Boston Federal Reserve president Eric Rosengren discussed stablecoins in a recent presentation on June 25. Rosengren stressed that stablecoins could be a “disruptor” to prime money market funds and the Boston Fed president remarked that the exponential growth of stablecoins is concerning.

Rosengren: ‘We Should Be a Bit Concerned About Stablecoin Markets Growing Very Rapidly’

Members of the Federal Reserve are quite aware of stablecoins and the massive market these pegged-assets have created. Today statistics show there’s $111 billion in stablecoin capitalization amongst the long list of these types of tokens.

Out of all that money, on Sunday, June 27, there’s $63 billion in reported stablecoin trade volume out of the $96 billion in crypto swaps recorded globally. Boston Fed president Eric Rosengren has noticed the growth and the banker thinks it could pose a problem to short-term money markets.

During the presentation dubbed “Financial Stability,” Rosengren highlighted stablecoin markets as a “periodic disruption to short-term credit markets.” The Boston Fed president further discussed inflation and the U.S. real estate market.

Rosengren discussed the subject of stablecoins and mentioned tether (USDT) with Yahoo Finance reporter Brian Cheung. After the presentation, Cheung asked the Boston Fed president: “Isn’t the financial stability risk of those stablecoins like tether only as big of a risk as the Fed will allow given its historical role as a back stopper?”

“The reason I talked about tether and [stablecoins] is if you look at their portfolio, it basically looks like a portfolio of a prime money market fund but maybe riskier,” Rosengren responded to Cheung’s question. “We actually had a stablecoin that ran into financial difficulties last week. Tether, as you highlighted, has a number of assets that, during the pandemic, the spread got quite wide on those assets. The Fed intervened in order to make sure that short-term credit markets continued to operate,” Rosengren added. The Boston Fed president continued:

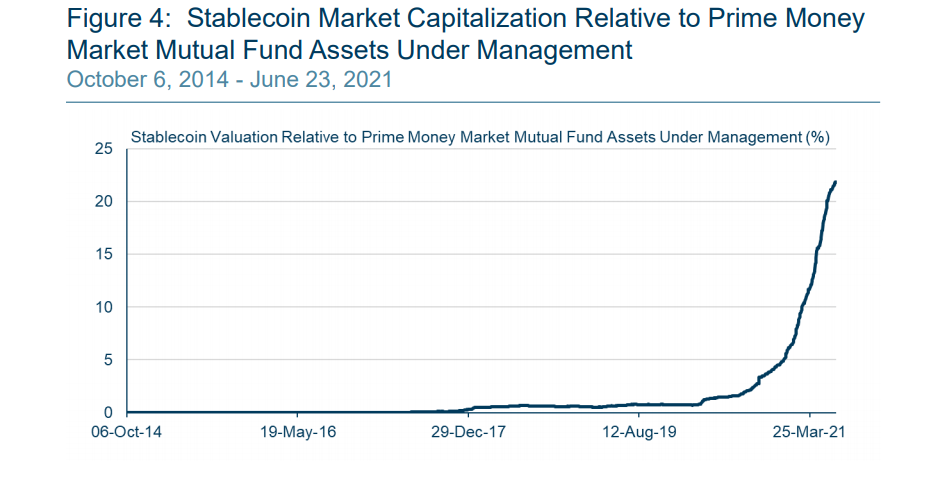

And the reason we should be a bit concerned about stablecoin [markets] is that it’s growing very rapidly so there’s exponential growth in stablecoins. The prime money market funds have been slowly going down as people have looked for a less risky way to hold their transactions accounts and many of them have moved to government money market funds.

Rosengren Highlights the Need to Start Thinking Carefully About What Happens to Things Like Stablecoins

Rosengren says the central bank and regulators need to “think more broadly” about what types of things could unsettle short-term credit markets. “Certainly stablecoins are one element,” the Boston Fed president remarked.

Cheung further asked “if the Fed is going to backstop those markets if they do experience stress, then wouldn’t there not be as big of a financial stability risk from those types of products? Rosengren replied that he thinks regulations should change more often, so officials don’t have to return to such matters every decade.

“I do worry that the stablecoin market that is currently, pretty much unregulated as it grows and becomes a more important sector of our economy,” Rosengren emphasized. “That we need to take seriously what happens when people run from these types of instruments very quickly,” he added. Rosengren further said:

Just like the money market funds caused a bad disruption in credit markets, I think a future financial stability problem could be occurring if we don’t start thinking carefully about what happens to things like stablecoins next time we have a bad market difficulty.

Tether (USDT) is by far the largest stablecoin in existence today and has a $62 billion valuation. Behind tether, is usd coin (USDC), a stablecoin issued and maintained by the company Circle. USDC has a $25.8 billion capitalization and between both USDT and USDC combined, the two stablecoins represent 79% of the entire $111 billion stablecoin market cap.

What do you think about Rosengren’s statements about tether and stablecoins? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3hdnNtU

Comments

Post a Comment