As Bitcoin’s Yearly Inflation Rate Dips to 1.77%, BEA Data From May Shows US Inflation Fears Are Legitimate

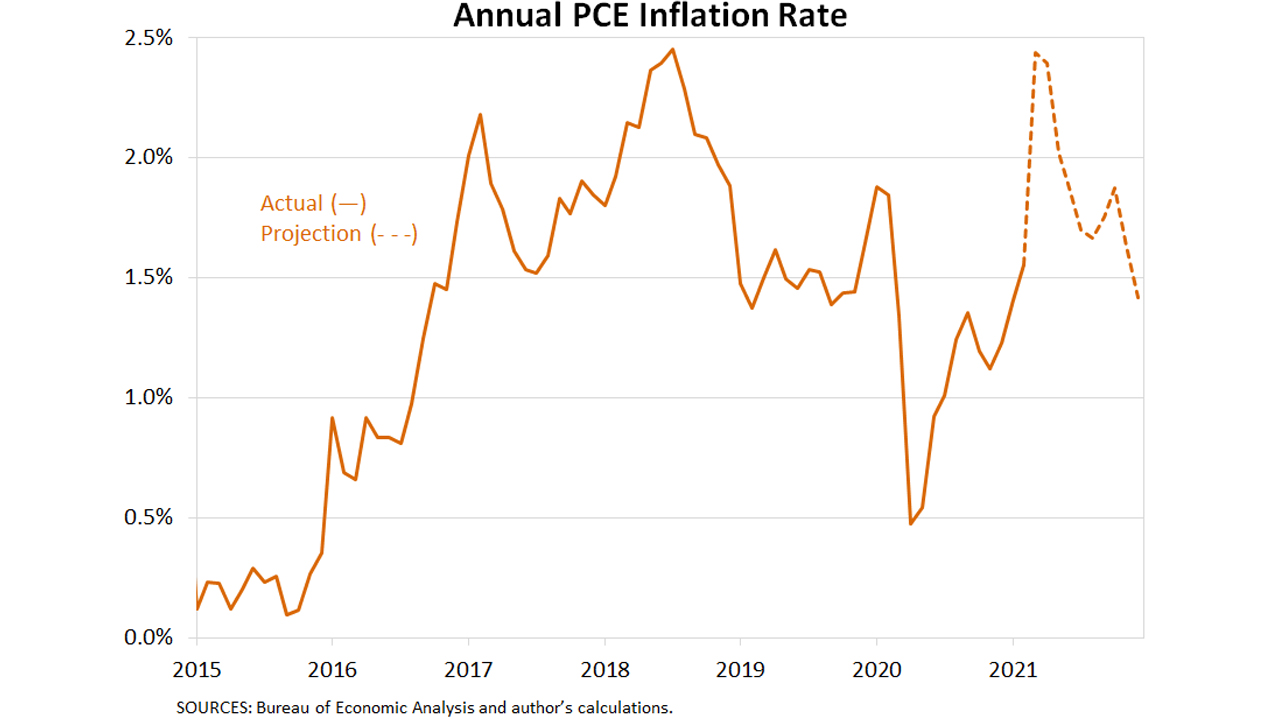

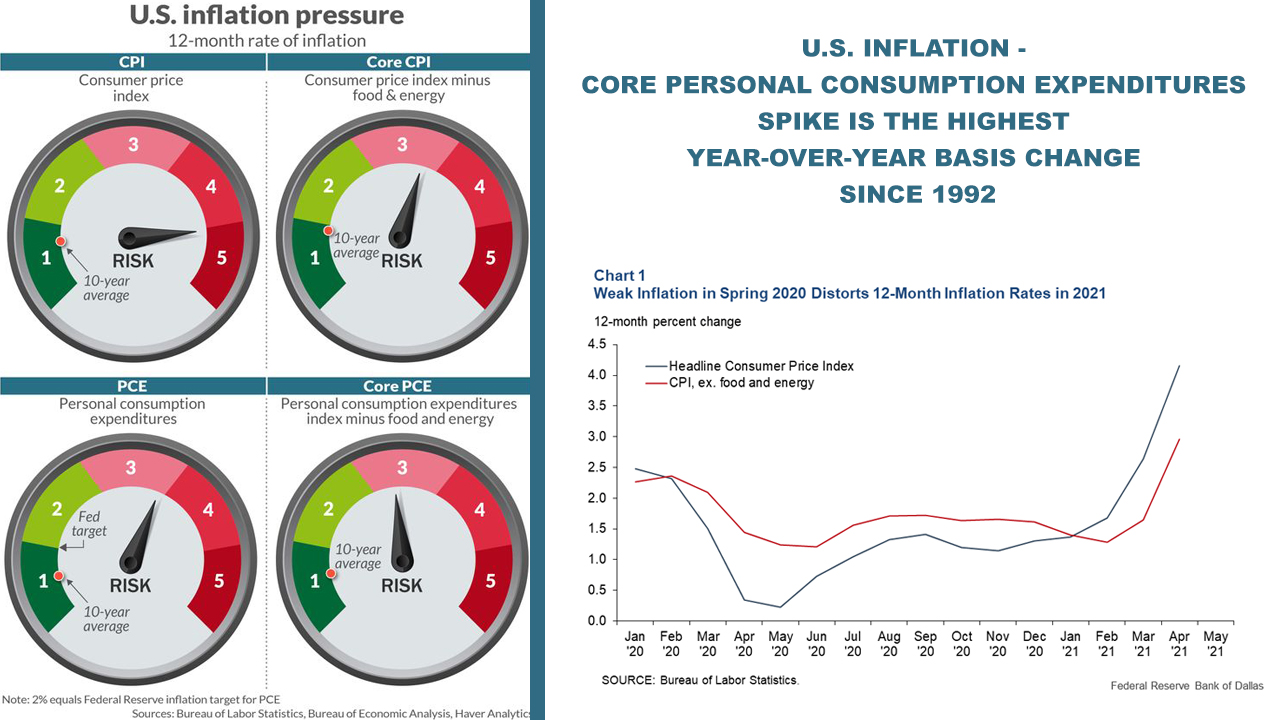

The U.S. economy is looking stagnant according to data stemming from the Bureau of Economic Analysis, as core personal consumption expenditures (PCE) jumped 3.4% in May from a year prior. The recent PCE spike is the highest year-over-year basis change since 1992 and the statistic is fueling inflation concerns.

Amid ‘Never Ending’ Market Rallies, Core Inflation Indicator Jumps Highest in Close to Three Decades

After more than a year of lockdowns and business shutdowns alongside the massive monetary expansion introduced by the Federal Reserve, economists are worried about rising inflation. Last week the Fed revealed its possible future interest-rate decisions and global markets shuddered for a couple of days and then recovered.

Northmantrader.com founder, technical analyst, and macroeconomic commentator, Sven Henrich, jokingly wrote about the manipulated markets in a blog post called “The Never Ending Rally.” Henrich remarked on how the president of the Federal Reserve Bank of Minneapolis Neel Kashkari made markets feel better on Friday.

“Last week’s trial balloon by the Fed, if that was the intent, made it clear again that this market runs not only on easy money, but also on the continued expectation of easy money,” Henrich wrote. “So the Fed followed its long adopted approach to monetary policy: Go in big, go in fast, and go out excruciatingly slow for fear of the consequences of upsetting markets.”

While Wall Street is getting the benefits from the Fed, Americans returning back to work are facing an assault on their purchasing power. Even retirees are getting hammered with inflation woes as Barron’s award-winning financial columnist Gail MarksJarvis explained on Saturday.

“As the pandemic fades and the country reopens,” MarksJarvis said, “retirees are emerging to the unsettling whiff of inflation. Gas prices are up more than 50% year over year. Grocery prices have climbed 2.2% overall. Airfares are up nearly 25%.”

