This week, FTX debtors issued a press release and a 20-page document noting that bankruptcy administrators had located $5.5 billion in liquid assets. The document details that investigators discovered fiat currencies, crypto assets, and securities as part of FTX’s and Alameda Research’s cache. However, the disclosure to unsecured creditors does not mention the extremely large stash of non-fungible tokens the company had accrued over the years.

FTX and Alameda’s Liquidated Assets Include Thousands of NFTs and ENS Names

FTX’s inner circle and the quantitative trading company Alameda Research were heavily involved in the non-fungible token (NFT) hype that began in 2021. In fact, after FTX and Alameda filed for bankruptcy protection, our news desk parsed through a large number of Alameda/FTX-associated wallets and discovered thousands of NFTs and Ethereum Name Service (ENS) names.

The discoveries were derived from wallets labeled by Block researcher Larry Cermak and parsed data from the crypto monitoring application Arkham Intelligence and dappradar.com‘s portfolio viewer. For example, the Alameda-linked address “0x116” holds around $100,000 in crypto tokens, but it also holds 107 ENS names. It’s possible that Alameda thought it could flip ENS names in the future, as the firm obtained a great number of common names.

Alameda and now the liquidators own ENS names such as “tickets.eth,” “payment.eth,” “network.eth,” “dungeon.eth,” “packager.eth,” “nootropic.eth,” “breakfast.eth,” and many more. Most are not worth very much, but some of the specific ENS names like “payment.eth” and “network.eth,” have sold for close to $9,000 per name. Alameda’s ENS name collection is not mentioned in the 20-page presentation shown to FTX’s unsecured creditors.

Last year in January, there were a lot of controversies when a few mirrored non-fungible token (NFT) collections appeared on the scene, copying the artwork of Cryptopunks and Bored Ape Yacht Club (BAYC) NFTs. Interestingly, Alameda’s ETH address “0x0f4” holds a massive quantity of unofficial “flipped” Cryptopunks and “mirrored” BAYC NFTs.

The “0x0f4” address holds 2,447 NFTs in the wallet from 629 different NFT collections. Alameda’s “0x0f4” collected NFTs from compilations such as Time Frog, Party-Animals, Metawarden, Shrouded Playground, and many more from dozens of relatively unknown NFT collections.

Alameda collected blue-chip non-fungible tokens (NFTs) as well, and records show the firm obtained 11 legitimate Cryptopunks, which are collectively worth an estimated $784,000. The trading platform purchased seven different Art Blocks Curated, which have an estimated value of around $1.47 million on Jan. 20, 2023.

Alameda and now the liquidators own 81 land NFTs from The Sandbox, which are collectively worth an estimated $155,000. Alameda obtained two Otherdeeds as well, which are now worth around $25,000, and 12 different Meebits, which are valued at an estimated $88,000 today. A great deal of blue-chip NFTs can be found in the ETH address “0xca4.”

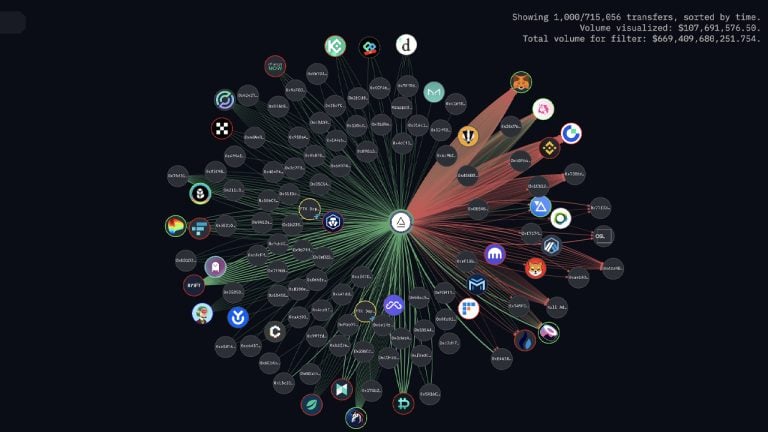

That specific wallet holds some of Alameda’s most valuable NFTs, including the Otherdeed land titles and two Mutant Ape Yacht Club (MAYC) NFTs worth roughly $50,000 in combined value. Larry Cermak’s Alameda address list highlights approximately 29 different Ethereum addresses. Furthermore, Arkham Intelligence data indicates that there are 68 addresses tied to the quantitative trading platform Alameda Research.

Out of the large swath of Alameda addresses, a decent handful of the wallets own NFTs. Most of these wallets are assumed to be controlled by the FTX bankruptcy team and liquidators. Just in tokens alone, Alameda’s 68 tethered Ethereum-based wallets indicate a net value of around $189.12 million.

What do you think about Alameda’s involvement in the NFT and ENS name markets? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/I7raGKP

Comments

Post a Comment