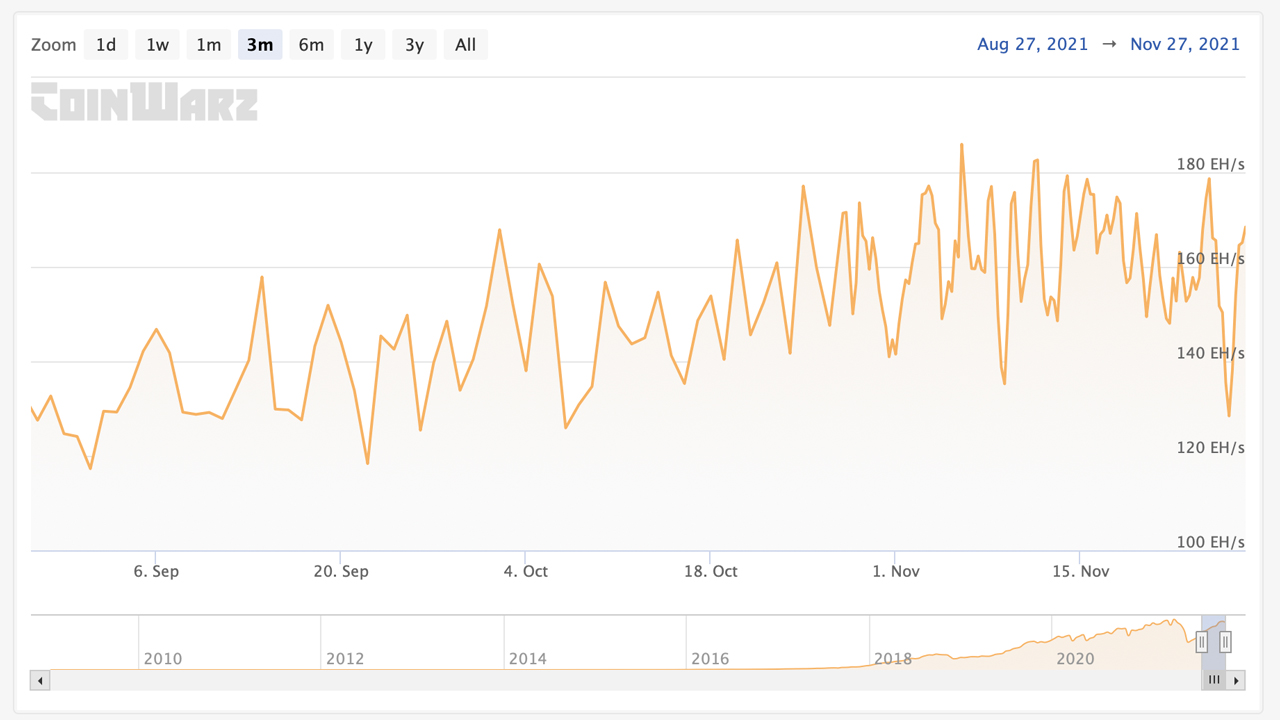

Bitcoin’s hashrate has been volatile in recent times following the same patterns as the crypto asset’s price. Three days ago, Bitcoin’s hashrate neared the 180 exahash (EH/s) zone only to plummet to 128 EH/s two days later. The recent shifts have taken place before the upcoming network difficulty adjustment, which is due to change on Sunday. After nine increases in a row and for the first time since mid-July, the difficulty will drop lower instead of increasing.

Bitcoin Hashrate Slides Following Price Drop — Mining Difficulty Decrease Expected

The fiat value of bitcoin (BTC) has caused the network’s processing power to slow down toward the end of November. Seven days ago, Bitcoin.com News reported on how Bitcoin’s hashrate was steadily climbing higher during the last three months. Today, BTC’s hashrate is coasting along at 168 EH/s after reaching a high of 178 EH/s on November 24. After reaching that high on Wednesday, on Friday the hashrate dropped to a low of 128 EH/s, losing 28% in 48 hours.