Amid the never-ending market rally for a small privileged few, core personal consumption expenditures (PCE) index data was published by the Bureau of Economic Analysis (BEA) on Friday. The data was concerning because the PCE rose 3.4% higher than the number for May 2020, which is the largest year-over-year increase in close to three decades.

The BEA is a U.S. government agency that provides economic and market statistics. Every month, the BEA releases data on the total value of American consumption expenditures. The PCE price index found in the BEA’s Personal Income and Outlays report, and shows the changes in inflation tied to everyday goods and services purchased by U.S. consumers. All kinds of commodities and for-profit solutions are mixed into the PCE equation like services, nondurable goods, and durable goods.

Treasury Yields Jump and Transitory Inflation

Despite the dreary PCE data, the yield on the benchmark 10-year Treasury note spiked by almost four basis points, and gold markets jumped higher as well. Similar to Henrich, economist and gold bug Peter Schiff has also been commenting on the Fed’s monetary theatrics and even published a radio broadcast called “Everything Is Awesome Because the Fed Says so.”

“High inflation keeps pushing the price of oil higher,” Schiff tweeted on Friday. “So far today it’s already hit $73.40, the highest price since Oct. of 2018. Yet investors aren’t buying gold because instead of looking at what’s actually happening to oil, they believe the Fed that it’s only transitory.” Schiff added:

New definition of transitory: An adverse permanent change in conditions that if fully appreciated by the public or investors would accelerate both the impact on an economy or financial markets, and the damage done to the reputations of incumbent administrations or central banks.

Coinshares Report Says Bitcoin’s Relationship With Inflation Changes Statistically Significant

