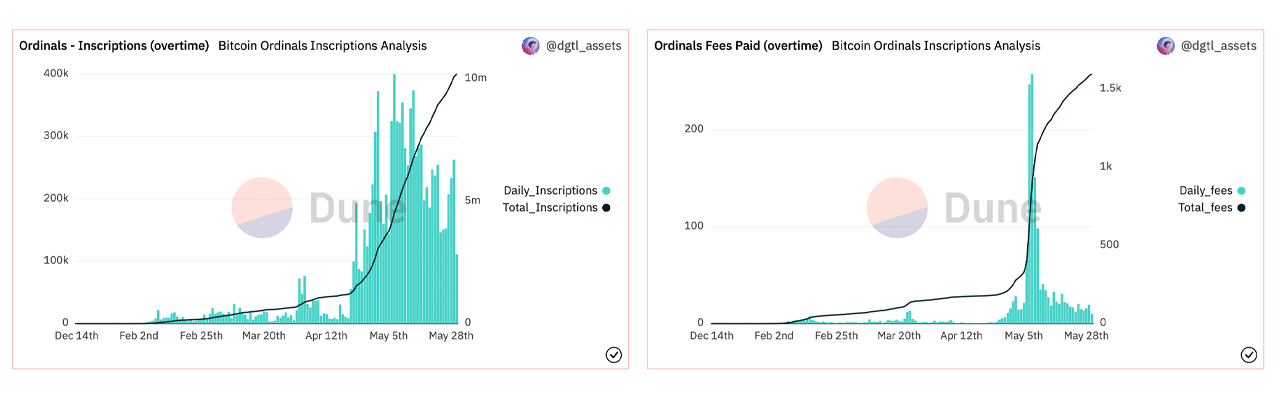

On Monday, May 28, 2023, a pivotal landmark was reached as the aggregate quantity of Ordinal inscriptions minted on the Bitcoin blockchain exceeded 10 million in under half a year. Since Ordinal inscriptions’ inception, bitcoin miners have garnered roughly 1,596 bitcoins, valued at $44.37 million.

10 Million Ordinal Inscriptions and Counting

This week witnessed the total Ordinal inscriptions surpassing the 10 million mark; as of this writing, 10,142,233 inscriptions have been issued. Moreover, the BRC20 token economy consisting of 24,677 registered BRC20 tokens boasts a combined value of $433 million. Bitcoin inscriptions have carved out a niche in the realm of non-fungible token (NFT) markets and currently stand as the second-largest blockchain in terms of NFT sales.

Data from the past 30 days reveals that $190 million worth of Bitcoin-based NFTs have been traded, with the most significant sale being a Space Pepe sold for $4.56 million. Having amassed over 10 million inscriptions, bitcoin miners have obtained supplementary fees equivalent to 1,596 bitcoins or $44.37 million since December 2022. In marketplaces focused on Ordinals, 347,129 transactions have been documented, generating $176.46 million in trade volume.

Among Ordinals and BRC20 marketplaces are Ordinals Market, Ordswap, Ordinals Wallet, Open Ordex, Gamma, Magic Eden, and Unisat. Recently, Ordinals Market collaborated with Bitcoin Miladys on a project to bridge BRC20s with Ethereum’s ERC721 tokens. Notably, just days before Ordinal inscriptions hit the 10-million mark, Casey Rodarmor — creator of the Ordinals inscription technology — resigned as the codebase’s chief maintainer.

Rodarmor transferred control of the project to an enigmatic software developer known as Raphjaph. Of the 10 million Bitcoin-based inscriptions hosted on the chain, 91% or 9.2 million feature plain text inscriptions. Over 775,000 Ordinal inscriptions comprise image files like PNGs or JPEGs, while the remainder of inscriptions on Bitcoin consist of videos, applications, and audio recordings.

Although Ordinals have gained popularity, several bitcoiners and cryptocurrency influencers have expressed disapproval. Some argue that Ordinal inscriptions contribute to a considerable backlog of transactions and elevated onchain fees for network activities. Detractors have labeled the inscriptions trend an “attack” and “spam,” asserting that financial transactions should be the sole transfers on the Bitcoin blockchain.

What are your thoughts on the rapid growth of Ordinal inscriptions on the Bitcoin blockchain and their impact on the NFT market? Share your insights and opinions in the comments section below.

from Bitcoin News https://ift.tt/HvhI87x

Comments

Post a Comment