On Tuesday, October 18, researchers from the crypto analysis platform Cryptoquant identified an outflow of 48,000 bitcoin coming from the trading platform Coinbase Pro. According to the researcher’s summary of the situation, a large portion of the funds were old coins.

Whale Transfers 48,000 Bitcoin Amid Coiled Market

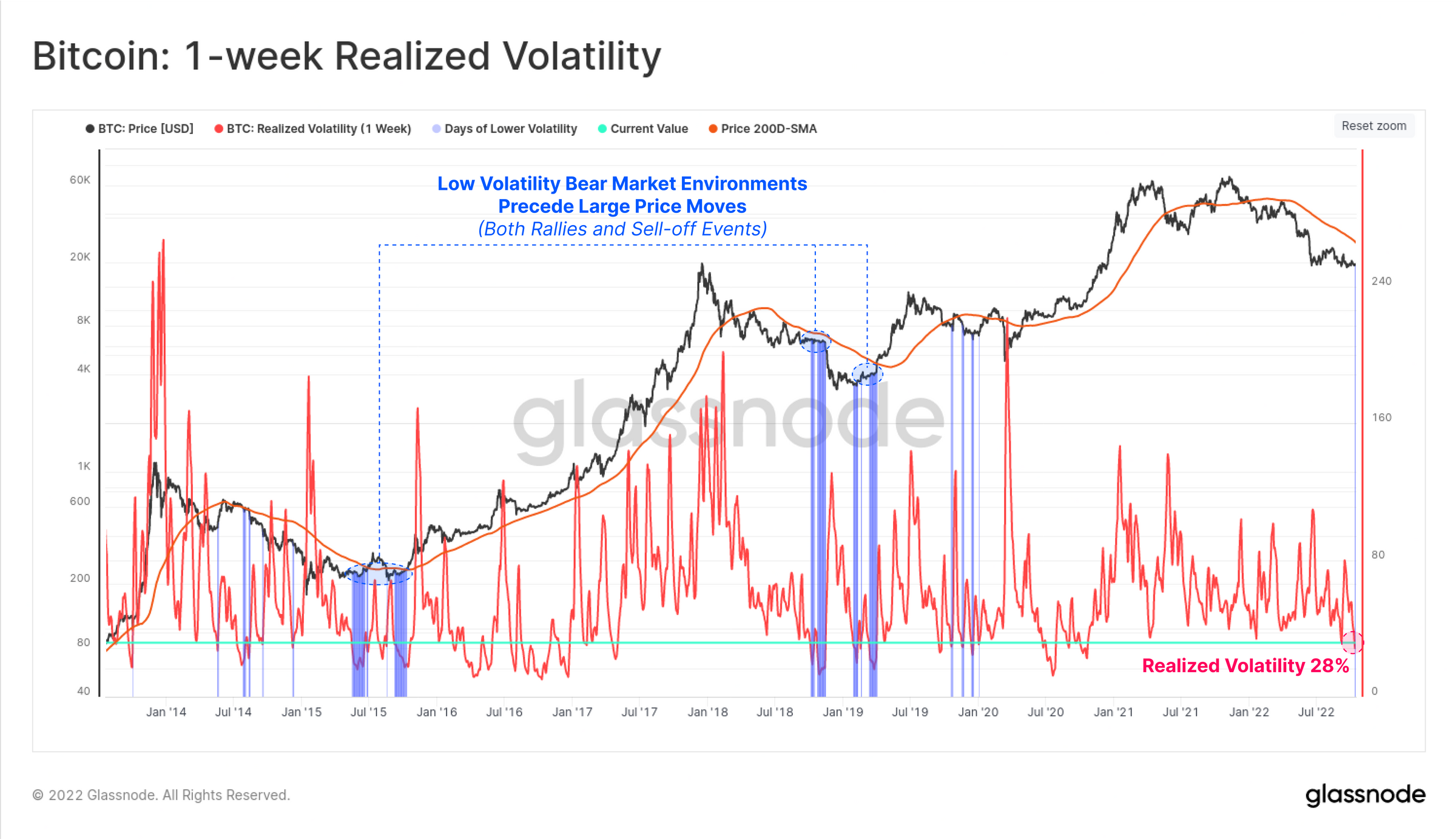

While bitcoin (BTC) has been trading under the $20K region and trading sideways, observers have witnessed a number of old coins move onchain. The onchain movement comes at a time when market volatility is expected. For instance, the latest Glassnode Insights report called “A Coiled Spring,” expects some bitcoin price fluctuations to occur in the near future.