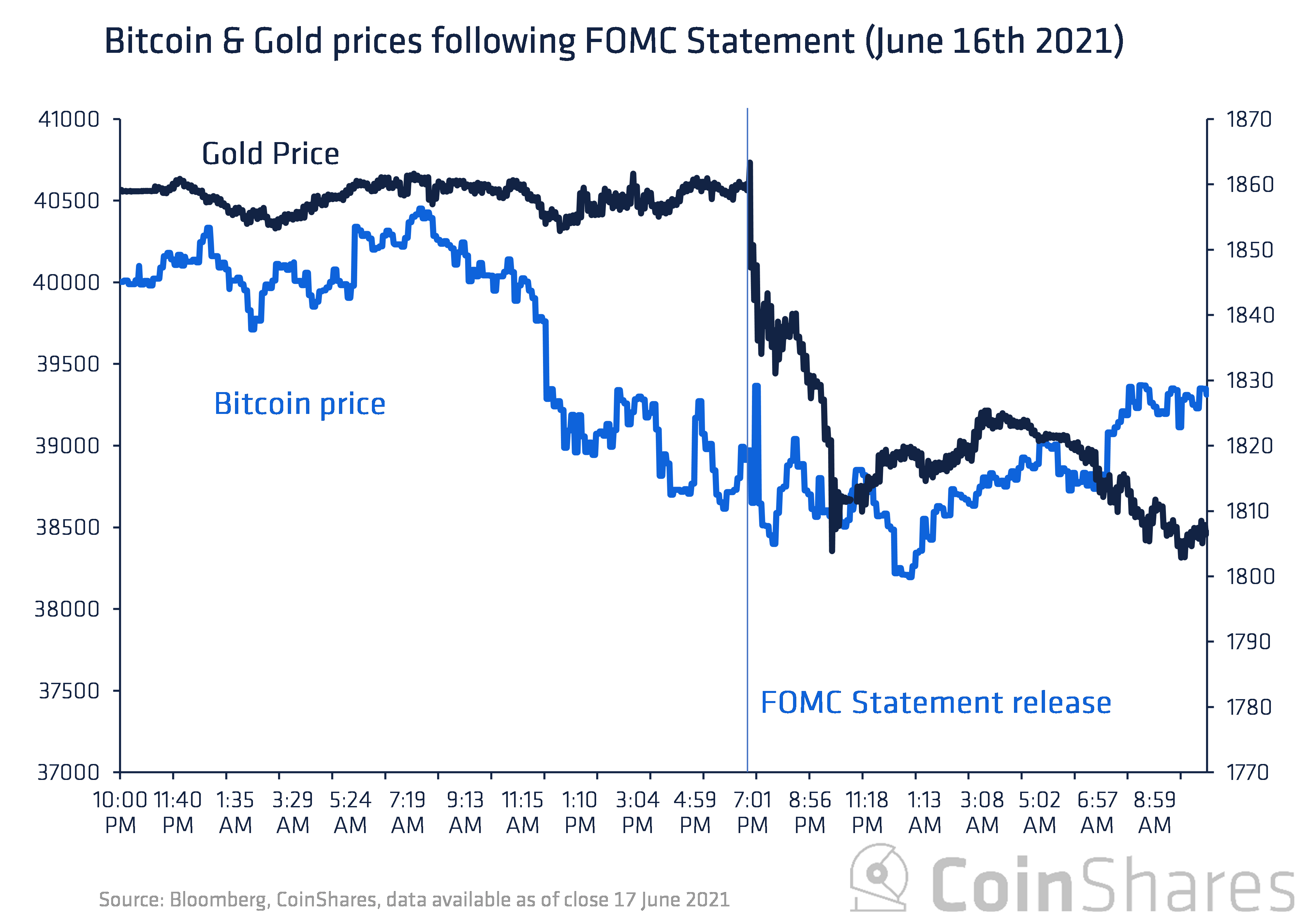

As concerns about rate hikes and the recent PCE data rattled markets, Coinshares’ James Butterfill published a report on how data suggests that bitcoin is beginning to fulfill the role of an inflation hedge. “Observing bitcoin’s price changes relative to changes in inflation shows that this relationship is becoming statistically significant,” Butterfill’s research highlights.

The researcher’s report details that it’s difficult to know if inflation is headed our way and how long it could last. The Coinshares study also notes that since the inception of the Bitcoin network, data shows “the relationship between bitcoin and inflation is currently better than between inflation and gold.”

“There is increasing evidence that bitcoin is maturing as an asset,” Butterfill’s research concludes. “After the most recent FOMC statement (16th June) where an unexpectedly hawkish tone was expressed, prices moved in a very similar way to gold. This is highlighting that bitcoin is behaving as investors would expect from a real asset, by appreciating when the U.S. dollar declines and vice versa.”

Satoshi’s Design Is Meant To Be Predictable

As Butterfill’s report highlights, it’s difficult to know or predict what the global economy will do. What makes it much worse is how unpredictable the Fed’s monetary system — with its never-ending rallies and busts — can be. Even though bankers and bureaucrats continuously tout that inflation is only 2% to 2.24%, the surging value of goods and services highlights the fact that 2% inflation is a myth.

