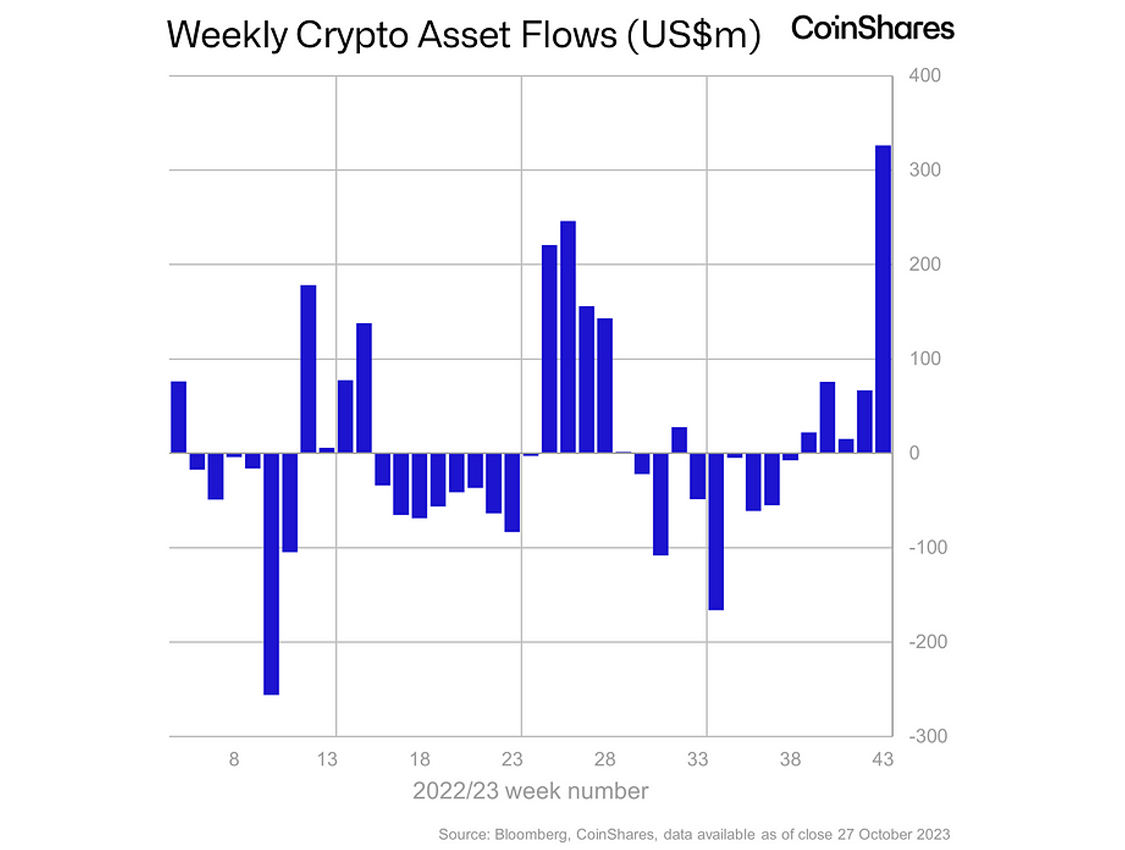

While closing out October, the digital asset market has witnessed a significant rush in optimism, culminating in $326 million in fund inflows, marking the largest single-week gain in one and a half years, according to Coinshares latest digital asset fund flows report.

Digital Asset Market Soars Higher With Record-Breaking Inflows

This week’s Coinshares report, Volume 155, highlights the rising optimism and a higher rate of inflows. Bitcoin (BTC) dominated the influx, capturing 90% of the inflows at $296 million, demonstrating market confidence despite recent price increases. Coinshares researchers also noted substantial inflows into various alternative digital assets. However, this renewed optimism did not extend to ethereum (ETH), which experienced a $6 million outflow.

The report further indicates that the market is responding positively to the current conditions, with BTC leading the way in terms of investor interest and capital allocation. Interestingly, the research also notes a $15 million influx into short bitcoin investment products, highlighting a segment of the market hedging against potential future declines in bitcoin’s value. Last week, BTC’s climactic rise to $35,000, erased $232 million in short positions in a single day.

Solana has also garnered increased investor interest, with $24 million in inflows reported. This suggests a broadening of investor interest beyond bitcoin, with alternatives like SOL gaining traction and capturing a substantial portion of market activity. Coinshares underscores the diversification of investments in the digital asset market, highlighting the potential opportunities that exist within various segments of the market.

The crypto market report highlighted that total assets under management (AUM) are now standing at $37.8 billion, the highest since May 2022. Regionally, only 12% of the flows came from the U.S., totaling $38 million. Coinshares attributes this to investors awaiting a spot-based exchange-traded fund (ETF). Canada ($134 million), Germany ($82 million), and Switzerland ($50 million) led in investments. Coinshares further noted that Asia saw its largest weekly influx at $28 million.

What do you think about the latest inflows in the digital asset market sector? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/EIvzmbM

Comments

Post a Comment