South Korean crypto traders are more inclined to invest in high-risk, high-reward altcoins than their American counterparts, according to a new report. The share of major cryptocurrencies like bitcoin and ethereum in the trading volumes on the largest Korean exchange is much smaller than the one registered on the leading U.S. exchange, the research indicates.

Majority of South Korean Investors Interested in Altcoins With Potential for High Profit

Many South Koreans favor a high-risk approach to crypto investments that can potentially return high rewards, the Web3 market strategy consulting firm Despread has established in a new study focused on trading on the country’s major cryptocurrency exchanges.

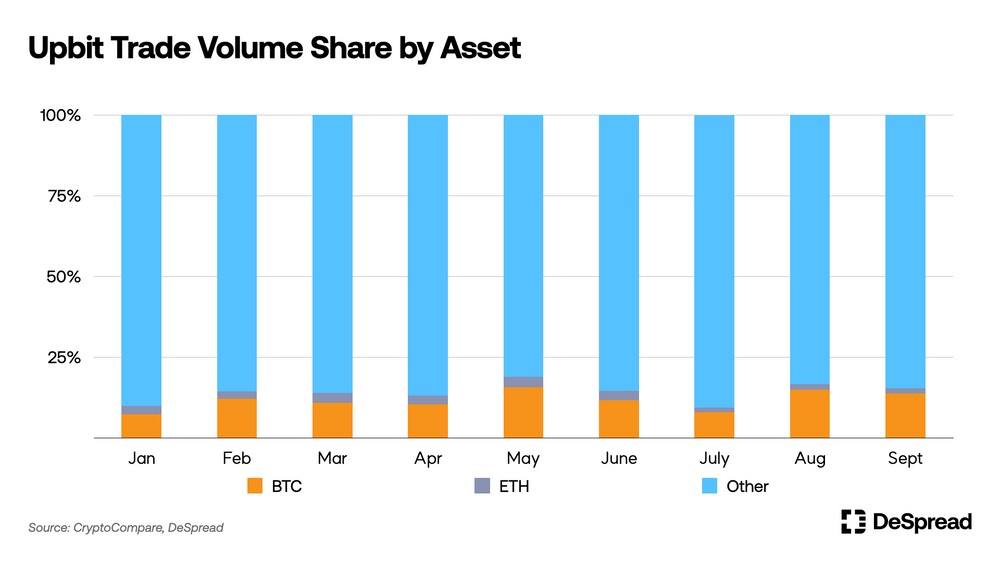

“The majority of individual investors on Upbit show strong interest in altcoins with high profit potential and tend to accept the associated high risks. This is considered one of the reasons for the high proportion of altcoin trading in the Korean market,” the authors said in a blog post.

Upbit is South Korea’s largest crypto trading platform, accounting for between 70 and 80% of the domestic exchange market this year. In February, the platform recorded its highest trading volume of $36 billion. It’s followed by Bithumb, Coinone, and Korbit.