“The bitcoin market is primed for volatility, with both realized and options implied volatility falling to historical lows,” Glassnode wrote on October 17. “Futures open interest has hit new all-time-highs, despite liquidations being at all-time-lows. Volatility is likely on the horizon, and Bitcoin prices rarely sit still for long.”

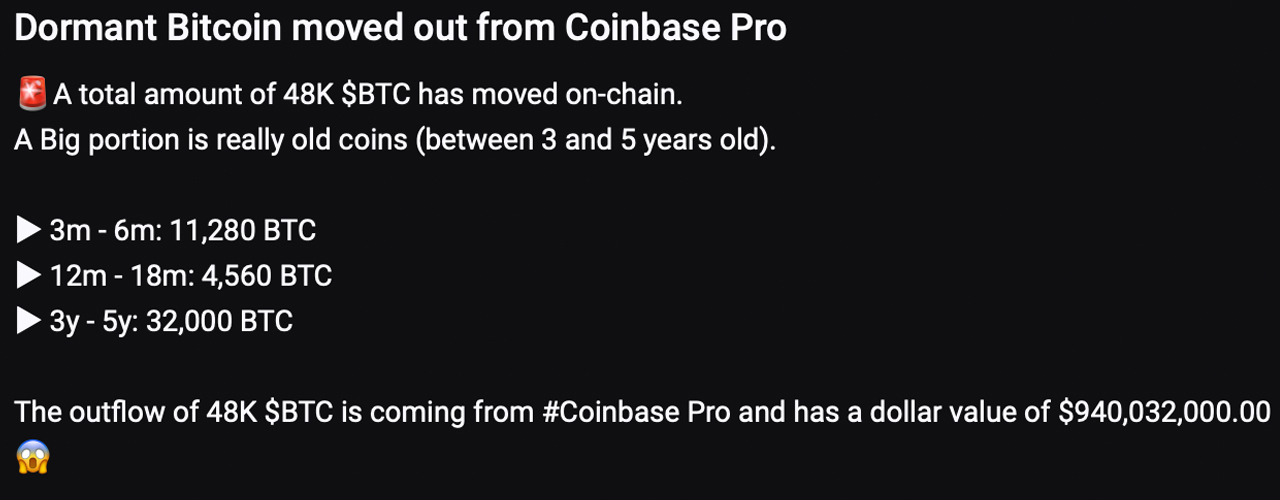

The following day, researchers from the crypto analysis platform Cryptoquant tweeted that 48,000 dormant bitcoins moved onchain on Tuesday. “Dormant bitcoin moved out from Coinbase Pro,” Cryptoquant said on Twitter. “The outflow of 48K BTC is coming from Coinbase Pro and has a dollar value of [$940 million].”

Cryptoquant said that a “big portion” of the onchain spending stemmed from batches of really old bitcoins, at least three to five years in age. The researchers estimate roughly 32,000 BTC of the 48K were between three to five years old. “Further investigation is needed to conclude whether it’s an exchange in-house flow, sent to a new wallet, or just a clean outflow,” Cryptoquant detailed on Tuesday.

In an update following the initial post, Cryptoquant explained that 8,000 BTC was deposited on Coinbase shortly after. “The transactions were partially split into batches of 122 BTC. We’ve seen this multiple times during the 2021 bull run, right? Ahem institutions,” Cryptoquant added.

11-Year-Old ‘Sleeping Bitcoins’ Wake After Years of Slumber

In addition to the 48,000 coins moving onchain with a great majority being dormant bitcoins, a few addresses from 2011 have sent a few batches of so-called ‘sleeping bitcoins’ this month. Btcparser.com caught sleeping bitcoins moving from an address created on May 14, 2011, when they were transferred on October 10, 2022, at block height 758,046.

On the same day, a dormant address created on October 24, 2011, moved 40 BTC. Seven days later, a batch of 10.29 sleeping bitcoins from an address created on September 20, 2011, was transferred for the first time in 11 years.

What do you think about the old bitcoin spends happening in recent times? Let us know your thoughts about this subject in the comments section below.

from Bitcoin News https://ift.tt/fIPV8Xk

Comments

Post a Comment