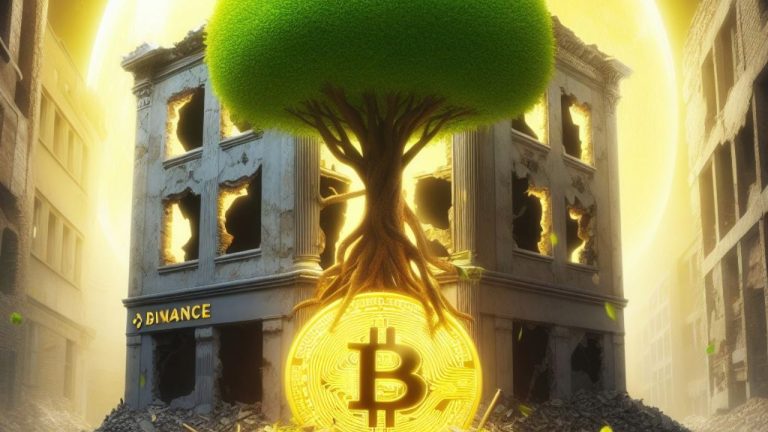

While the recent settlement between Binance, its former CEO Changpeng Zhao, and the U.S. Department of Justice (DOJ) has shocked the entire crypto industry due to the supposed money laundering and terrorism-related financial implications it has, many analysts and execs believe this is ultimately a good outcome, considering that it will cause the crypto space to grow absent uncertainties related to one of its largest actors.

Analysts Argue Binance Settlement Signals Growth in the Industry

The landmark settlement between Binance, one of the largest cryptocurrency exchanges in the world, its former CEO Changpeng “CZ” Zhao, and the U.S. Department of Justice (DOJ) on the charges of money laundering and terrorism financing might bring a new era to the cryptocurrency industry, according to analysts and crypto executives.

Brian Armstrong, CEO of Coinbase, stressed that this action might open new roads for the industry, which will have to be built with compliance in focus. Armstrong stated:

Today’s news reinforces that doing it the hard way was the right decision. We now have an opportunity to start a new chapter for this industry. We took a lot of arrows operating here in the U.S. due to the lack of regulatory clarity, and my hope is that today’s news serves as a catalyst to finally achieve that.

Coinbase is also facing legal actions from the U.S. Securities and Exchange Commission (SEC), which alleges the exchange operates as an unregistered securities broker, evading U.S. regulations for years.

More Reactions

Analysts at JPMorgan, led by Managing Director Nikolaos Panigirtzoglou, also believe the settlement is significant for the cryptocurrency environment, eliminating future uncertainties related to the largest crypto actor. In statements offered to The Block, JPMorgan analysts declared:

We see the prospect of settlement as positive as uncertainty around Binance itself would subside and its trading and BNB Smart Chain business would benefit.

Furthermore, the $4.3 billion deal helps to dispel the potential “systemic risk” of a hypothetical collapse of Binance, according to JPMorgan.

Other analysts believe that with Binance under the DOJ’s surveillance and being forced to exit the U.S. completely, the opportunity for finally greenlighting a spot Bitcoin ETF is upon the crypto market. Michael Rinko, research analyst at Delphi Digital, told CNBC:

If you’re actively investigating the company and the CEO who’s telling everyone the price of these assets, how are you then going to greenlight an ETF? Having this settlement behind us could be the final big, big step needed for this ETF.

What do you think about the state of the crypto industry after Binance’s plea deal? Tell us in the comments section below.

from Bitcoin News https://ift.tt/6T0Lkg8

Comments

Post a Comment