In the past month, recent data reveals that sales of non-fungible tokens (NFTs) originating from the Bitcoin blockchain have surged to $173.28 million. Surpassing 20 alternative blockchain networks, Bitcoin-based NFT sales now secure the second position in the realm of blockchain sales, with only Ethereum reigning supreme.

Bitcoin-Based NFTs Storm the Market, Surpassing 20 Blockchain Competitors

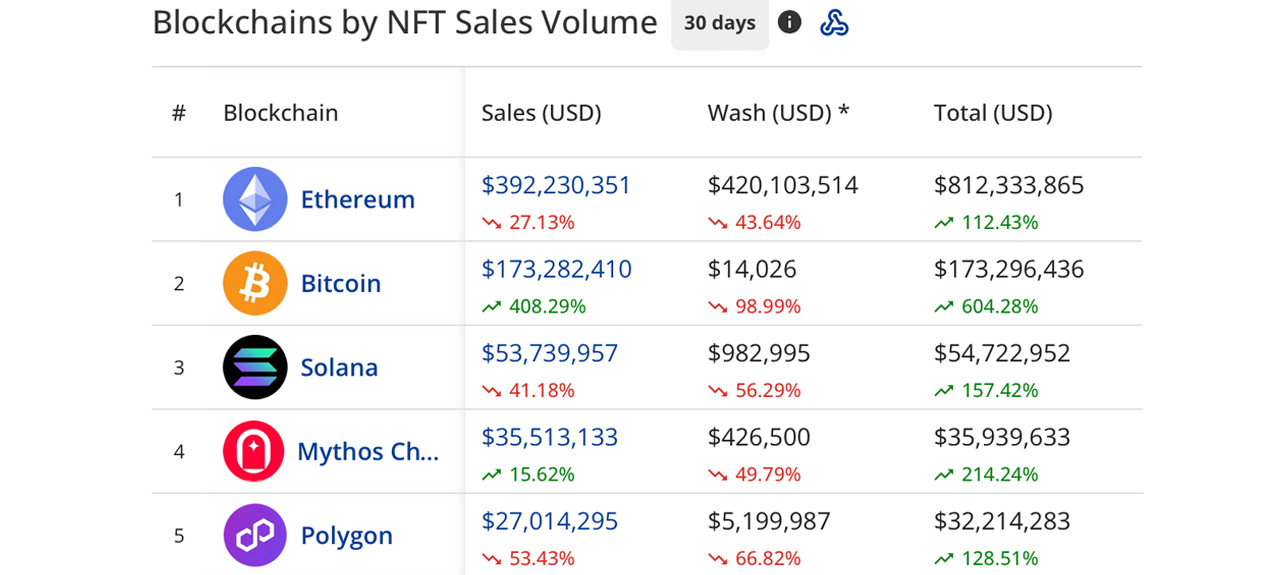

Amidst the fervor surrounding the Ordinal inscription trend, Bitcoin-based NFTs have skyrocketed in popularity. The sales amassed over the past 30 days firmly established the network as the second-largest in terms of sales within this time frame. While Ethereum NFT sales saw $392.23 million, this past month Bitcoin sales tallied up to $173.28 million, up 408.29% from the month prior.

