During the last few weeks, a crypto asset called solana has been making its way up the charts and has made it into the top ten cryptocurrencies by market capitalization. Solana reached an all-time price high on Monday, capturing $74 per unit and an 80% gain over the course of the week. In addition to the fresh price highs, the Solana ecosystem has grown significantly with more than 300 projects leveraging the system.

Solana Captures an All-Time Price High

The crypto asset solana (SOL) has made it into the top ten cryptocurrencies in terms of market valuation on Monday. The digital currency SOL reached an all-time high (ATH) as well that day, when it jumped above the $74 handle. According to statistics, during the course of the seven trailing days up until Monday, SOL jumped over 80% in a week, 109% over the last two weeks, and 160% in the last month. Against the U.S. dollar, SOL has gained 1,960.5% during the trailing 12-month period.

Solana’s official Twitter page has 393.4K followers and Google Trends data shows the search query worldwide has jumped in recent times. The project’s website solana.com claims developers can “build crypto apps that scale” and says “Solana is a fast, secure, and censorship-resistant blockchain providing the open infrastructure required for global adoption.” The Solana network is not like Bitcoin (BTC) which uses proof-of-work (PoW) for consensus.

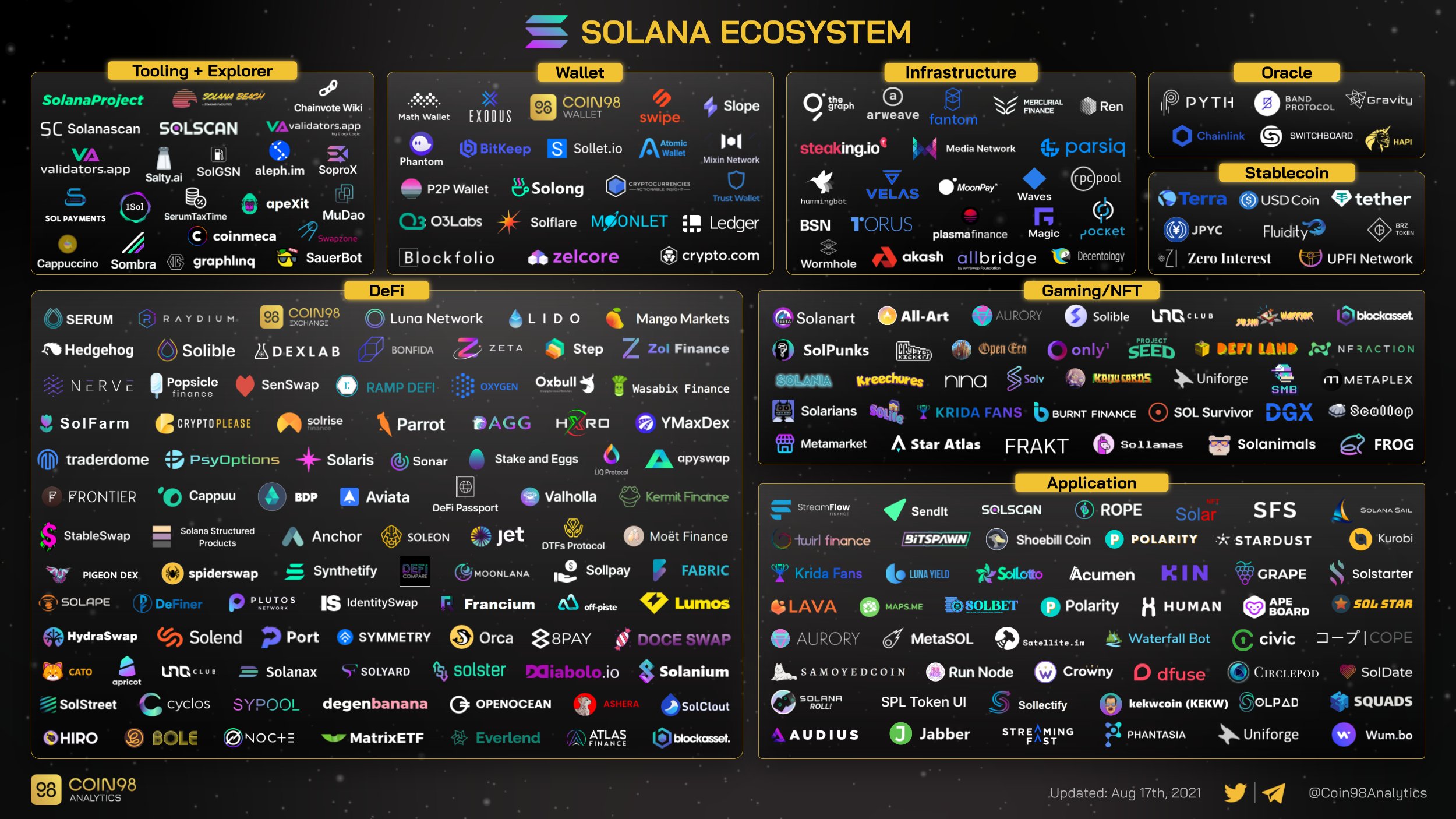

Quite a few projects are utilizing the Solana blockchain, as a tweet from Coin98 Analytics shows the Solana protocol is leveraged by over 300 different projects. Solana comprises a system of 200 nodes that support significant throughput and a consensus method called proof-of-history.

The founder and CEO of Solana, Anatoly Yakovenko, believes that “Solana outpaces the Bitcoin, Ethereum, Libra, Tendermint, and Algorand blockchain networks.”

“Whereas other blockchains require validators to talk to one another in order to agree that time has passed, each Solana validator maintains its own clock by encoding the passage of time in a simple SHA-256, sequential-hashing verifiable delay function (VDF),” Yakovenko explains.

The Solana founder’s blog post about the subject adds:

This differs from the current standard of blockchain infrastructure, which relies on a sequential production of blocks that are hindered by waiting for confirmation across the network before moving forward. Proof of History presents a fundamental move forward in the structure of blockchain networks in regards to speed and capacity.

$20 Billion Market Cap, Solana Mainnet Stops Producing Blocks on December 4, 2020, for 6 Hours

Solana says it can process 50,000 transactions per second and fees are about $0.00025 per transaction. SOL’s market valuation on August 16 is over $20 billion, and the crypto asset has a circulating supply of around 286,294,787 coins. SOL’s top trading pair is tether (USDT), capturing 50.3% of swaps and is followed by the U.S. dollar, commanding 23% of trades. These are followed by BTC (12.12%), BUSD (7.25%), ETH (2.97%), and TRY (1.41%).

Solana has also had some hiccups along the way. In December 2020, a blog post detailed that the protocol’s mainnet stopped producing blocks. “At approximately 1:46 p.m. UTC on December 4th, 2020, the Solana Mainnet Beta cluster stopped producing blocks at slot 53,180,900, which prevented any new transactions from being confirmed,” the team detailed.

What do you think about the Solana project and the crypto asset’s recent rise in value? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3st3wFV

Comments

Post a Comment