Ever since Celsius paused withdrawals on June 12, the company has been the focus of attention due to the lender’s financial hardships. A month later, Celsius filed for bankruptcy in the U.S. by leveraging the Chapter 11 process. Two days after the bankruptcy filing, a report disclosed that two people familiar with the matter allege that the private lending platform that owes Celsius $439 million is Equitiesfirst.

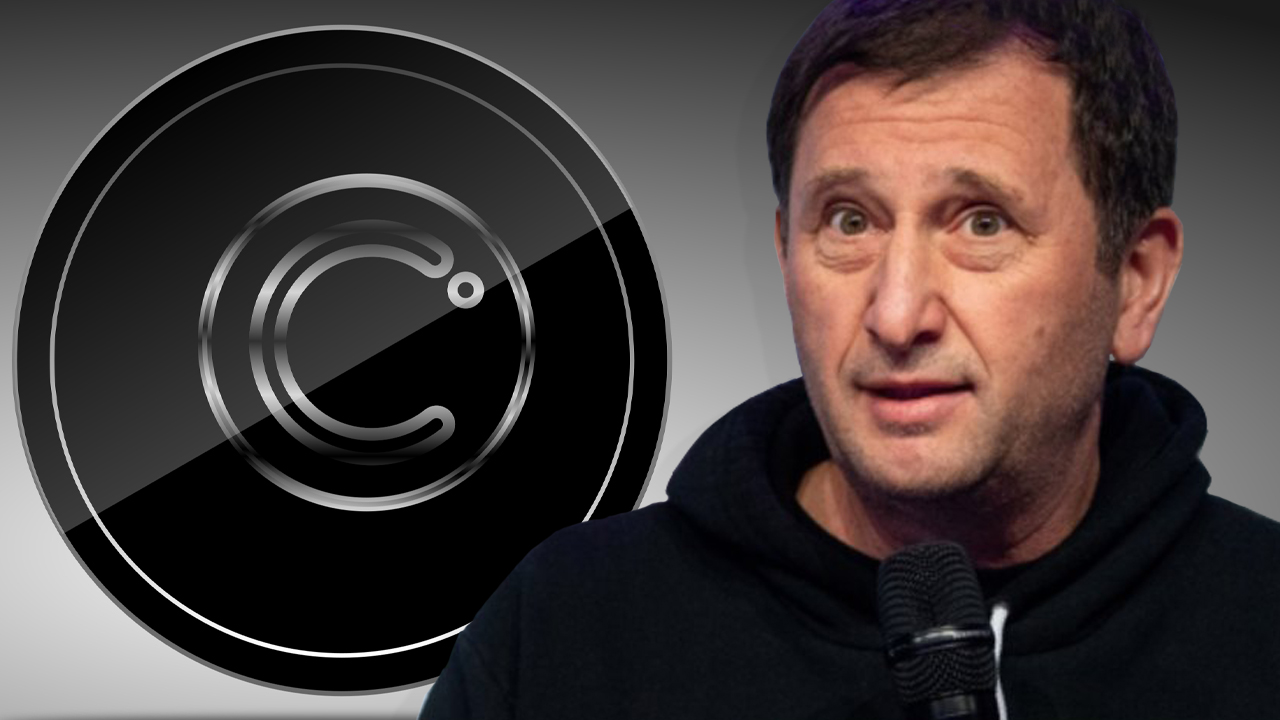

FT Sources Allege Private Lending Platform That Owes Celsius $439M Is Equitiesfirst

During the last few weeks, bankruptcies, liquidations, and insolvencies have been a very hot topic in the crypto world. Three well known crypto companies have filed for bankruptcy protection which includes the digital currency exchange Voyager Digital, the crypto lender Celsius, and the crypto hedge fund Three Arrows Capital (3AC). Celsius filed for bankruptcy on July 13, 2022, or 31 days after the company froze withdrawals.

Prior to the bankruptcy filing in July, there was speculation during the second week of June that said Celsius had funds locked into specific decentralized finance (defi) protocols that needed immediate adjustment or significant collateral would be liquidated. A few days before Celsius filed for bankruptcy, the company’s wallets reportedly transferred millions of usd coin (USDC) at different times to pay down loans in Compound and Aave.

When Celsius filed for bankruptcy protection, the filing detailed that Celsius was owed a large sum of funds. On July 15, the Financial Times (FT) reported that “Equitiesfirst [has been] revealed as [the] mysterious debtor to troubled crypto firm Celsius.” The report claims two people familiar with the matter disclosed that Equitiesfirst is the ostensible borrower that owes the crypto lender $439 million.

Founded in 2002, Equitiesfirst is an investment firm that “specializes in long-term asset-backed financing,” according to the company’s website. While Equitiesfirst manages stocks, it has also been dealing with select cryptocurrencies since 2016. The managing director and head of Equitiesfirst Singapore, Johnny Heng, spoke about cryptocurrencies in April 2022.

“We used to be pure equities, until some six years ago, we started to offer loans against cryptocurrency as well, and that activity has really taken off [in] the past year or two,” Heng told hubbis.com in an interview. Speaking with FT, an Equitiesfirst spokesperson said: “Equitiesfirst is in [an] ongoing conversation with our client and both parties have agreed to extend our obligations.”

Meanwhile, celsius network (CEL) token investors tried to short squeeze the company’s native token well before the company filed bankruptcy. However, after the bankruptcy filing, CEL slipped by 58% against the U.S. dollar before it rebounded. Statistics recorded on July 16, 2022, indicate that despite CEL’s market volatility, the crypto asset has gained more than 30% during the last 30 days.

What do you think about the report that says Equitiesfirst has been revealed as the mystery debtor that owes Celsius millions? Let us know what you think about this subject in the comments section below.

from Bitcoin News https://ift.tt/UxBltOw

Comments

Post a Comment