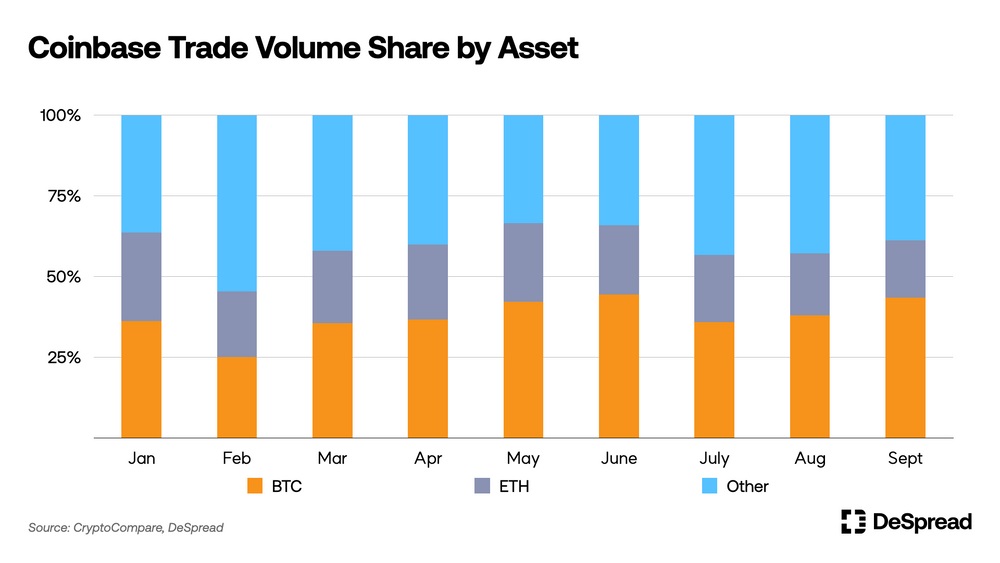

Trading on America’s leading cryptocurrency exchange, Coinbase, is quite different. Unlike Upbit, which is dominated by individual investors, Coinbase’s trading volume is to a much higher degree driven by institutional players.

Institutions account for about 85% of the exchange’s total trading volume, according to its Q2 shareholder letter. These investors tend to pursue portfolio stability and as a result trading in bitcoin (BTC) and ethereum (ETH), the cryptos with the largest market cap, has a much larger share.

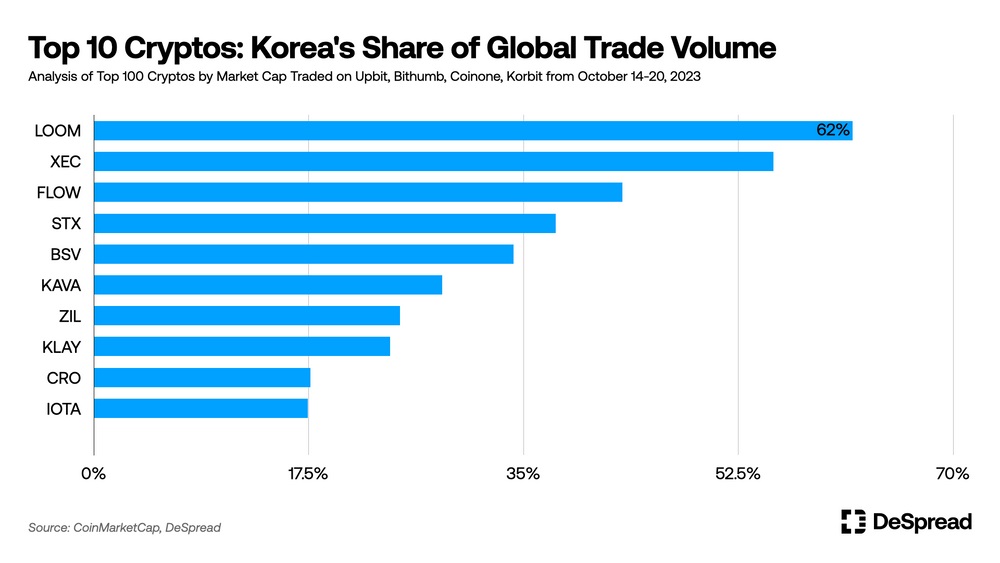

Among the altcoins most actively traded in South Korea, in comparison with the global market, loom network (LOOM) claimed the top spot last week, recording the highest trading volume with a ratio of 62%, Despread revealed.

Loom was followed by ecash (XEC) with 55% and flow (FLOW) with 43%. Stacks (STX) and bitcoin SV (BSV) also made it to the rankings with ratios of 37% and 34% respectively, the company detailed in the report published Thursday.

“While there are cryptocurrencies that receive temporary attention, such as loom network and flow, cases like stacks and ecash continue to receive consistent attention on Korean exchanges regardless of temporary events. These cases are noteworthy as they are consistently traded in the Korean market regardless of global trends,” the researchers noted.

Why do you think South Koreans are more inclined to invest in altcoins? Share your thoughts on the subject in the comments section below.

from Bitcoin News https://ift.tt/84yGbUE

Comments

Post a Comment