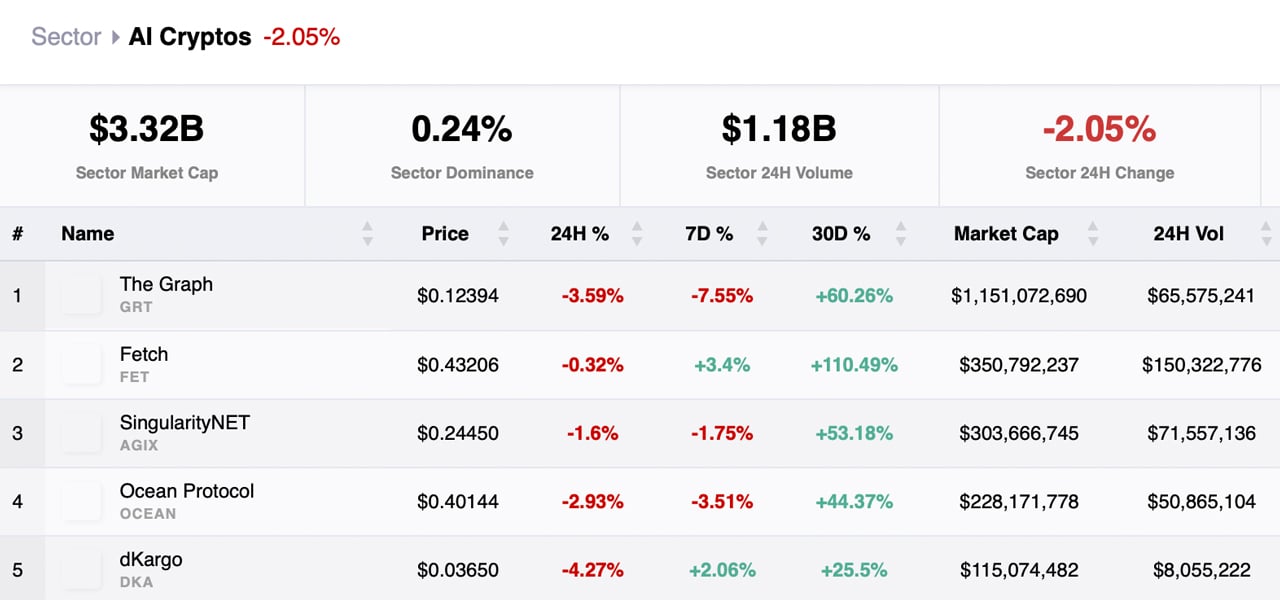

In the early months of 2023, the AI-driven crypto market soared, reaching a peak of over $4 billion. Yet, by the end of July, this sector experienced a notable decline, dropping to $2.6 billion. Despite this downturn, the last three months have witnessed a recovery in the AI-focused crypto landscape, with its value increasing to $3.32 billion, bolstered by an infusion of roughly $720 million.

AI Cryptocurrencies Experience Substantial Uptick

As the AI-influenced crypto market once again surpasses the $3 billion mark, the leading AI cryptocurrencies have experienced substantial growth in the last 30 days. This sector, centered around AI-related digital currencies, has seen a dynamic year, reaching a high of more than $4 billion in February.

Following this peak, however, there was a substantial decline, with $1.5 billion in value disappearing by July 2023. Specifically, at the end of July, the valuation of the AI-centric crypto economy stood at $2.6 billion.

AI tokens are digital assets in AI-driven crypto initiatives, playing a role in embedding artificial intelligence into a range of projects. These ventures span from asset management and generative art to price prediction, as well as the functioning of decentralized autonomous organizations (DAOs), among other applications like Web3 and the Internet of Things (IoT).

The leading AI-related cryptocurrency in terms of market capitalization is the graph (GRT), boasting a valuation of $1.15 billion. This week, GRT experienced a 7.55% decline, yet it has surged by 60.26% against the U.S. dollar over the past month.

The digital currency fetch (FET) recorded a 3.4% increase this week and triple-digit growth over the last month, climbing 110.49%. Additionally, singularitynet (AGIX) and ocean protocol (OCEAN) saw their values rise by 53.18% and 44.37%, respectively. A significant number of AI coins have enjoyed notable gains recently.

VAI soared by 147.83%, and delysium (AGI) increased by 163.83%. In contrast, neuroni ai (NEURONI) faced a 34.34% decrease, arcona (ARCONA) dropped 29.03%, and ai meta club (AMC) declined by 18.83% this month. GNY, BCUBE, and XRT were also notable losers during the 30-day period.

As the AI cryptocurrency market navigates through a year of fluctuating fortunes, its future remains uncertain. This confluence of technology and finance, while promising, poses unanswered questions about the long-term impact and stability of AI-driven digital currencies in the global financial ecosystem.

What are your thoughts about the AI-centric crypto economy? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/jbcmGt2

Comments

Post a Comment