The market capitalization of all 10,722 cryptocurrencies in existence is around $1.42 trillion on Wednesday and during the last 24 hours, all of these crypto-assets combined lost 3.92%. Meanwhile, bitcoin captures 45.73% of the entire $1.42 trillion capitalization and ethereum commands 17.8%. As both of these leading assets have improved this week, seven-day changes against the U.S. dollar show a great number of other crypto-assets have seen much bigger double-digit gains.

Steemit Coins, 51% Attacked Tokens, and Forgotten Crypto Assets

An interesting assortment of crypto assets have seen double-digit gains as larger competitors like bitcoin (BTC) and ethereum (ETH) have seen weaker improvements. For instance, BTC has gained 2.74% against the U.S. dollar during the last seven days.

ETH has jumped close to 10%, but not quite, with an 8.89% rise over the last week. While they are at the very least weekly improvements against the dollar, a number of unconventional crypto assets have jumped much higher.

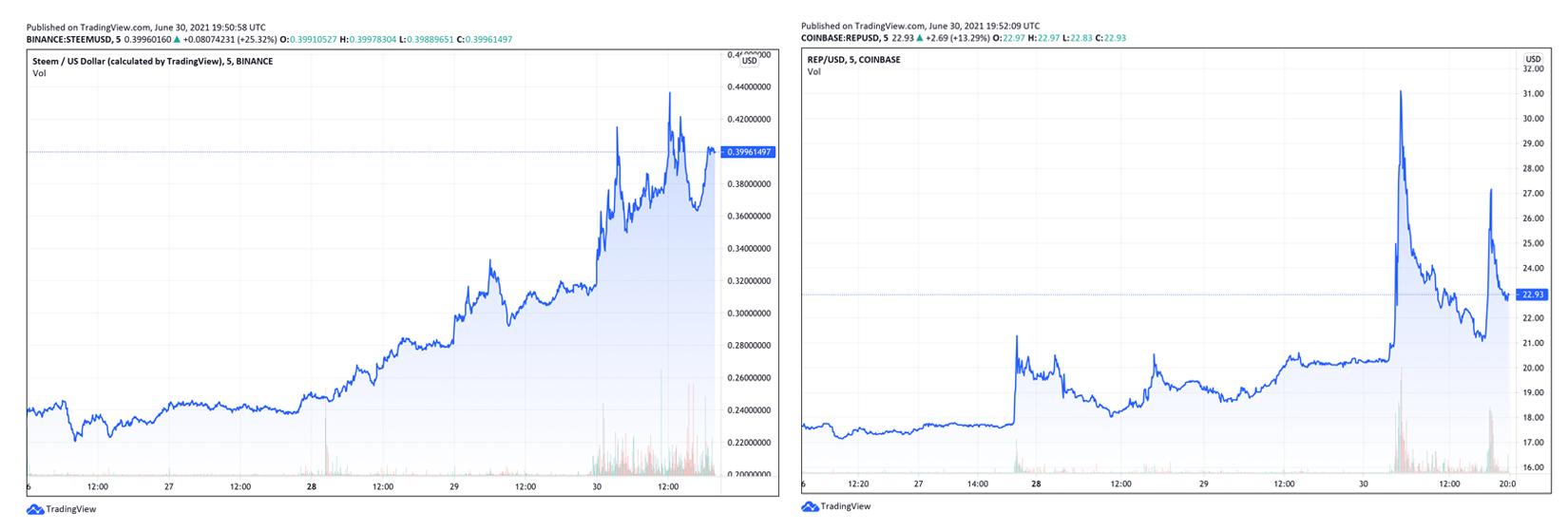

Steem (STEEM) has gained 54% this week and the crypto asset’s cousin steem dollars (SBD) spiked over 31% during the last seven days. The two digital currencies are leveraged for upvoting and tips on the Steemit blogging platform.