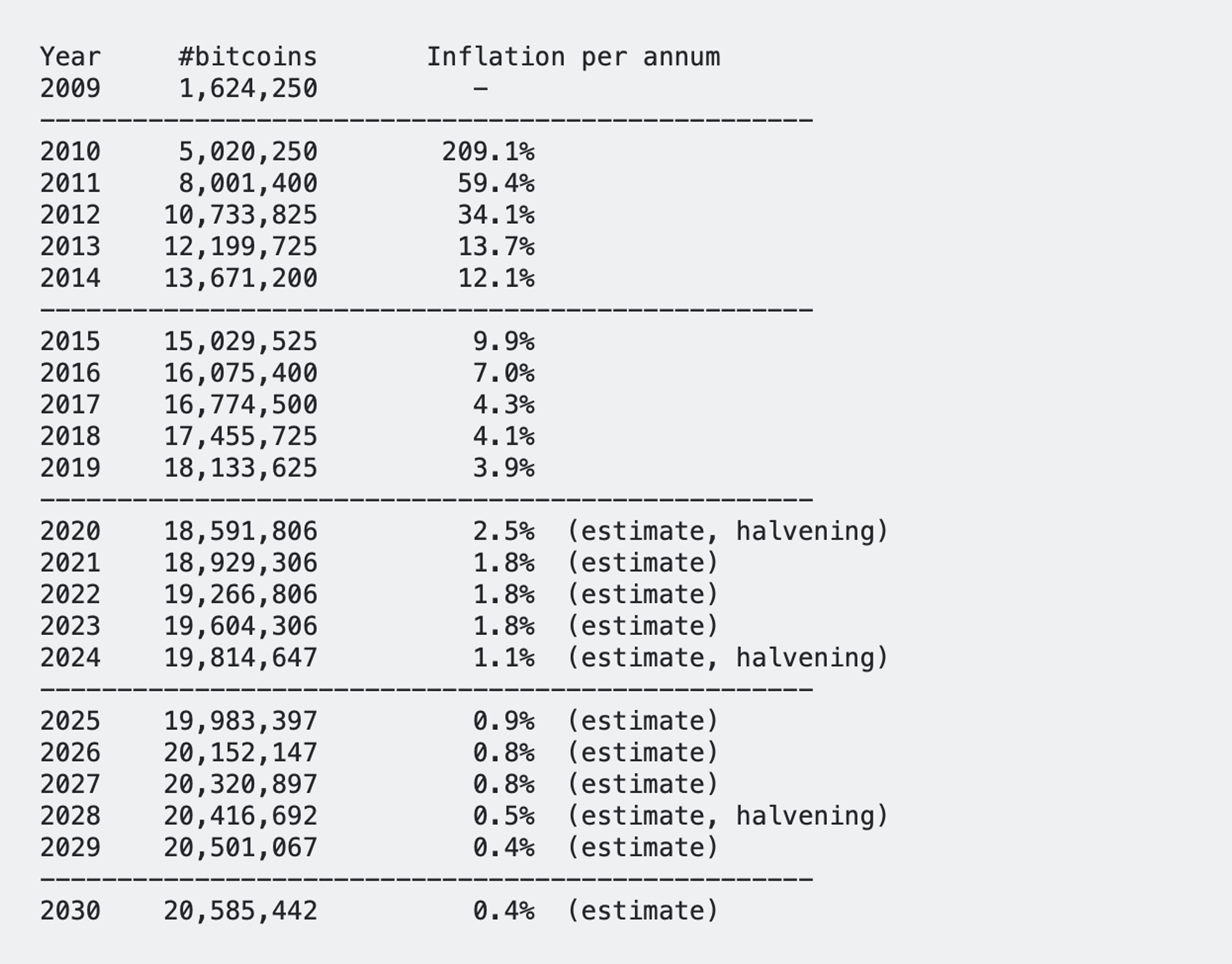

In contrast to unpredictable monetary expansion, tightening, and mythical inflation rates, Bitcoin’s inflation rate per annum is only 1.77%. Central banks and politicians have always leveraged a 2% target reference, but data from web portals like shadowstats.com and equipmentradar.com, clearly shows the general increase in prices for goods and services is much higher than 2%. Unlike the Fed’s system, Bitcoin’s inflation rate per annum shrinks every four years during the reward halvings.

Satoshi’s idea of an active supply coupled with demand and the reward rate decreasing every four years developed a predictable economic system with an inflationary rate no one can control. We can actually predict with rough estimates how much lower Bitcoin’s inflation rate per annum will be in the future. By 2025, it’s estimated that Bitcoin’s inflation will be lower than 1% and by 2028 the network’s inflation rate per annum will be 0.4%.

What do you think about the recent inflation concerns and the PCE data spike? Do you think assets like gold or bitcoin are a better hedge against inflation? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3y2kAV2

Comments

Post a Comment