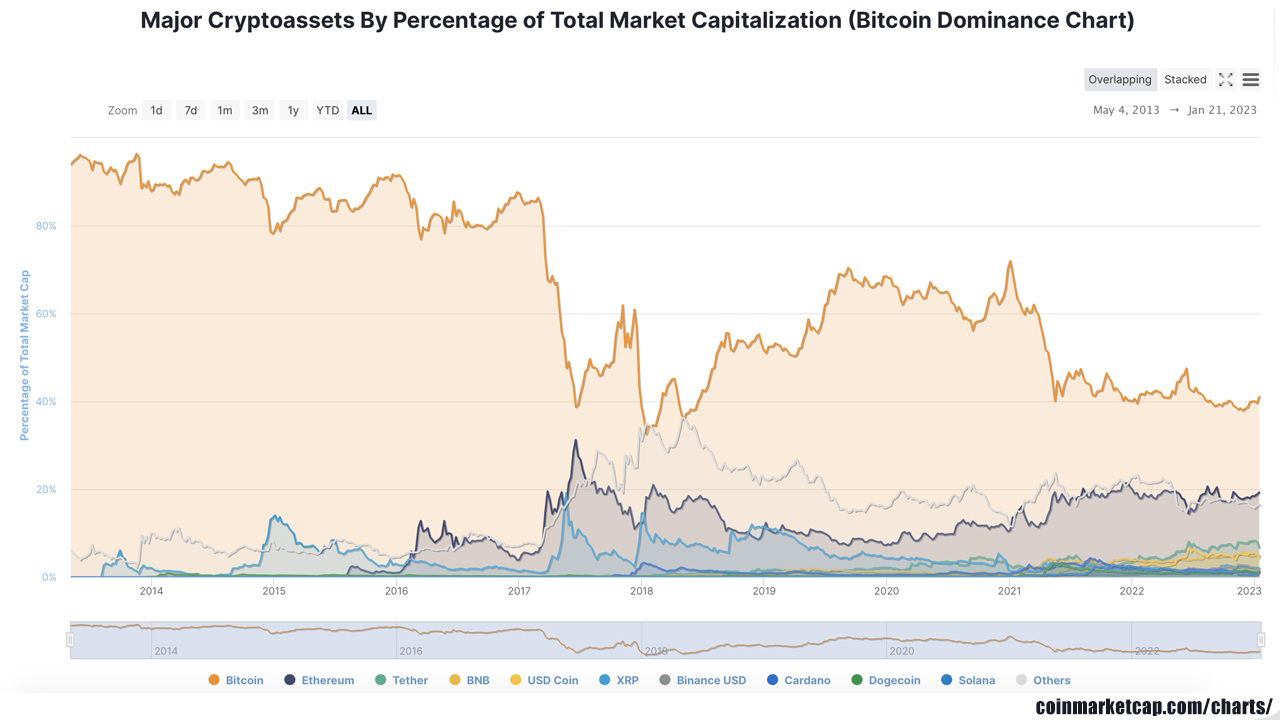

On Jan. 21, 2023, the price of bitcoin reached a 24-hour high of $23,333 per unit at 5 a.m. Eastern Time on Saturday. The entire crypto-economy is now valued at $1.05 trillion after rising 7.2% against the U.S. dollar. Bitcoin’s price rise has led to the crypto asset’s dominance level surpassing the 40% region among thousands of crypto assets, as the digital currency’s market valuation has climbed to $443 billion.

Bitcoin’s Value Rises 37.2% in 30 Days, Pushing Dominance Level Above 40%

Bitcoin jumped above the $23,000 zone on Jan. 21 and the crypto asset’s value is now 37.2% higher than it was 30 days ago. The increase has pushed BTC’s dominance level above the 40% region. According to coinmarketcap.com (CMC) data, BTC’s dominance level on Jan. 21 is around 42.4%.

The leading crypto asset’s dominance level rose above the 40% region after the first week of January 2023. The crypto economy aggregator coingecko.com (CG) indicates that bitcoin’s dominance is around 41.1% on Jan. 21. Bitcoin’s dominance is the digital currency’s market capitalization divided by the crypto economy’s entire market valuation.

From 2009 to 2017, BTC’s dominance level held above the 80% range. But after dropping below 80%, the dominance level never returned to that position. While BTC’s dominance is around 41-42% today, CG metrics show the second-leading crypto asset, ethereum (ETH), has a dominance level of around 18.4%.

CMC data suggests ETH’s dominance is around 19.3% out of the $1.05 trillion in U.S. dollar value. Other major dominant players in January 2023 include tether (USDT) as it commands 6.33% market dominance, and binance coin (BNB) has a dominance level of around 4.57%.

The stablecoin USDC has a market dominance level of around 4.13%, and XRP’s is roughly 1.99%, according to CMC statistics on Saturday afternoon at 11:30 a.m. Eastern Time. Between BTC, ETH, USDT, BNB, USDC, and XRP, the dominance level of all six coins is around 78.72% on Jan. 21. The last time BTC’s dominance was this high was six months ago in mid-July 2022.

What do you think will be the next major development in the crypto market and how will it affect bitcoin’s dominance levels? Share your thoughts about this subject in the comments section below.

from Bitcoin News https://ift.tt/M8dSJEc

Comments

Post a Comment