Rising Bitcoin Prices Cause Cascade of Short Liquidations, Highest Ratio of Short vs. Long Wipeouts Since July 2021

The top two crypto assets have risen significantly in the past seven days, with bitcoin jumping 22.6% and ethereum increasing 18.6% against the U.S. dollar. According to market data, both crypto assets saw the largest increase on Saturday, Jan. 14, 2023. The sudden spike in value caused the highest ratio of short liquidations vs long liquidations since July 2021, according to a recent Alpha report from Bitfinex.

Bitfinex Analysts See a Cautious Approach From Bulls as Market Remains Highly Illiquid Despite Price Surge

Bitcoin (BTC) and ethereum (ETH) prices have risen significantly against the U.S. dollar, causing a cascade of short liquidations on Jan. 14. The cryptocurrency exchange Bitfinex discussed the matter in its most recent Alpha report #37. When a trader opens a short position against bitcoin or ethereum, they expect the price of the crypto assets to decline in the future.

However, if bitcoin’s price climbs quickly, short traders either get liquidated or must buy back the bitcoin at a higher price. When the price of BTC or ETH rises too much, short sellers are liquidated, meaning their short position is closed by the crypto derivatives exchange. According to Bitfinex researchers, a significant number of liquidations took place on Jan. 14.

“Short liquidations fueled the entire increase in bitcoin and ethereum,” Bitfinex analysts said in the Alpha report. “Short liquidations at $450 million outweighed long liquidations by a ratio of 4.5. On Jan. 14, the market saw the highest ratio of short liquidations vs long liquidations since July 2021,” the analysts added. They also mentioned that the liquidation figures and short vs long liquidation ratio was even more severe among altcoins.

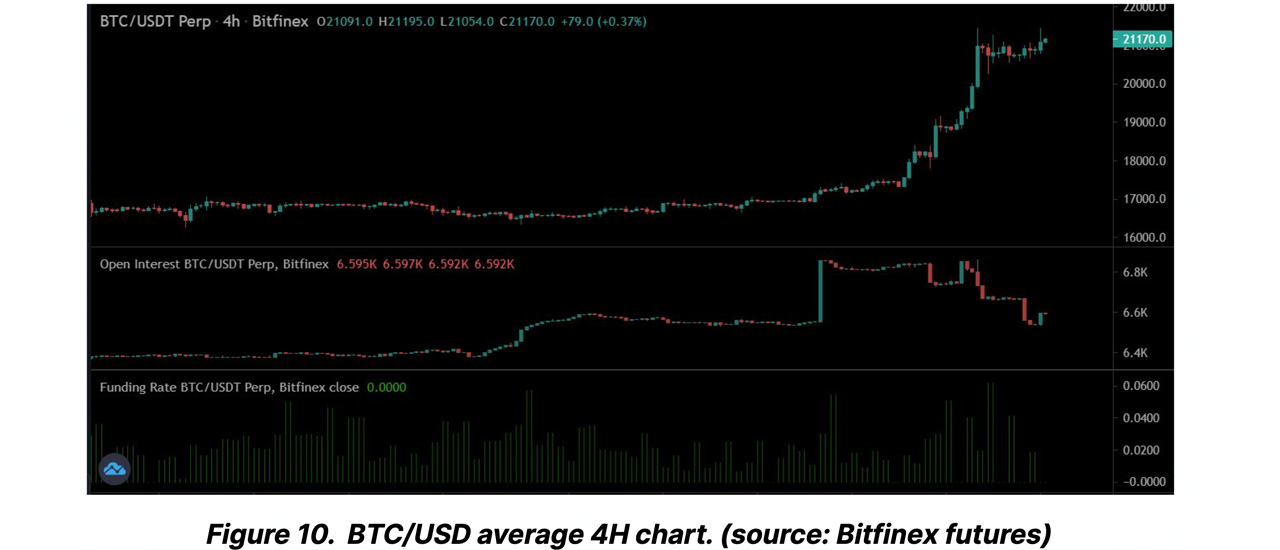

Bitfinex analysts further detailed that a retraction in bitcoin’s price still remains probable. “While it is typical for bear markets to have a complete wipeout of shorts,” the analyst noted. “The entire rally has been built on the backbone of continuous market shorts keeping funding low and prices being pushed up by forced liquidations and running stops. So, a pullback in bitcoin price remains a possibility.”

The Alpha report adds:

Although the move might be interpreted as organic, it is entirely engineered by limited traders in the market, which is evident from the market depth remaining the same week-on-week. The price impact from market orders is also the same as last week for [bitcoin], and there is little change for altcoins. This means that even with the leg up, the market remains highly illiquid, and with the sharp fall in open interest over the weekend, a pullback might be expected with a cautious approach from bulls.

Crypto Supporters Debate the Gartner Hype Cycle Position and ‘Disbelief’ Phase

When the liquidations took place three days ago, Bitfinex reported that Bybit experienced the largest short open interest wipeout since its inception. “The negative funding rates below $16,000, followed by increasing aggregated long-side open interest for [bitcoin], were the driving force behind the price surge,” the researchers explained.

The recent rise in bitcoin and ethereum prices has caused many people to speculate whether the crypto bottom is in. On Jan. 16, 2023, bitcoin analyst Willy Woo shared an illustrated image of the Gartner Hype Cycle and said, “I suspect we are in the ‘disbelief’ phase of the cycle.”

A number of people disagreed with Woo’s opinion about being in the ‘disbelief’ phase of the cycle. Crypto proponent “Colin Talks Crypto” replied to Woo, saying, “No way.” Colin further stressed that it would “mean the typical bear market got massively shortened, (which is highly unlikely, especially in today’s poor macro climate).” The crypto supporter and Youtuber added:

It would mean a bitcoin 4-year cycle somehow magically became a 2-year cycle or something.

What do you think about the Bitfinex Alpha report and the short liquidations that took place this week? Do you think we are in the ‘disbelief’ phase of the Gartner Hype Cycle? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/taoSu2j

Comments

Post a Comment