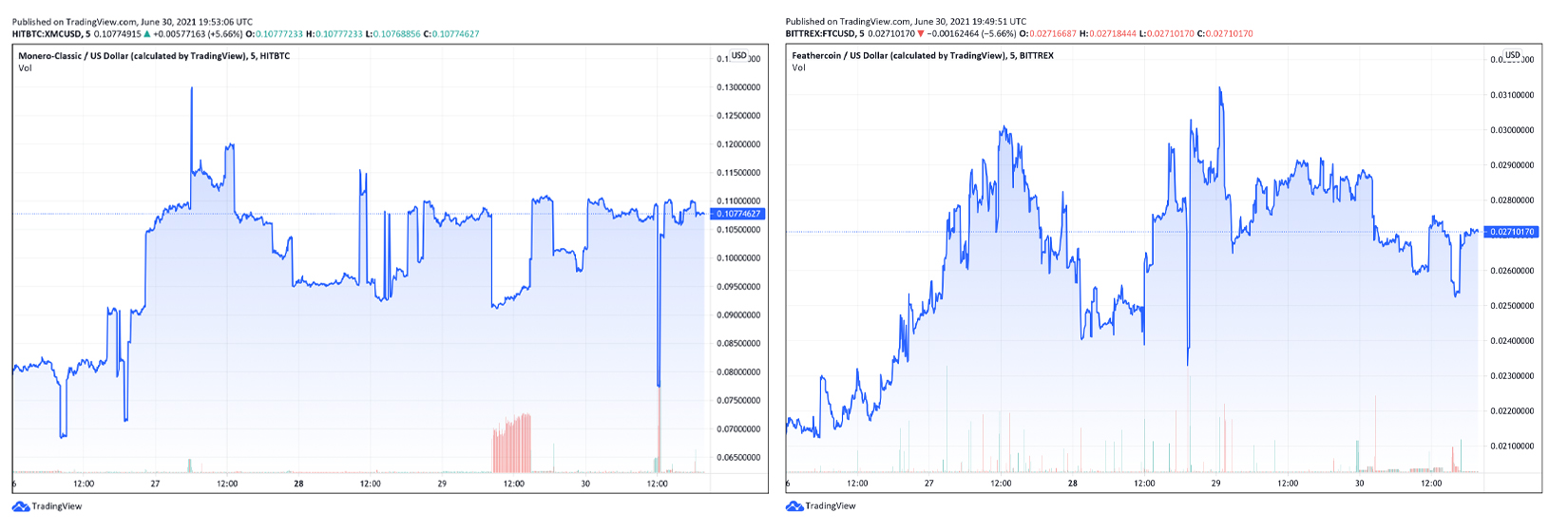

Below, steem’s 54% rise, the prediction market crypto-asset augur (REP) jumped 51%. REP tokens are used in the Augur system to give users the ability to create a prediction market on any topic. Another unconventional rise this week was monero classic’s (XMC) 45% jump. XMC is a fork of the privacy coin monero (XMR).

Then crypto assets that have seen 51% attacks, also saw double-digit gains this week. For example, below XMC’s rise, the digital currency vertcoin (VTC) rose 40% during the last seven days. And the coin below VTC, which has also been 51% attacked, is bitcoin gold (BTG) rising 38% this week.

Seven-day changes against the U.S. dollar also show the 51% attacked ethereum classic (ETC) saw a 31% rise during the trailing seven-day week. Interestingly, a forgotten digital currency launched on April 16, 2013, feathercoin (FTC) has gained 29% this week.

FTC is an ancient coin that used to be a top ten crypto market cap contender, but today feathercoin holds the 100th position. Market aggregators also show that Vinny Lingham’s civic (CVC) token has jumped 26% over seven days.

The newer meme-based ERC20 token, that shares the concept of dogecoin (DOGE), shiba inu (SHIB) rose 22% during the course of the week. While seven-day gains have been higher for these crypto coins, 24-hour statistics have been different. For example, ETC is down -1.57% on Monday, VTC -4.12%, and FTC is down -8.29%.

What do you think about the double-digit gains seen by this unique bunch of crypto assets? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/2UUz6zQ

Comments

Post a Comment