On Sunday, the non-custodial market protocol Aave announced that the Aave DAO has approved a new stablecoin for the ecosystem called “GHO.” Aave Companies proposed the stablecoin during the first week of July and the collateral-backed stablecoin will be pegged to the U.S. dollar’s value.

A New collateral-Backed Stablecoin Crafted by Aave Companies Is Due to Launch After the Aave DAO Votes on Genesis Parameters

Aave explained on Sunday that the Aave decentralized autonomous organization (DAO) approved a proposal to create a stablecoin token called “GHO.” “The community has given the green light for GHO,” the official Aave Twitter account detailed. “The next step is voting on the genesis parameters of GHO, look out for a proposal next week on the governance forum.”

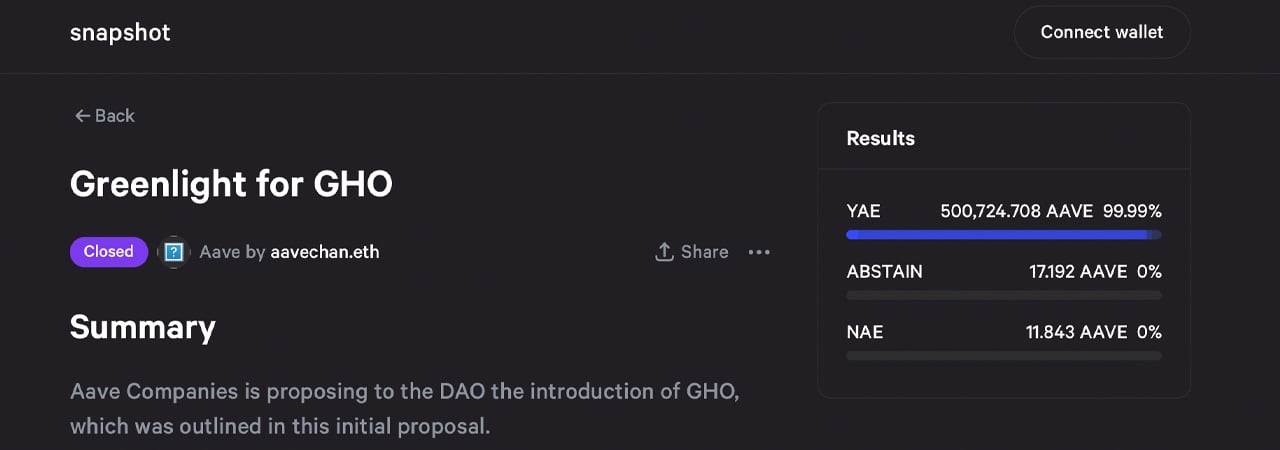

The GHO introductory blog post, published on July 7, 2022, says the stablecoin will be “backed by a diversified set of crypto-assets chosen at the users’ discretion, while borrowers continue earning interest on their underlying collateral.” The governance proposal was approved by a great majority of Aave DAO voters, as more than 99% of voting participants voted in favor of launching GHO.

The governance proposal’s approval snapshot says GHO will “provide benefits for the community via the Aave DAO by sending 100% of interest payments on GHO borrows to the DAO” and GHO will be “administered by Aave governance.” Aave’s stablecoin will join the stablecoin economy, which is currently valued at $153 billion. Tether (USDT) leads the stablecoin pack and usd coin (USDC) follows behind USDT, in terms of overall market capitalization.

GHO will also join stablecoin crypto assets that leverage collateral assets and some that leverage the method of over-collateralization. Makerdao’s DAI stablecoin is over-collateralized and Tron’s USDD is also over-collateralized, which means there’s more collateral than necessary to cover the stablecoin’s backing during times of extreme market volatility.

“As a decentralized stablecoin on the Ethereum mainnet, GHO will be created by users (or borrowers),” Aave Companies’ blog post about the subject explains. The blog post further adds:

Correspondingly, when a user repays a borrow position (or is liquidated), the GHO protocol burns that user’s GHO. All the interest payments accrued by minters of GHO would be directly transferred to the Aave DAO treasury; rather than the standard reserve factor collected when users borrow other assets.

Aave Companies Says Community Was Very Engaged With GHO Governance Proposal

Aave also has a native token which is ranked 45 out of more than 13,000 crypto assets today. The digital asset has a market valuation of around $1.46 billion and aave (AAVE) has increased 84.7% during the last month. The open source decentralized lending protocol is the third largest decentralized finance (defi) protocol in terms of total value locked. Data from defillama.com indicates that Aave has $6.59 billion locked on July 31. In mid-May, Aave launched a Web3, smart-contracts-based social media platform called the Lens Protocol. The Lens platform has more than 50 applications built on top of the Polygon (MATIC) network.

As far as the GHO stablecoin is concerned, Aave Companies said that the community was “very engaged with the GHO proposal, providing incredibly helpful and informative feedback.” Aave detailed some of the things mentioned by the community the team will focus on which includes DAO-set interest rate vulnerabilities, supply caps, a peg stability module, and the “necessity for properly vetting potential facilitators.” For now, the community will have to participate in voting on the stablecoin’s genesis parameters before the crypto token is issued.

What do you think about the upcoming Aave stablecoin project called GHO? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/B4bYAVh

Comments

Post a Comment