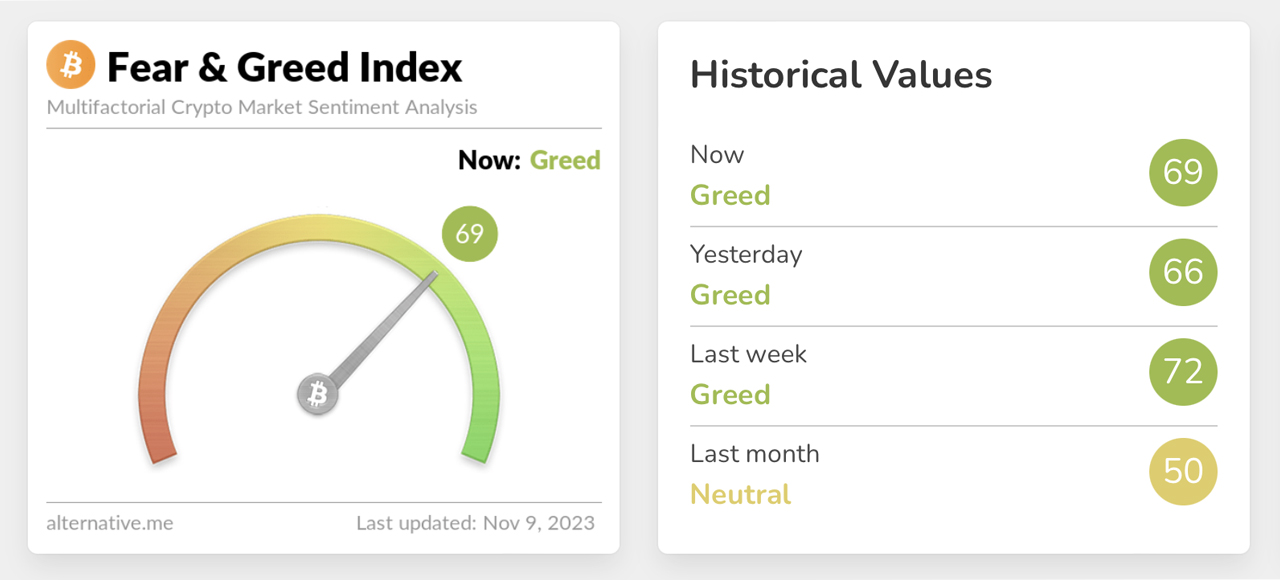

The Crypto Fear and Greed Index (CFGI) currently reveals a mood of “greed” within the cryptocurrency market, scoring a 69 out of 100. As of November 9, 2023, at 5:20 a.m. Eastern Time, the price of bitcoin peaked above $37K — a peak not observed since the first week of May 2022, stretching over a span of more than 550 days.

Bitcoin Rises Above $37K Zone; Shorts Crushed With $96 Million Loss

The valuation of bitcoin (BTC) has escalated by 4.4% against the U.S. dollar this Thursday, marking a strong 34% appreciation over the previous month. Bitcoin is now trading just above the $37K threshold, a level last witnessed on May 6, 2022.

This indicates that for an extensive period of over a year, or just beyond 550 days, bitcoin’s price lingered below the $37K mark. It has been 238 days since BTC’s value dipped below $25,000, which occurred on March 16, 2023, and 299 days since it fell under the $20,000 mark on January 14, 2023.

Further, bitcoin has not been priced at $10,000 or lower since July 27, 2020, which dates back approximately 1,200 days. From 2020 to 2023, bitcoin’s price remained below $10,000 for a duration of 202 days, below $20,000 for 471 days, and under $25,000 for 637 days in total.

This week, bitcoin’s price has maintained a solid position above $35K, signaling a bullish outlook as suggested by the latest technical oscillators and moving averages. The 10-day short-term exponential moving average (EMA) and simple moving average (SMA) are flashing bullish signals, indicative of a strong price trajectory in recent times.

Despite these positive indications, the Crypto Fear and Greed Index (CFGI) continues to suggest a tilt towards “greed.” The index mirrored this sentiment last week and the day prior as well, while it reflected “neutral” feelings last month as reported by alternative.me.

According to the CFGI, “extreme fear” may hint at widespread concern among traders and investors, potentially marking a prime entry juncture. Conversely, “extreme greed” suggests that the crypto market might be ripe for a price correction.

Nonetheless, recent statistics highlight that those who wagered on a crypto downturn by positioning short bets have incurred losses amounting to $162 million in the past day alone, with bitcoin’s swift ascent towards $37K causing the liquidation of over 59% of these shorts, equating to about $96 million.

What do you think about the Crypto Fear and Greed Index? Share your thoughts and opinions about this subject in the comments section below.

from Bitcoin News https://ift.tt/iQzNwEY

Comments

Post a Comment