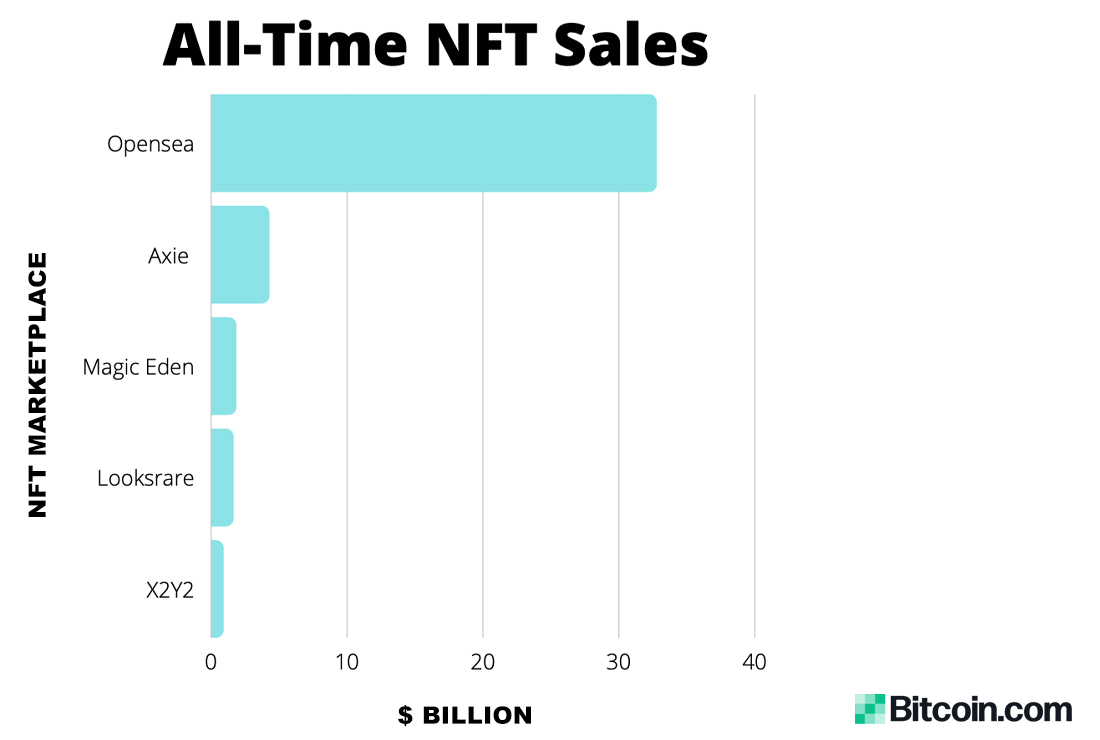

While non-fungible token (NFT) sales have slipped since the start of the year, the top five marketplaces, in terms of the largest number of all-time sales, have reached more than $40 billion. Moreover, the NFT marketplace platform Opensea captured over $32 billion worth of sales as the NFT market platform currently dominates the top five NFT marketplaces by 79%.

Top 5 NFT Markets Cross $40 Billion in All-Time Sales, Opensea Dominates by 79%

During the month of October, the top five NFT marketplaces surpassed the $40 billion mark, in terms of all-time sales, with approximately $41.36 billion on Oct. 29, 2022. The largest NFT marketplace in terms of sales was Opensea as it nears the $33 billion range with $32.76 billion recorded on Saturday.

Statistics from dappradar.com indicates that the $32.76 billion in sales were executed by $2.34 million traders. On Saturday, Oct. 29, the average price paid for an NFT via Opensea is around $352.

Opensea is followed by the Axie Marketplace ($4.26B), Magic Eden ($1.83B), Looksrare ($1.62B), and X2Y2 ($891M). Axie Marketplace tends to NFTs that stem from the play-to-earn (P2E) blockchain game Axie Infinity and the market has seen 2.17 million traders to date.

The average price paid for an NFT via Axie Marketplace is around $171. Solana’s Magic Eden has captured $1.83 billion in sales that were settled by 1.21 million traders. The average value paid for an NFT on Magic Eden on Oct. 29 is $124.

The NFT marketplace Looksrare has seen fewer traders, as records show 107,636 settled trades via the Looksrare market. However, the average price paid for an NFT on Saturday is far larger as the average NFT sale is $6.59K on Looksrare.

X2Y2 has not tapped a billion in NFT sales yet, but it has been inching its way toward that milestone. On Oct. 29, 2022, the NFT market X2Y2 settled $891 million among 158,273 traders. The average price paid for an NFT on X2Y2 is approximately $582.78 at the time of writing.

Other leading NFT marketplaces in terms of all-time sales include Mobox ($694M), Solanart ($665M), Bloctobay ($458M), Atomicmarket ($435M), Immutable X Marketplace ($337M), and Rarible ($300M) respectively. Despite being down a great deal in monthly sales, more than $40 billion in lifetime sales among the top five markets is quite a feat.

Data from cryptoslam.io shows that NFT sales across the globe during the last 30 days added up to $426 million, which is down 21.32% from the month prior. The last 30 days saw around 4,556,057 NFT transactions among 510,859 NFT buyers.

What do you think about the top five NFT marketplaces surpassing more than $40 billion in all-time NFT sales? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/uf9O8JA

Comments

Post a Comment