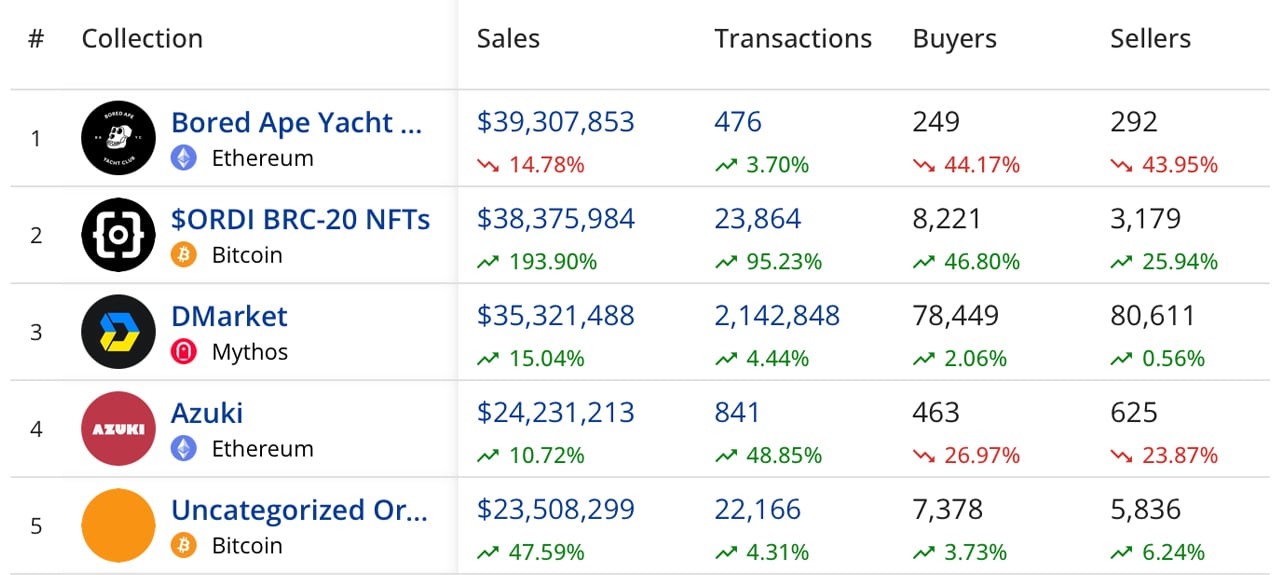

However, there has been a significant 47% decline in the number of buyers for Bitcoin-based NFTs, totaling 6,955 over the course of the past 30 days. Insights from cryptoslam.io data highlight that the leading NFT collection, in terms of sales during this period, is the Bored Ape Yacht Club (BAYC).

The BAYC collection garnered $39,307,853 in sales over the past month, closely followed by the Ordi BRC20 NFTs, which amassed a slightly lower amount at $38,375,984. Noteworthy sales also transpired within other Bitcoin-centric NFT collections, including uncategorized Ordinals, as well as Space Pepes.

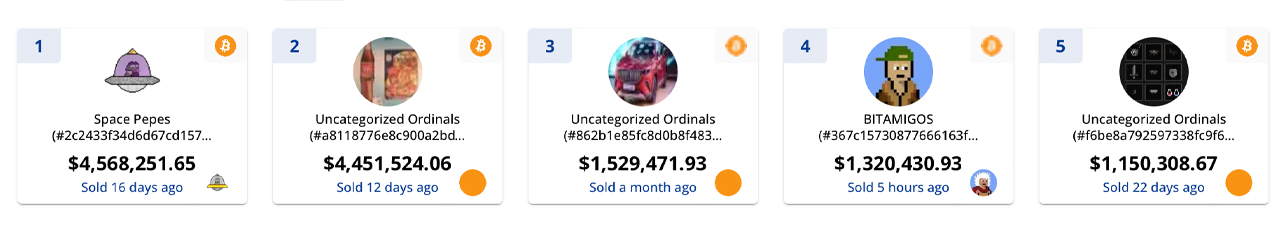

Sales from uncategorized Ordinals reached $23,508,299, while Space Pepes accumulated $12,247,480 in sales. Additionally, the Bitcoin Frogs NFT collection hopped its way to $9,849,639, while $NALS NFTs secured around $6,818,592 in sales over the past 30 days. The Bitcoin blockchain took center stage as the birthplace of the top five most expensive NFT transactions during this period.

These included a $4.5 million sale of a Space Pepe, as well as three uncategorized Ordinals that fetched prices exceeding a million dollars each. A Bitamigos NFT, for its part, commanded a $1.3 million price tag. It is also worth noting that nine out of the top-priced NFTs sold last month were derived from Bitcoin.

As of May 24, 2023, the Bitcoin blockchain has surpassed nine million inscriptions, coinciding with the surge in Bitcoin-based NFT sales. This trend has rewarded miners with an estimated value of approximately 1,495 BTC or $40.27 million since the emergence of inscriptions on the chain.

Initially, skepticism surrounded the ability of Bitcoin to generate sufficient NFT activity to rival prominent NFT blockchains such as Solana and Polygon. However, the oldest blockchain network in existence so far has demonstrated its prowess as a formidable competitor.

What are your thoughts on the rise in Bitcoin-based NFT sales? Share your opinions and insights in the comments section below.

from Bitcoin News https://ift.tt/eVMGjXL

Comments

Post a Comment