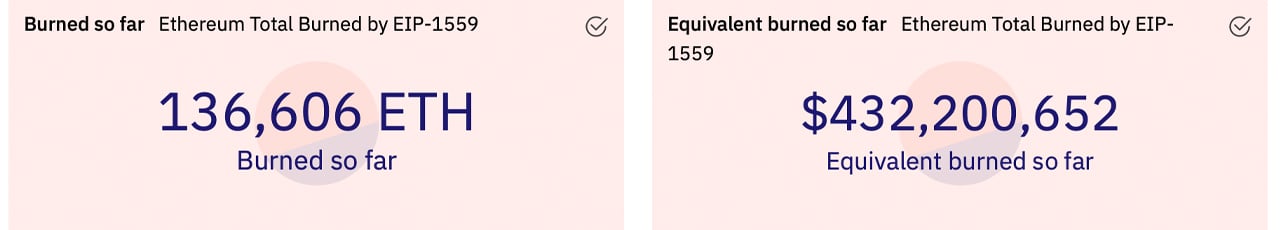

Approximately 25 days ago, the Ethereum blockchain implemented the London hard fork and a number of features were added to the ruleset. One of the most anticipated changes was EIP-1559 which makes the crypto asset ether deflationary by burning a fraction of coins. Since August 5, over $432 million worth of ether has been burned, and at the time of writing, 136,606 ether has been burned.

Over $432 Million in Ethereum Burned

The Ethereum (ETH) blockchain is the second most valuable crypto market in terms of market valuation. Out of the $2.14 trillion market capitalization of all the coins in the crypto economy, ethereum’s overall market valuation is $374 billion or 17.5% of the entire crypto economy.

25 days ago, ETH saw a successful London upgrade and ether has gained 29.7% this month. However, the Ethereum chain had a hiccup this past week when the chain split and ether gas fees doubled in value week-over-week.

The EIP-1559 feature makes it so the network follows a different transaction pricing mechanism that introduces a base fee for every block found on the network. Essentially, the remainder of the fees are burned and people assume that over time, this will significantly reduce the overall supply of ethereum in circulation. At the time of writing, the Ethereum network has burned approximately 136,606 ether worth $432,200,652 using current ether exchange rates.

$400 Million Can Buy a Sports Team, 2,000 Homes, 10 of the World’s Most Expensive Sports Cars

To put the amount of ether burned into perspective, $400 million could purchase a whole sports team in the NBA or NFL, and a dozen NHL teams. $400 million could buy a trip to space and it can also purchase ten of the world’s most expensive automobiles.

Just for kicks, a person with $400 million could purchase 2,000 medium-sized homes for $200K per house. In addition to the 135K ether burned since the upgrade, there are numerous Ethereum-compatible platforms like Opensea and Uniswap that are the ecosystem’s biggest ETH burners.

The non-fungible token (NFT) marketplace Opensea commands the most ethereum burned to date with 2.2 million ether transactions and 21,105 ether burned. Statistics from Dune Analytics indicate that “ether transfers” make up the second-largest burning entity with 10 million transfers but only 10,845 ETH burned.

Opensea and ether transfers are followed by platforms like Uniswap V2, Tether, Axie Infinity, Uniswap V3, Metamask, and the stablecoin project USDC. The Opensea registry, 1inch, Sushiswap, and MEV bot have burned a significant amount of ether as well since August 5.

What do you think about all the ethereum that has been burned so far? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3BofXWJ

Comments

Post a Comment