Plan B’s Stock-to-Flow Bitcoin Price Model ‘Predicts $100K by Christmas,’ S2F Creator Discusses ‘Time Model’

The pseudo-anonymous bitcoin analyst called Plan B gave his 704,000 Twitter followers an update on the notorious stock-to-flow (S2F) bitcoin price model. Plan B stressed on August 27, that the “next months will be key” as he believes the bitcoin S2F model “predicts $100K by Christmas.”

‘$100K by Xmas’

Plan B is a popular figure in the bitcoin world as the pseudo-anonymous analyst is well known for his stock-to-flow (S2F) price model. In basic terms, the model quantifies the commodity’s (bitcoin) scarcity and then divides it by yearly issuance (the flow).

For quite some time now, Plan B and many other S2F fans have insisted that if the model is correct, BTC could one day reach $100K and in the future, possibly a million U.S. dollars per coin. However, in June and July, bitcoin (BTC) prices pulled back a great deal, after reaching a value of more than $64K per unit.

After the price drop, Bitcoin.com News reported on how Plan B was still confident that the bitcoin “bull is not over.” Following the last S2F update, Plan B spoke about his model on August 27th, and gave a prediction.

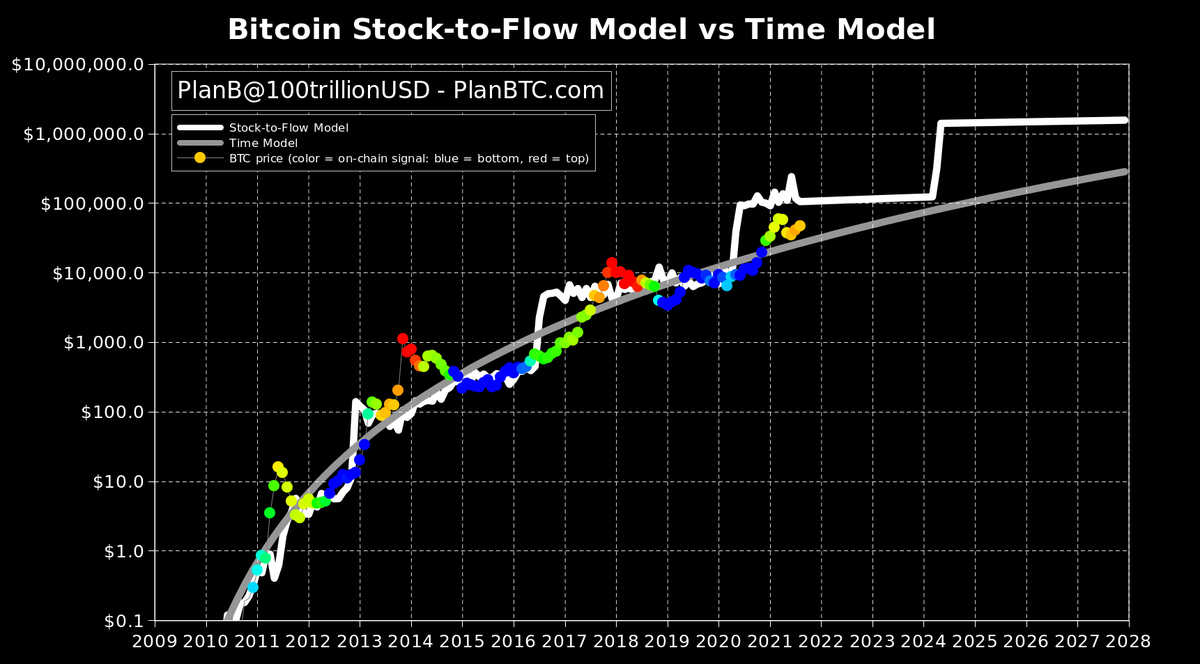

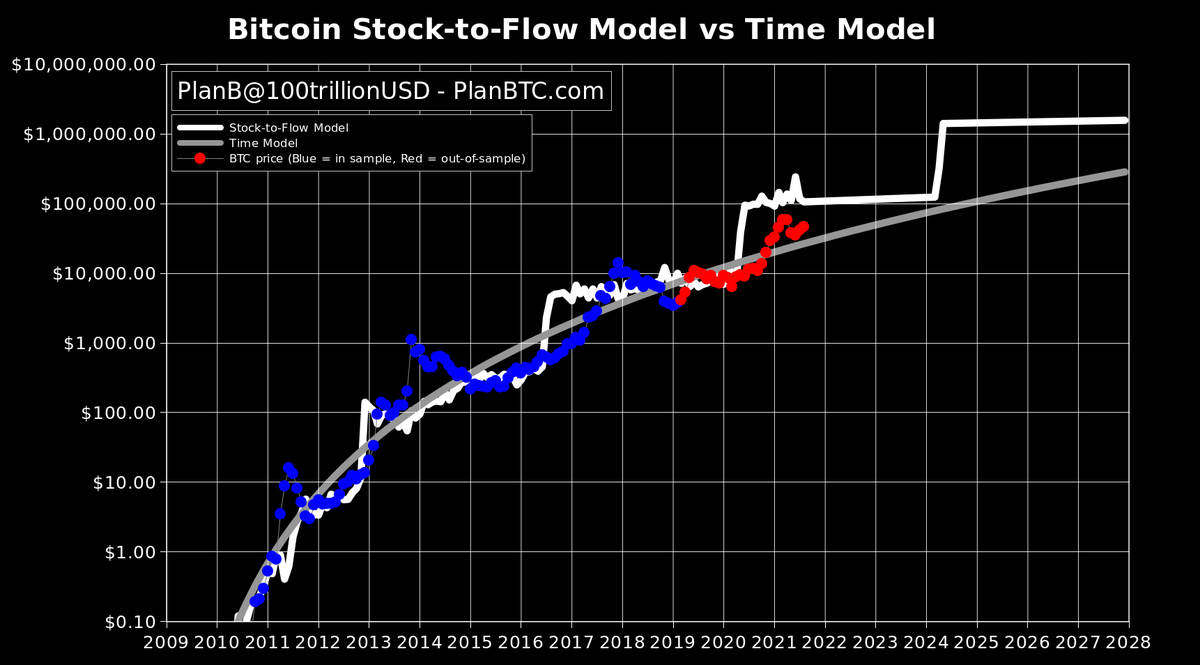

“Bitcoin stock-to-flow model predicts $100K by Christmas,” Plan B tweeted. “Time model (diminishing returns, lengthening cycles) $30K. Next months will be key. Note that color overlay is on-chain signal (not time to halving), indicating we are between bottom (blue) and top (red), in line with S2F,” the pseudo-anonymous analyst added.

The Time Model Discussion, Plan B’s S2F Preference

Intothecryptoverse.com’s Benjamin Cowen replied to Plan B’s August 27 tweet, and said: “The time model just shows the ‘fair value.’ It does not say that the price of bitcoin has to be that price at a certain time. We can move above and below it, like we do with the S2F model.”

