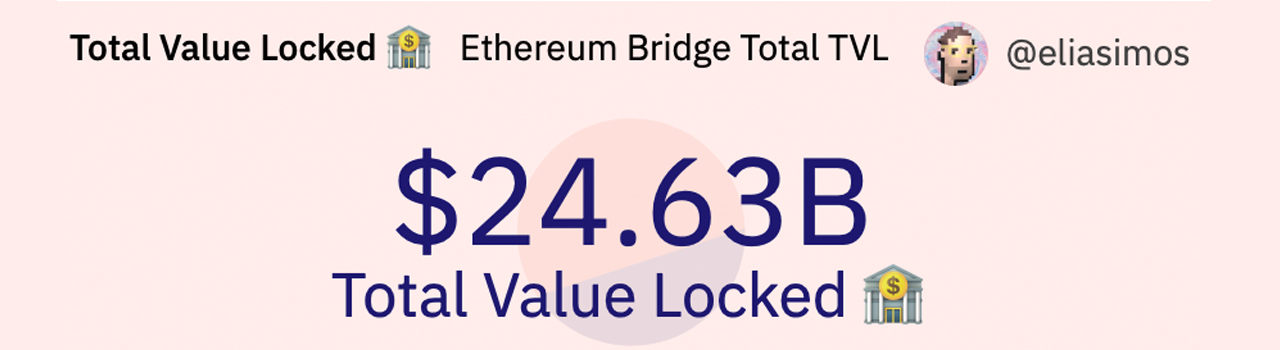

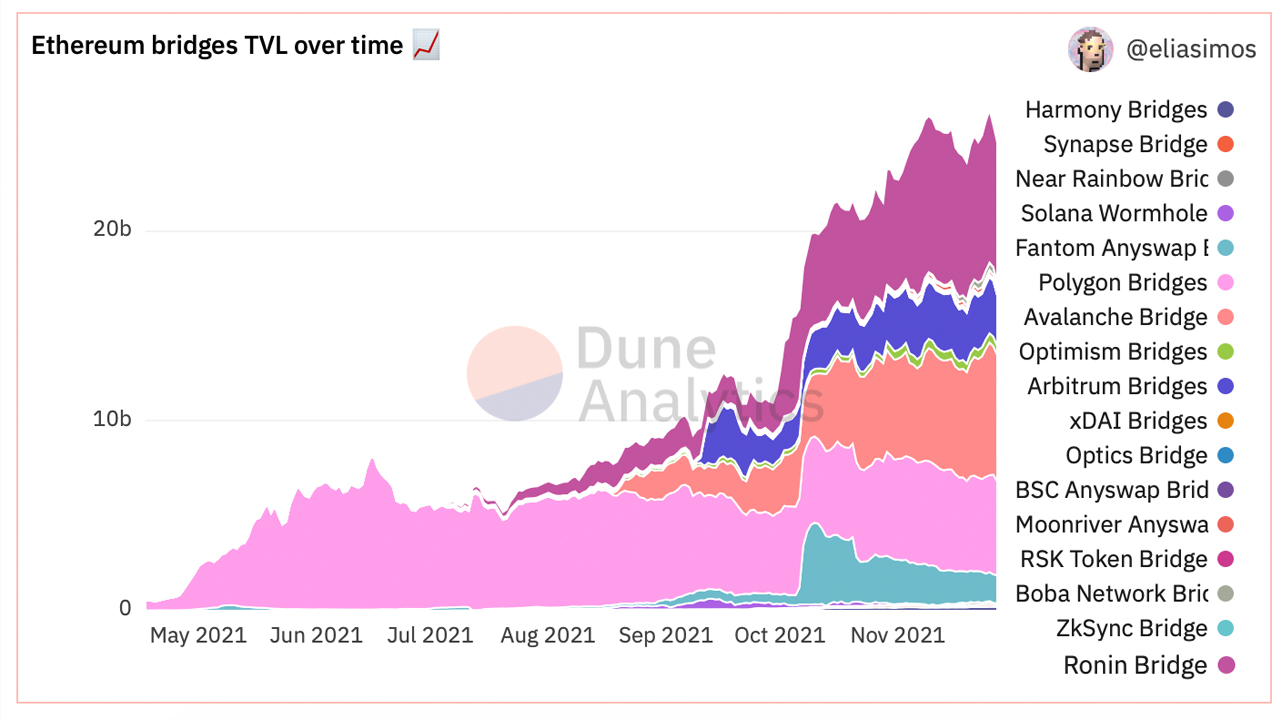

30 days ago on October 28, the total value locked (TVL) in cross-chain bridges to Ethereum was around $22.48 billion and in the face of the recent market dump, the TVL still increased by 9.56%. At the time of writing, there are 135,148 unique depositors and Axie Infinity’s Ronin Bridge holds the largest TVL.

Cross-Chain Bridge TVL Continues to Climb

While the total value locked in decentralized finance (defi) is $258 billion, the TVL is split among a myriad of blockchains. This includes blockchain networks such as Ethereum (ETH), Binance Smart Chain (BSC), Solana (SOL), Avalanche (AVAX), terra (LUNA), tron (TRON), Fantom (FTM), and Polygon (MATIC).

Today, Ethereum commands $170.48 billion of the $258 TVL in defi or 65.89% of the aggregate. Binance Smart Chain captures $19.11 billion on Saturday, which is only 7.40% of the TVL. Solana commands a $13.86 billion TVL this weekend or 5.37% of all the value locked in defi.

Many of these defi networks leverage a connection to the Ethereum Virtual Machine (EVM) which allows the protocols to do various things like access liquidity pools and stake tokens. Users leverage cross-chain bridges to connect their assets to the EVM and to utilize Web3 wallets like Metamask, Safepal, and others.

Close to a month ago, on October 29, Bitcoin.com News reported on the $22.48 billion TVL in cross-chain bridges to Ethereum. Since then the TVL has increased by 9.56% to $24.63 billion with Axie Infinity’s Ronin Bridge leading the pack. Statistics from Dune Analytics show there are 135,148 unique depositors leveraging cross-chain bridge networks to Ethereum.

Besides Ronin, other cross-chain bridges connect to blockchains such as Avalanche, Polygon, Arbitrum, Fantom, Optimism, Boba Network, and Harmony. While Ronin’s bridge TVL is $7.4 billion, the AVAX TVL tied to cross-chain bridge technology is $6.7 billion. Bridges like Arbitrum and Optimism are used as a means to leverage Ethereum transactions but with lower fees.

Ethereum fees have dropped in recent times as the average ether fee according to l2fees.info is $9.64 per transaction. But the L2 (Layer 2) fee offered by Polygon Hermez is around $0.25, Arbitrum is $2.78 per transfer, and Optimism is $1.67 per transaction. L2 fees offered by Loopring are $0.26 per transfer and Zksync users will pay around $0.39 today.

What do you think about the increase in cross-chain bridge usage during the last 30 days? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/3p9gUh4

Comments

Post a Comment