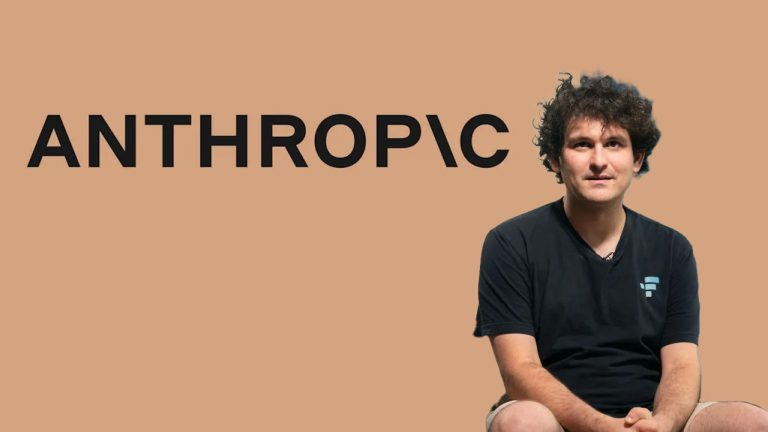

Amidst widespread media coverage highlighting Anthropic, the startup behind the generative artificial intelligence (AI) chatbot Claude and its pending multi-billion-dollar infusion, federal prosecutors overseeing the Sam Bankman-Fried case are pushing to sideline this subject during the trial. Thane Rehn, the assistant U.S. attorney, strongly asserted that it’s “immaterial whether some of those investments might ultimately have been profitable.”

FTX’s Stake in Booming AI Startup Anthropic Under Fire in Federal Court

After receiving substantial funding from tech giants Microsoft and Amazon this year, it’s been reported that Anthropic, the generative AI startup, is gearing up to pool in another $2 billion. Achieving this would potentially catapult the firm’s valuation to a staggering $20-30 billion. Notably, with FTX as a key investor in Anthropic, there’s a shimmering hope for the beleaguered exchange’s clientele. The value derived from Anthropic’s shares could essentially make them whole again, a prospect that has sent waves of excitement among FTX creditors.

Amplifying this sentiment, a prominent group of these creditors, the FTX 2.0 Coalition, took to the rebranded social platform X (formerly known as Twitter) to voice their optimism.

“Anthropic to raise from Google at $20-30B valuation, putting FTX’s stake at $3-4.5B. FTX customers now stand to be made whole,” the FTX 2.0 Coalition broadcasted on X.

However, by Sunday, the plot thickened. Federal prosecutors presented a letter penned by Rehn to the presiding judge, ardently requesting the court to sidestep any chatter related to Anthropic’s investment. The government’s standpoint is clear: the crux of the matter isn’t if the victims will get their dues, but whether Bankman-Fried had deceitfully misused client funds. Rehn emphasized, “It is immaterial whether some of those investments might ultimately have been profitable.”

To further his argument, the prosecutor explained:

Permitting the defendant to introduce evidence of Anthropic’s valuation in its venture fundraising rounds would necessitate a mini trial regarding the value of assets available through the bankruptcy and the degree to which they might cover customer and other creditor losses.

At the heart of the matter, Rehn contended that Bankman-Fried shouldn’t be allowed to present this evidence as a counter to the government’s claims regarding FTX’s bankruptcy. Specifically, since the government isn’t showcasing any proof about the potential recovery amount for the victims. The authorities are of the opinion that such evidence lacks relevance and should be entirely omitted from the trial proceedings.

Alongside the legal charges aimed at Bankman-Fried, the FTX estate has dealt with the Anthropic shares. As June 2023 drew to a close, the debtors put a temporary hold on the sale of FTX’s shares in Anthropic that the financially beleaguered firm had amassed before it collapsed.

What do you think about the request to exclude talking about FTX’s Anthropic investment in court? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/rUnEp3O

Comments

Post a Comment