Plan B responded to Cowen’s statement and said: Of course BTC price can move above and below both models.[The] point is that BTC price is currently ABOVE time model, so it is not illogical to expect lower prices if you follow [the] time model. And [the price of BTC] is BELOW S2F model, so it is logical to expect higher prices if you follow S2F.”

Cowen, however, replied further stating:

The extension above the time model in terms of percent shows that we should expect it to ultimately extend further than it already has. If we started expecting it to go lower the minute it moved above the fair value, well that would also be irrational.

Plan B has been bullish for a long time and Bitcoin.com News has covered the S2F trajectory and the model’s criticisms. The model’s creator has often said that BTC will see six-digit prices and he believes the model is on track. The pseudo-anonymous analyst tweets about S2F regularly among other statistics and figures that are tethered to bitcoin.

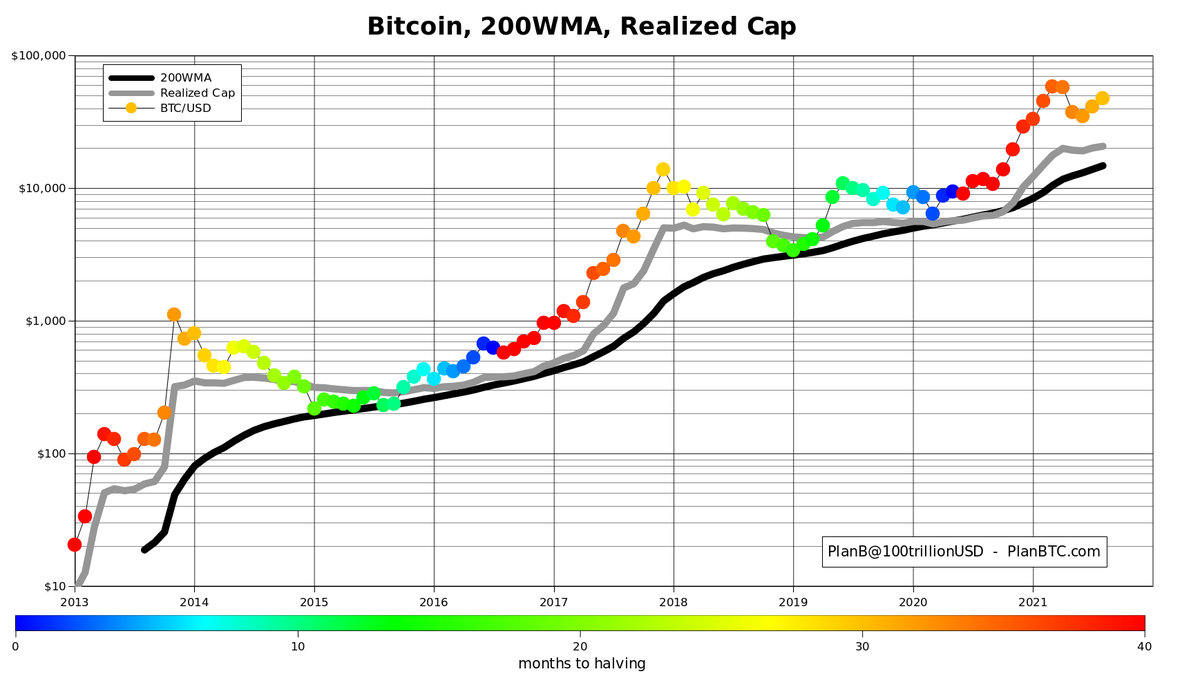

“Nobody who bought bitcoin and hodled 4+ years (200 weeks) lost money, ever,” Plan B said last week. “Also, both 200wma and realized cap (average cost price of all 18.8M BTC) are at all-time high (ATH).” On August 19, Plan B explain why he prefers the S2F model in contrast to the time model and other estimates.

“S2F model: BTC=a*(S2F ratio)^b,” Plan B stated. “Time model: BTC=a*(months from Jan09)^b. Why I prefer S2F model: [It] tells you when price increases: after halvings, [has] more robust parameters (a,b), time not an input variable, S2FX not a time series, interpolation [is] possible, [and its] usable with other assets,” the S2F creator added.

What do you think about Plan B’s stock-to-flow update and the call for a $100K by Christmas? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3gKz7hH

Comments

Post a Comment