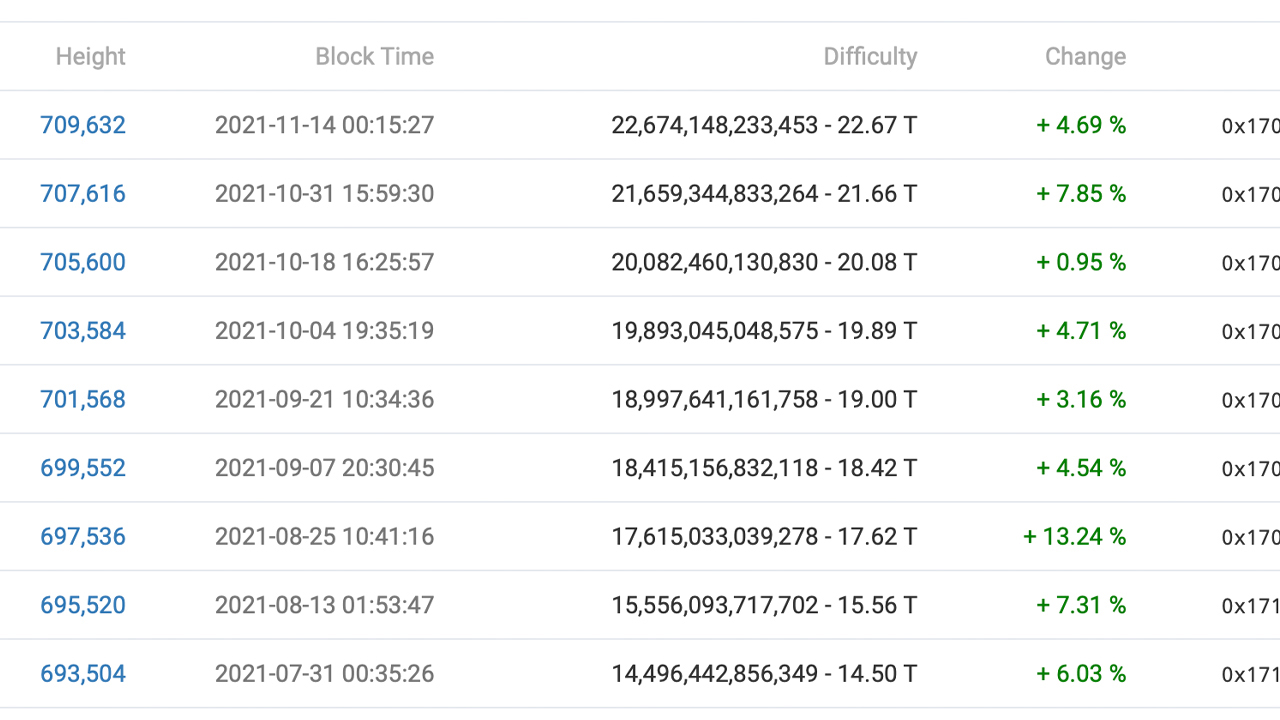

The slow down is causing the network difficulty to stay lower than usual and this Sunday it’s expected to drop for the first time since July 17, 2021. After the mid-July difficulty change, BTC’s difficulty increased nine times in a row.

It is now 52.48% harder to mine BTC than it was 133 days ago on July 17. The next change, which is slated to happen during the early morning hours (EST) on Sunday, is expected to slide by -0.38%. It’s not much but it will deter the mining difficulty from reaching its all-time high (ATH).

There’s also been a lot of changes in terms of hashrate distribution among mining pools. Bitmain’s Antpool is the largest bitcoin miner today with 16.79% of the network or 26.15 EH/s in hashrate. Foundry USA is the second-largest bitcoin mining pool with 16.55% of the network’s hashpower, or 25.77 EH/s. While F2pool holds the third position with 15.33% of the hashpower, or 23.87 EH/s, unknown hashrate or stealth miners command 13.14% of the network’s hashpower or just over 20 EH/s.

Bitcoin’s mining difficulty recorded an ATH on May 13, 2021, when it reached 25.05 trillion. Today, the network difficulty is 22.67 trillion and the decrease should bring it down to 22.59 trillion by Sunday, November 28, 2021. The 0.38% change is minuscule compared to most difficulty shifts but it will keep the difficulty lower for another two weeks which is helpful to miners while the price of BTC is much lower than it was two weeks ago. Bitcoin’s difficulty increased by 4.69% two weeks ago, four days after BTC reached a price ATH at $69K per unit.

What do you think about the upcoming difficulty decrease and the recent hashrate action? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3rdG017

Comments

Post a Comment